Putting Rate Cut Expectations To The Test

The Fed Committee face the spotlight as markets price in rate cuts for 2024. But opinions on when and how many are split.

There has been one major topic of discussion of late: Rate cuts. The big questions arising… “When will the Fed first cut rates?” and “How many cuts will we see in 2024?”

CPI was released earlier this week, with no big surprises. Figures were in line with expectations. Headline came in at 3.1% YoY (falling from 3.2% prior) and Core at 4.0% YoY. The only figure outside of estimates was Headline MoM, coming in at 0.1% against expectations of 0.0%.

Current Pricing

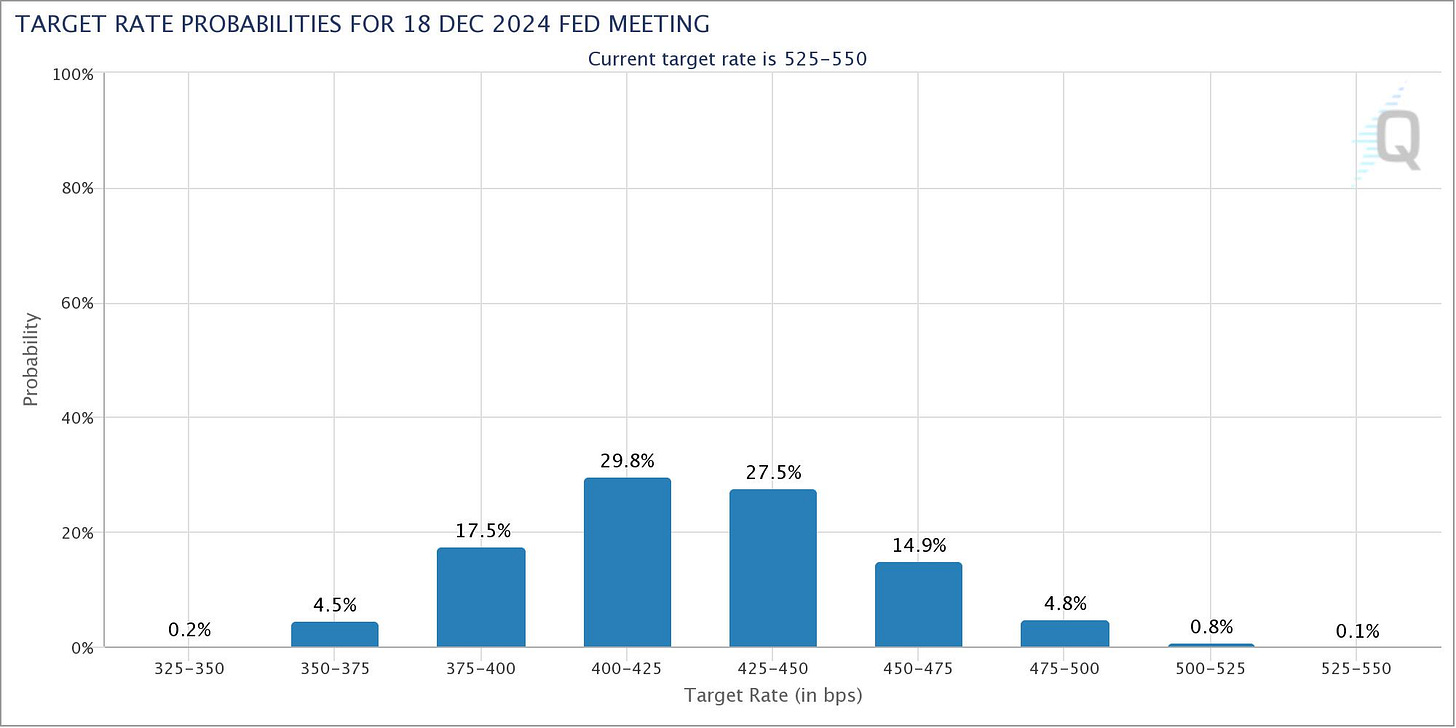

Money market traders scaled back their estimates of rate cuts following the stronger-than-forecast jobs data and report on inflation that was largely in line with forecasts. They now see a 42% chance that the first rate cut will come in March, down from 53.5% a week ago. A higher probability has now been placed in a rate cut in the May meeting.

Markets are pricing in 125bps of cuts by the end of next year.

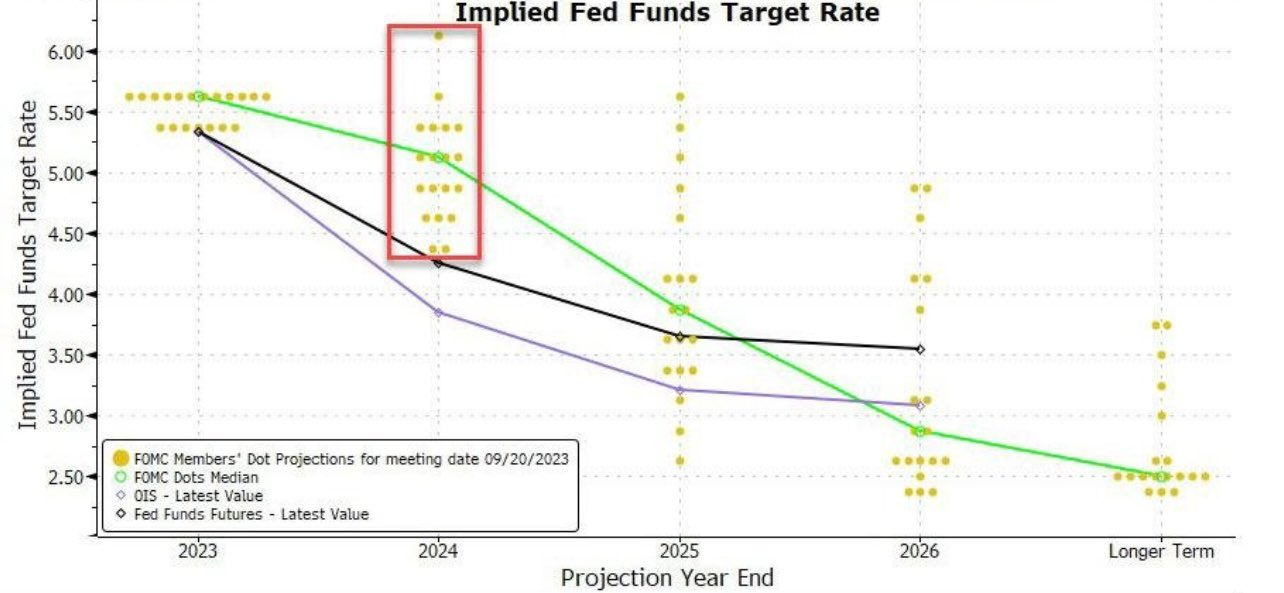

What was the last dot plot? The median forecast was for rates to end 2024 at 5-5.25%. Slightly different to the 4-4.25% markets are pricing.

Firstly, FOMC

Probabilities are at 98.4% chance that the Fed will hold rates at current levels in today’s meeting. By our take, Chair Powell will likely give the same comments that he usually does. “Move carefully” this and “prepared to do what it takes” that. We could throw in a “higher for longer” bingo card, too (although markets don’t believe this rhetoric). But his communication will need to be precise. There is not much room to allow for unnecessary misunderstandings (more on this in the ‘Real Rates’ section).

The feature of today’s Fed meeting will be the dot plot. Markets are keen to see where the majority of FOMC participants see the target rate at the end of 2024, 2025 and the longer run.

They are likely to be more conservative than markets currently are. A survey of 49 economists saw expectations of the committee pencilling in just a half percentage point of rate reductions in 2024.

“Why?” And Not “When?”

Maybe the correct question to ask about rate cuts is “Why?” and not “When?”

If rates are being cut because inflation is cooling and the Fed believe they have it under control, that will be good news for investors and the economy. This would achieve the sought-after soft landing - a scenario where central banks have raised rates enough to stop an economy from overheating and experiencing high inflation, but without causing a severe downturn.

However, it’s another story if the Fed is cutting rates due to a sharp decline in the economy, a recession that is imminent, or both. That would indicate that unemployment is expected to rise significantly and that declining demand will negatively impact company profits.

The reason for the cuts will also indicate how many there will be. If the economy is in or in danger of recession, officials will likely ease policy rapidly and by a lot. Smaller, slower cuts are probable if there’s no deep downturn.

Over the Fed’s last five credit-tightening cycles, the average time from the last rate increase to the first reduction was eight months. As the last hike was in July, history puts a March cut on the cards.

The rest of this article discusses:

Real rates

2024 inflation

Market jumping the gun

Real Rates

A real interest rate is an interest rate that has been adjusted to remove the effects of inflation. Once adjusted, it reflects the real cost of funds to a borrower and the real yield to a lender or to an investor.

At present, the real rates are at their tightest since at least 2007, and they may passively tighten further if inflation continues to fall.