Relentless Rally

How long can a strong market last? Longer than you think.

“Markets can remain irrational longer than you can remain solvent.” - John Maynard Keynes

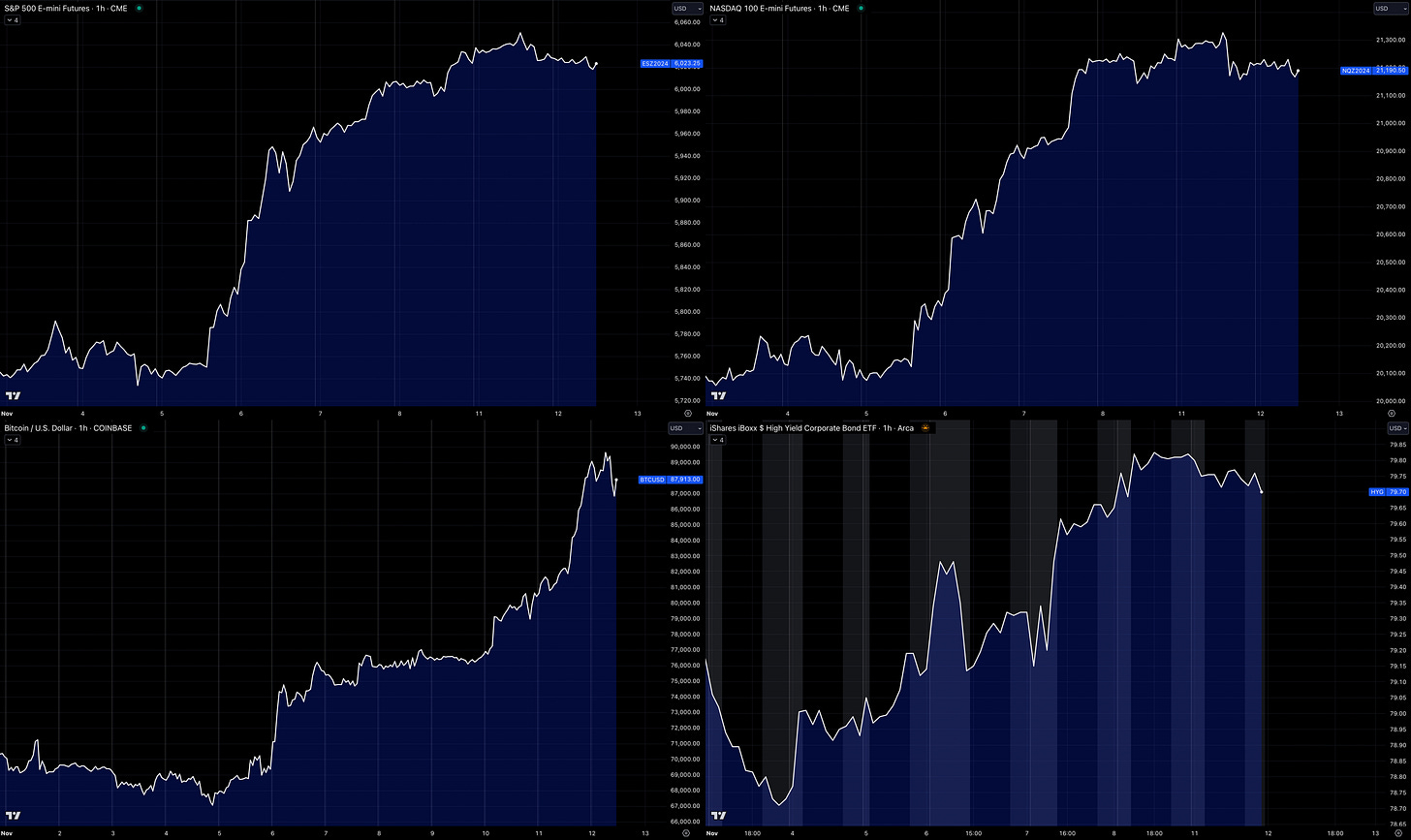

As crazy as things might seem, they can get even crazier. John Maynard Keynes’ well-known assertion underscores the erratic nature of financial markets and the inherent risks associated with taking positions against them, even in instances where you might contend that valuations are misaligned or irrational. U.S. equity benchmarks are at or very close to all-time highs, Bitcoin is experiencing significant upward momentum indicative of a new supercycle, and there is a notable increase in demand for junk bonds.

The extent of the rally in equities in particular is well depicted in the below graphic. It shows the relative return of U.S. stocks versus the rest of the world. When looking at the rolling 5-day performance, the U.S. gains exceed the All-World (ex-U.S.) by the highest amount since the GFC.

While there remains a willingness to pursue Bitcoin and certain speculative small-cap stocks, other market themes are currently experiencing profit-taking activities as investors and traders pivot towards a more selective approach. For instance, the biotechnology sector (NASDAQ: IBB) experienced a pronounced reversal during this week’s trading.

The pertinent question emerges: what transpires after a period of euphoria?

A sudden market collapse appears highly improbable. Although additional profit-taking is expected, dip-buyers are likely to provide a level of support. In this context, stock pickers will likely increase their activity, seeking to identify equities that continue to present strong value without being excessively overextended technically.

A common misjudgment in such market environments is the assumption that a sharp downward reversal is imminent. Typically, markets of this nature tend to maintain a tendency to rise for a sustained period. It is only after the efficacy of dip buying diminishes and the market exhibits signs of stagnation that the potential for deeper corrective actions begins to materialise.

The most challenging aspect of a strong market is the need to exercise patience when it appears that all stocks are rising faster than your portfolio. This situation can create a sensation of missed opportunities, which is a common sentiment among investors. Focusing on maximising the trend rather than chasing it.

Below the paywall: Market notes and thoughts ahead of CPI.

A Note On The Market

Strategist Ed Yardeni described current markets as having “animal spirits” let loose. “Stock investors are also thrilled by the regime change to a more pro-business administration promoting tax cuts and deregulation,” he wrote in a note on Monday.