Momentum cooled as US equities slipped modestly last week, though the damage looked worse midweek before Friday’s recovery. Heavy selling through the cash open earlier in the week reflected the pressure from rising global long-end yields and the jump in the Fed Effective Rate, which rippled through short-end pricing and lent the USD fresh support. Last week’s PMI signals suggest tariff costs are no longer passing through cleanly, raising concern that as demand softens, one of the pillars of the 2025 equity story, margin resilience, may be tested.

The Magnificent Seven lagged even as the AI narrative kept running hot, while energy stocks rallied on crude strength. Inflation-sensitive sectors, particularly consumer names, remained under pressure as markets refocused on the Fed’s price stability mandate. Notably, the S&P 500’s forward P/E briefly touched levels only seen during the dot-com bubble and the 2020 pandemic surge.

Fed Chair Powell offered little to traders searching for clarity, emphasising caution and reiterating the challenges of balancing risks across employment and inflation. With no signal toward an October cut, markets were left trading on rates repricing. Beneath the surface, speculation around Fed governance and structure added to the noise: proposals ranged from adopting the tri-party general collateral rate as a new benchmark to shifting the inflation target to a range, and to actively shrinking the balance sheet through MBS sales. While none of this is imminent, the drift toward structural reform underscores how the Fed is navigating both policy and politics simultaneously.

Corporate headlines once again underscored two dominant themes: AI and restructuring. Intel surged after reports of early talks with Apple for an investment, on top of government and foreign capital already entering the stock. Nvidia committed $100 billion to OpenAI, Boeing deepened its partnership with Palantir, and Alibaba joined the list of firms accelerating AI spend. Yet the sheer scale of commitments prompted warnings: Bain estimates a $800bn annual revenue shortfall versus the infrastructure required by 2030, while David Einhorn cautioned that the wave of spending risks becoming one of the biggest episodes of capital destruction in history. Elsewhere, Electronic Arts surged on reports of a $50bn privatisation bid led by Silver Lake and Saudi Arabia’s PIF, while Micron’s upbeat but underwhelming results saw a muted reception given the high bar set for AI-linked semis. CarMax’s plunge highlighted how tariffs and credit strain are weighing on the auto sector, feeding broader concerns about consumer stress.

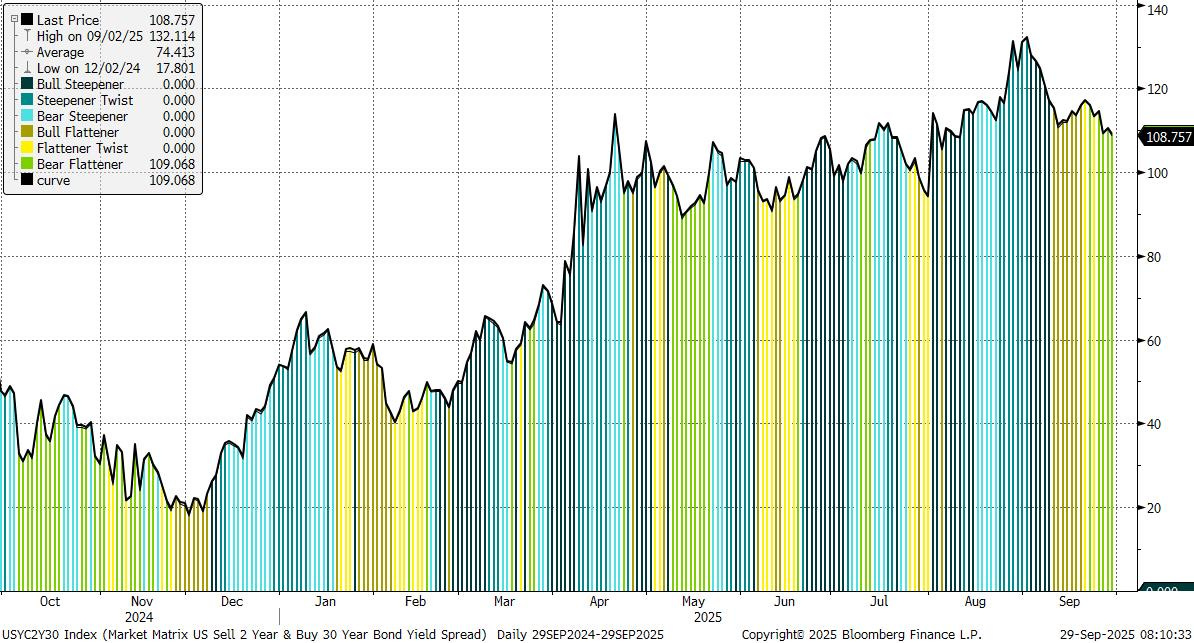

Economic data painted the same two-handed picture Powell described. Final 2Q GDP was revised sharply higher to 3.8%, showing consumer resilience, but August Core PCE remained sticky at 2.9% and continuing jobless claims stayed elevated. The split complicates the Fed’s path: growth looks firm, but inflation progress is limited and labour-market cracks are appearing at the margin. Rates markets adjusted accordingly, with USD firming as short-end pricing pulled back from fully discounting an October cut. Treasuries bear-flattened, with focus on the unusual rise in the Fed Effective Rate outside of a policy change, a development tied to repo-market tightness into quarter-end.

The Week Ahead

The week ahead brings a heavy macro slate. In the US, Friday’s payrolls will anchor the Fed outlook, while political risk lingers with the shutdown deadline and Trump’s proposed drug tariff. Asia’s focus is on China, including the PMI cycle and Golden Week consumption, alongside the RBA’s policy call and Japan’s Tankan survey. In Europe, Germany and euro-area CPI print, while in the UK, Reeves’ Labour conference speech, GDP, and PMI data come after a bruising stretch of gilt auctions.

First Off, Milei

Argentina has bought time. With implicit US backing, markets were yanked out of a tailspin. Dollar bonds due 2035 tightened more than 300bp, and the peso clawed back 10% in three days. Treasury Secretary Scott Bessent floated both a $20bn swap line and even direct US purchases of Argentine debt. That alone was enough to stop the rout. The irony is that no buying may ever be required: the promise of a backstop was sufficient to turn sentiment.