One of the defining trades of the year has been long gold (XAU). It’s outpaced global equities, USTs, bitcoin, and nearly every major commodity, with only its unruly sibling, silver (XAG), running hotter. Year-to-date metrics can feel arbitrary, but as we edge toward year-end, they start to matter.

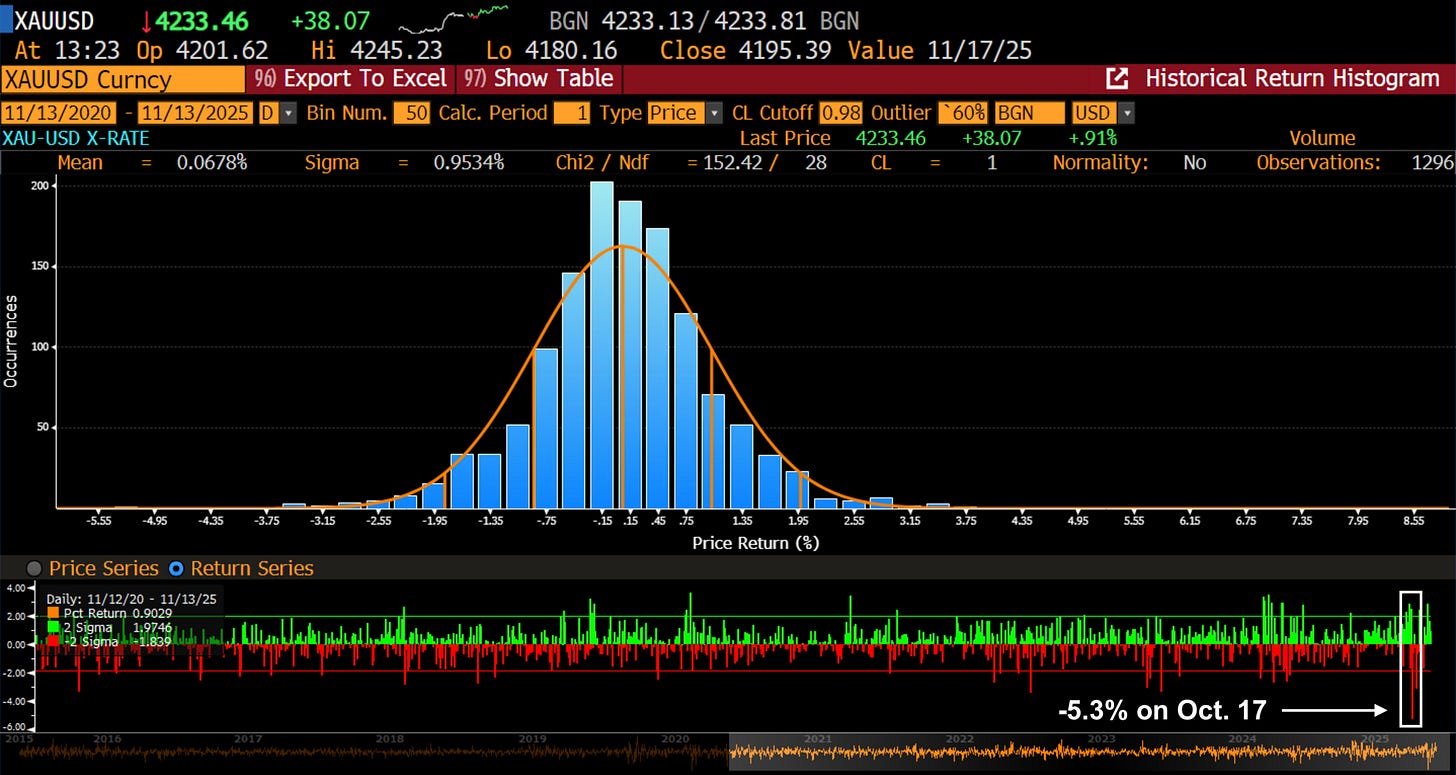

By late Q3, gold had entered the “everything is a catalyst” phase. Every narrative (debasement, rate cuts, geopolitics, liquidity) was drafted to justify the move. Some of those tailwinds were real. However, most of the late-stage movement was driven by momentum and chasers. That, in turn, led to XAU’s strongest selloff in the last five years.

Now the dust has settled. XAU has rebuilt its base and is once again stalking its all-time high near $4,381.

The broader commodity tape looks constructive. Silver futures (SI) have already taken out their yearly highs. Copper (HG), capped for months by tariff noise, is setting up for a structural turn. The PGMs (platinum and palladium) have quietly based after the recent washout. Even NatGas (NG) is creeping back into view.

Each commodity tells a different story about positioning and cycle, but the direction of travel looks increasingly aligned. Commodity markets are worth examining for some exposure ideas, both in the underlying and related equity plays.

Below, we outline some of our favourite cross-asset trades.