It has been instructive to see which of this year’s early convictions have survived contact with reality. Precious metals are attempting to redeem their bull-market credentials, with gold and silver making a valiant effort to recover. The USD/JPY trade has recovered a majority of its post–rate-check slide, an uncomfortable reminder for those who chased the move lower. Meanwhile, at the tip of the risk spear, Bitcoin continues to trade heavy.

Most consensus trades are bruised, but still fighting.

The AI trade, however, has turned the page to a harsher chapter. Over the long arc, artificial intelligence should be pro-equity, and we believe it will be: productivity up, margins up, multiples justified. In the meantime, it is indiscriminately killing SaaS stocks.

The catalyst of the recent software slaughter is Anthropic’s new tooling, Claude Code and Cowork (as well as other “vibe-coding” startups), which repositioned AI capabilities from a clever assistant to a junior employee. While various business models are threatened, software-as-a-service is particularly vulnerable. AI-native firms can often offer quicker and cheaper solutions, meaning companies that once operated in a defensible sector are now at risk of competition from new players. Users with no coding experience can now build software, dramatically lowering the programming skill barrier and undermining rigid, one-size-fits-all products.

Markets are in a shoot-first, ask-questions-later environment. Guilty until proven innocent.

The other casualty is private equity’s decade-long software binge, something credit desks have started calling “Loan-aggedon.” Wall Street’s largest alternative-investment firms are under pressure, driven by fears that artificial intelligence-driven disruptions would cause steep losses on their books. Blue Owl (OWL US), built on financing software businesses and a name we hold short exposure to in the portfolio, now trades where it last did in September 2023.

The latest leg lower reflects mounting concerns about the fallout that AI will cause among software companies, many of whom received funding from alternative asset managers at lofty valuations. UBS Group AG analysts this week estimated that private credit could see default rates surge to as high as 13% if the disruption is aggressive.

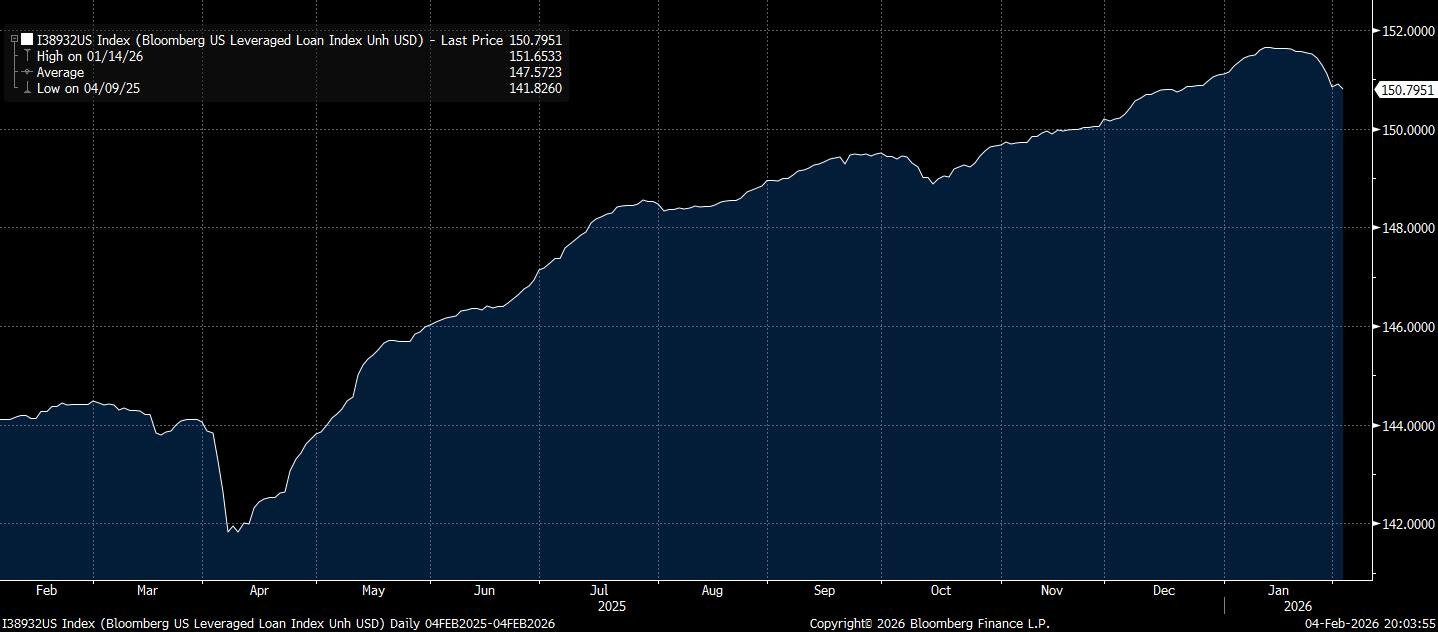

Anxiety about software has been simmering for months, but in recent weeks has boiled over into the leveraged-loan market, and this week the splash reached alternatives and business development companies (BDCs). Shares of BDCs, which pool private credit loans, have also hit multi-year lows as investors assess the level of software exposure in their portfolios. The lack of reporting means that while shares may trade daily, their portfolio health is only updated quarterly.