Solar Could Be The Hottest New Theme

There are several tailwinds for the renewable energy sector.

Renewable energy stocks, particularly solar companies, are experiencing a significant rally. Anticipation of new tariffs on Chinese solar panels, increasing demand for power, and government incentives are all acting as a tailwind for the industry.

Something that really caught the headlines last week was First Solar’s stock surging 40% higher. A recent report by UBS has emphasised First Solar as a major beneficiary of the escalating electricity usage in data centres driven by artificial intelligence.

With some major catalysts in favour, is solar energy something to get exposure to?

A shift to clean energy

In recent years, there has been a noticeable redirection of energy investments from traditional fossil fuels to renewable and sustainable energy sources. Investors with a long-term perspective are witnessing substantial returns from clean energy stocks, particularly when contrasted with investments solely focused on fossil fuels.

This has been particularly present in Europe. The energy crisis that stemmed from the Ukraine war, combined with a heightened focus on decarbonising the economy and combating climate change, has resulted in a significant surge in investments in renewable energy.

Recent data from the Ember thinktank indicates that in 2023, wind power surpassed fossil gas as the primary source of electricity generation in Europe for the first time. Furthermore, wind and solar energy together accounted for a record 27% of the EU bloc’s electricity production last year, marking an all-time high. Concurrently, coal and gas experienced a notable decline, with coal hitting an all-time low of just 12% of EU electricity generation.

While ‘renewable’ includes both wind and solar, we want to focus more on the solar aspect. We believe there is more scalability in this area of energy and, therefore, more possibilities for capital return.

Scalability

Solar power can be adopted by a household, which cannot be said for other renewables like wind turbines or hydroelectric power. That offers scalability in both the domestic and industrial markets. In the US, the EIA reports that about one third of solar generation comes from small-scale solar (defined as less than 1 MW capacity).

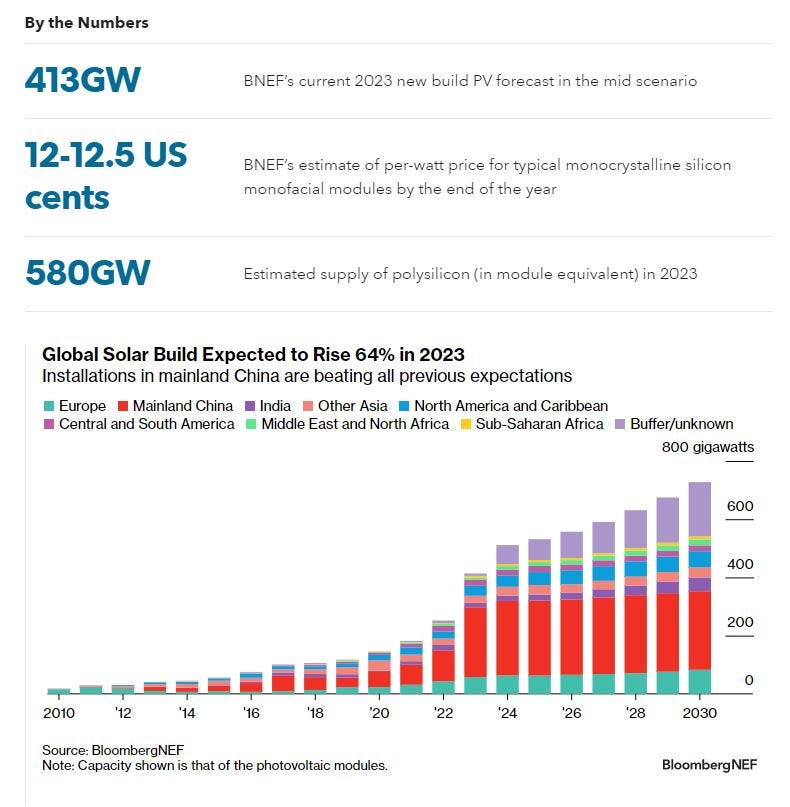

In a report released towards the end of last year, BloombergNEF highlighted a positive outlook for PV (photovoltaic). The global solar industry is anticipated to experience significant growth, primarily led by China. See the chart below:

High interest rates

Four factors exerted a particularly negative impact during the past year: interest rate hikes, which increased the cost of capital; high inflation, which increased development costs; bottlenecks in the network; and, finally, difficulties in supply chains. Rising interest rates particularly affect renewable energy companies due to the long-term nature of their cash flows and leveraged assets. Clean energy projects are subject to high upfront costs.

Because of these factors, markets valued energy names excessively negatively in 2023. But this now offers good opportunities for investors as monetary policies look set to ease (at some point this year anyway).