Stocks: 6 Disasters That Have Put Credit Suisse On The Brink

The crisis pile-up.

Issues with the Swiss bank date back to the turn of the century

More recent issues over the past two years have seen large client outflows

The stock has halted down in trading today (-20%), at record lows

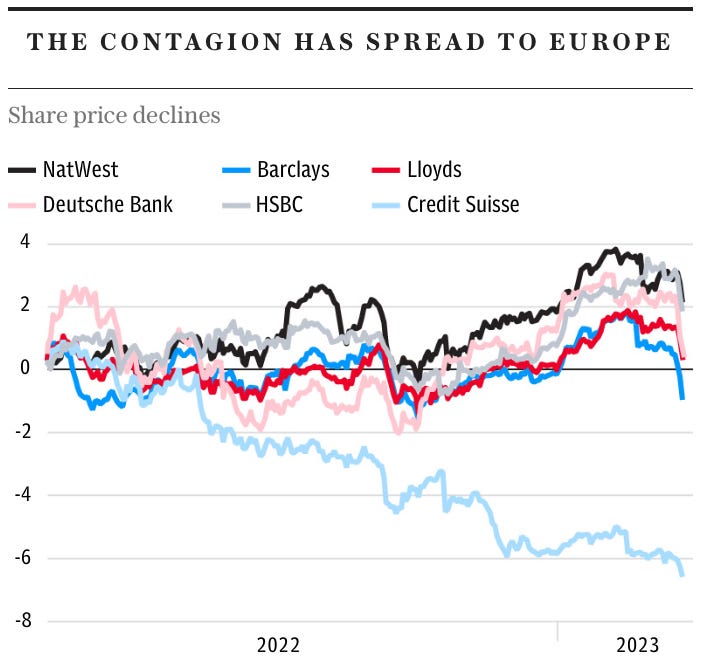

It’s been a significant past week for the banking sector, but not for the right reasons. Not only are banks facing pressure with the aggressive interest rate hikes, but Credit Suisse is also facing another scandal, something that is becoming a trend with the bank.

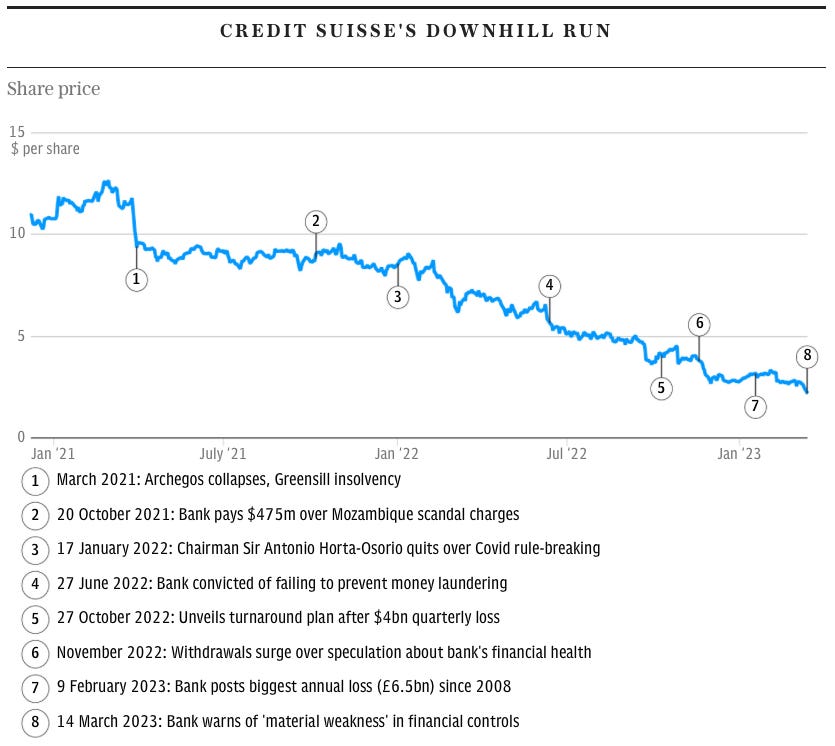

Firstly, the Swiss financial regulator said it was closely monitoring Credit Suisse and other Swiss lenders following the collapse of Silicon Valley Bank. Secondly, the bank was forced to admit it had “material weaknesses” in its reporting and control procedures. And finally, it revealed that a prolonged wave of customer outflows has yet to reverse.

Credit Suisse share prices are now:

Down 37% year to date.

Down 77% from the start of last year.

Down 97% from all-time highs.

Here’s all you need to know about the long list of embarrassments that caused Credit Suisse’s fall from grace.

The latest scandal

In its annual report on Tuesday, Credit Suisse said, “management did not design and maintain an effective risk assessment process to identify and analyse the risk of material misstatements in its financial statements”.

These errors do not relate to 2022 full-year results but rather in relation to cash flow statements going back three years.

Its auditor, PwC, first identified the flaws in the bank’s internal controls. The bank’s management team agreed with the assessment and decided to make changes to the process.

The SEC intervened last week, asking the bank to double-check that the weaknesses did not have any bearing on the financial results. The query concerned the netting treatment of some securities lending and borrowing activities. This resulted in balance sheet and cash flow positions being understated.

This problem, along with the general banking sector concerns, has left investors increasingly jittery.

But what are all the other major crises of Credit Suisse?

Greensill and Archegos

The disaster pile-up. It started with Greensill.

Credit Suisse provided financial backing for Greensill Capital as it hit stormy seas, vulnerable especially because of its business model as well as the buccaneering style of its boss, Lex Greensill.

On March 1st 2021, Credit Suisse announced they had suspended a group of four private investment funds that contained around $10 billion in securities created by Greensill, a move which swiftly triggered the collapse of the supply-chain finance firm.

Greensill filed for insolvency within days of the suspension of the funds, triggering a wide-reaching political scandal over lobbying by former UK Prime Minister David Cameron, who was paid millions by the company.

The Swiss quickly learnt the hard lesson that disaster seldom travels alone.

Archegos was next.

By the end of that same month, Credit Suisse had issued a statement saying it faced significant losses from exposure to an unnamed client.

That client turned out to be hedge fund Archegos Capital Management, led by former Tiger Management analyst Bill Hwang, which was forced to sell $20 billion in assets after a series of bets went spectacularly wrong.

Credit Suisse’s links to the collapse led to questions about its risk management, coming hot on the heels of Greensill and its exposure to failed German fintech Wirecard.

And then there was the corporate espionage

In 2019, the bank was caught in a corporate espionage scandal, and eventually admitted to hiring private detectives to track two outgoing executives. It triggered a regulatory investigation and culminated in the departure of its chief executive, Tidjane Thiam, the following year.

A group of executives were later found to have ordered surveillance in a further five cases between 2016 and 2019.

Credit Suisse said it had banned surveillance “unless required for compelling reasons, such as threats to the physical safety of employees”.

The 1999 shredding party

Some employees of Credit Suisse had a "shredding party" in Tokyo and managed to lose the company's banking licence because of that. If you don't know what a shredding party is, it consists of people gathering together and destroying documents that could be problematic for whatever reason.

Japanese authorities fined Credit Suisse after discovering that its bankers destroyed evidence related to an investigation into whether it was supporting companies to cover their losses. The bank eventually got its licence back, and the employees lost their jobs.

Fake names for Ferdinand

Credit Suisse was implicated in helping to store some of the estimated $5-$10 billion that the Philippine dictator Ferdinand Marcos and his wife, Imelda, stole from the country during his three terms as president.

It later emerged that Credit Suisse opened accounts for the couple under the fake names “William Saunders” and “Jane Ryan”, helping to shield their funds from scrutiny.

In 1995, a Zurich court ordered banks, including Credit Suisse, to return $500m of stolen funds to the Philippines.

Based on all the above, we have little sympathy for the demise of the share price to current levels. It also serves as a warning to investors in recent months: Just because a stock has fallen a lot, it doesn’t make it a cheap buy.

Our Twitter account posts quick, informative tweets and data throughout the week. We also join live trading spaces, which you can listen to. So please drop us a follow and turn notifications on to stay up to date.

Nice coverage, thank you!

Had an interview at CS in Zurich headquarters in 2019 for Capital Management, glad I did not end up there I guess ... atmosphere at the job is key for any individual ... no matter what anybody says, when you are surrounded by doom & gloom for a long time and constantly, no matter how strong one is, it will be felt sooner or later also in one's private life ...

Good Article! Am certain forced disclosures are going to start appearing elsewhere also now the floodgates have opened..