Stocks Continue In Goldilocks

A weekly look at what matters and how to trade it. (August 25th)

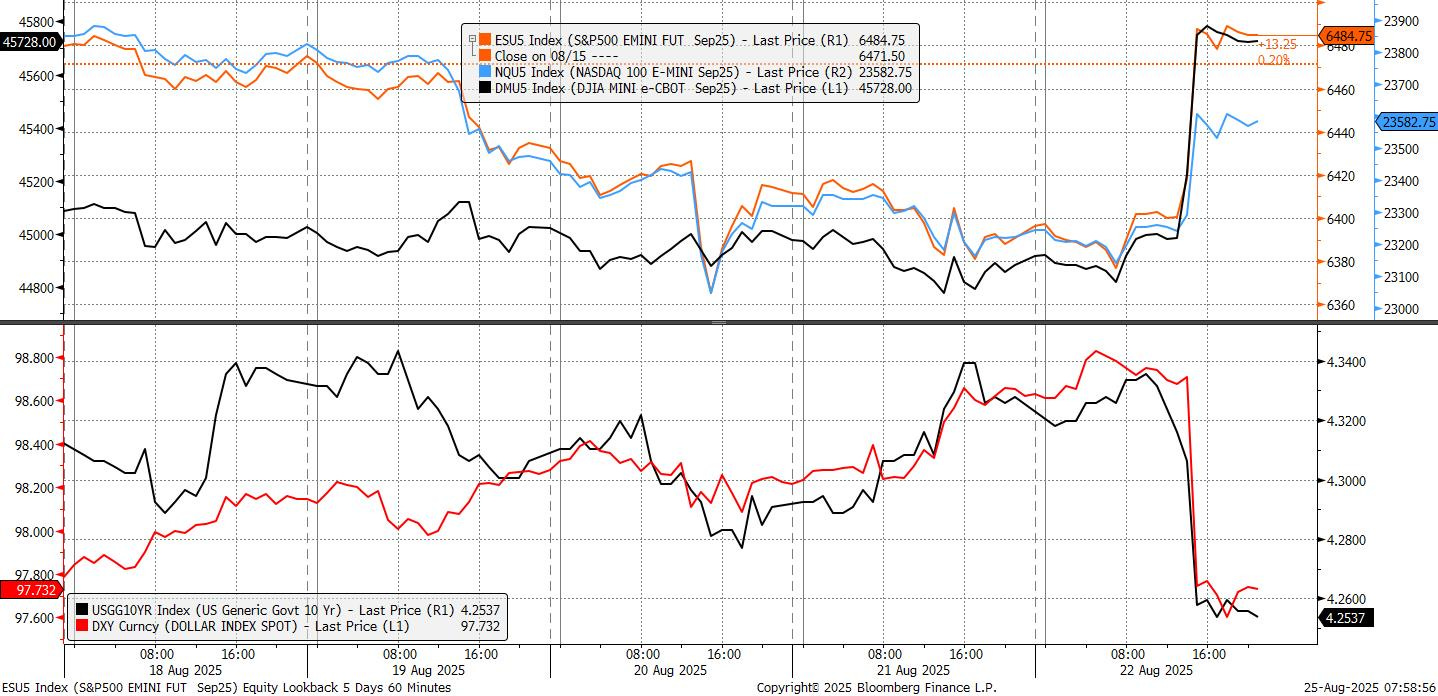

The Fed overshadowed everything else last week. Powell’s Jackson Hole speech was the most explicit policy signal in recent memory, with the chair acknowledging that “the shifting balance of risks may warrant adjusting our policy stance.” Markets took the hint. September is now fully priced for a rate cut. The KBW Bank Index closed at a record, a fitting symbol of how quickly dovish rhetoric can reset positioning.

Tech was a mixed bag. Palantir’s rout wiped $73 billion in market cap in 10 days, while Intel surged on SoftBank’s $2 billion investment and confirmation of a Trump-brokered 10% government stake. Apple and Alphabet finished the week strong on reports that Gemini could power a revamped Siri, injecting fresh optimism into AI’s integration with Big Tech. Realised and implied vol spreads are some of the lowest of this decade. All in time for Nvidia earnings this week.

The USD gave up its early-week gains in a sharp reversal post-Powell, with EUR/USD and USD/JPY both surging on rate differential repricing. Canada’s scrapping of retaliatory tariffs added fuel to the USD selloff. Treasuries bull-steepened, with the 10-year down just over 6bps, and markets now price in over 50bps of easing before year-end.

To access full articles and research, manage your account here.

The Week Ahead

The coming week is anchored by Friday’s release of US PCE inflation for July, the Fed’s preferred price gauge. Policymakers will want confirmation that tariffs aren’t feeding through into prices and that demand is slowing. A strong PCE print could force the Fed to rely on another soft August payrolls report before committing.

Beyond PCE, the US calendar is busy. Durable goods orders (Tuesday), consumer confidence (Tuesday), the second GDP estimate (Thursday), and jobless claims (Thursday) will all test the narrative of slowing momentum. Housing data are also due, with new home sales Monday and Case-Shiller prices Tuesday, while the University of Michigan’s final August sentiment survey rounds out Friday. On the supply side, Treasury auctions of 2s, 5s, and 7s will add duration to a nervous rates market.

In Europe, sentiment indicators will dominate the flow ahead of Friday’s flash August inflation data from Germany, France, Spain, and Italy. The week starts with Germany’s Ifo survey Monday, followed by French consumer confidence Tuesday, Germany’s GfK Wednesday, and broader EU and Italian confidence Thursday. Investors will parse these against the surprisingly resilient PMI prints to judge whether the eurozone recovery is real or tariff-distorted. Friday also brings German labour-market data, retail sales, and a string of French and Italian releases, alongside the ECB’s July meeting accounts on Thursday.

The UK has a muted week, with markets shut Monday for a holiday. Scheduled releases include the BRC shop price index (Tuesday) and the Nationwide house price index, with little impact expected on gilt pricing after last week’s BoE decision. Sweden offers more intrigue: Q2 GDP Friday will give a check on the Riksbank’s assumption that inflation pressures are temporary. Switzerland also posts Q2 GDP Thursday.

In Asia, Japan delivers a heavy slate Friday: Tokyo CPI, retail sales, labour-market data, and industrial production. With core inflation running above target and Q2 growth surprising to the upside, investors are increasingly positioning for a BoJ hike as early as October. BOJ board member Nakagawa speaks Thursday in Yamaguchi, with markets listening closely for policy hints. BOJ JGB purchases (Wednesday) and MOF bond auctions (Tuesday, Thursday) could also test market appetite given rising rate expectations.

Central banks are active across emerging Asia. The Bank of Korea (Thursday) is expected to hold at 2.50% while tweaking forecasts higher, setting up October as the more likely window for easing. The Philippines’ BSP meets the same day, with a 25bp cut widely expected after inflation undershot its 2–4% target range for five months.

Elsewhere, India reports Q2 GDP, with growth likely softening under manufacturing weakness but supported by services exports. Trade frictions with the US, including the threat of a 50% tariff on oil-related imports, add downside risk. In China, industrial profit data (Wednesday) and Friday’s PMIs will be watched for signs that stimulus is offsetting tariff drag. Singapore CPI (Monday) is expected to edge lower but remain consistent with MAS stability.

In EM Europe, Hungary’s MNB is seen on hold Tuesday at 6.50%, with inflation still elevated. In Canada, June GDP Friday will be key for the BoC after soft CPI last week tilted market pricing toward a September cut.

Equities

S&P Still Dancing to Powell’s Tune:

As we mentioned in our note on Friday, equities were quick to erase their early-week wobble and move decisively higher on Powell’s speech. The set-up was primed for a squeeze. Tech had shown cracks, and the Chair’s words kept the golden scenario intact: inflation not out of control, cuts still on the table, and no imminent hard landing.

That optimism wasn’t confined to mega-cap tech. The Russell 2000 ripped as much as 3.5% to fresh YTD highs, a reminder that small caps are effectively the highest-beta expression of Fed relief. These companies have carried the weight of elevated financing costs and tariff uncertainty for much of the post-pandemic cycle. A clear rate-cut path offers them sharp cyclical relief, and the market is responding accordingly.

Our Monday note from last week highlighted this:

“That’s why we like adding beta and laggards alongside the core longs:

Russell 2000 for broad small-cap beta.”

The takeaway is: policy expectations still dominate risk sentiment. Equities are wired to look on the bright side of life, and right now, the bright side is Powell keeping the easing narrative alive.

Euro Banks

European equities are holding up in what’s usually a weak seasonal stretch. The Stoxx 600 is up 2.8% so far this month, defying the typical August-September lull, and banks are the main reason why they can keep rallying.

The broad index has advanced more than 10% this year, on track for its best performance since 2023. The banks sub-index has soared 45%, but valuations are still far from stretched: banks trade at less than 10x forward earnings, a ~35% discount to the broader Stoxx 600 and a ~65% discount to the Nasdaq 100.

That rally casts banks as Europe’s “tech-like” performers—they’re powering index returns, but without the froth. That was evident from a surprisingly good earnings season for the sector. Three-quarters of banks beat estimates, with profit growth of almost 15% versus just 1.8% estimated. It’s a rare case where growth and value align.

The performance also highlights a regional split: value and small caps in Europe are carrying benchmarks, while in the US, it’s still growth that dominates. The question is whether Europe’s banks can extend the run as ECB easing squeezes margins, or if the earnings momentum buys them more time. For now, the answer appears to be the latter.

FX

Dollar Shorts Back In Vogue:

The DXY took a hit to end the week, with Powell’s speech logically seeing the greenback lose ground on the basis of a lower-yielding environment in the near future.