Stress Rising in the Shadows

A weekly look at what matters and how to trade it. (November 17th)

In this week’s report:

A recap of what moved markets last week

The rundown of the economic calendar for the week ahead

Equity positioning: derisking into year-end, but retaining optionality for upside

UK budget trades and SOFR commentary

CDS spreads and the AI complex

US equity markets endured a week of heightened volatility but ultimately managed to hold onto modest gains. The S&P 500 eked out a positive finish, even as multiple intraday selloffs and a higher VIX suggested the momentum from this year’s AI-driven rally is finally starting to fatigue. The volatility index closed above its 200-day moving average for the first time since the summer, a subtle but telling sign that complacency may be fading.

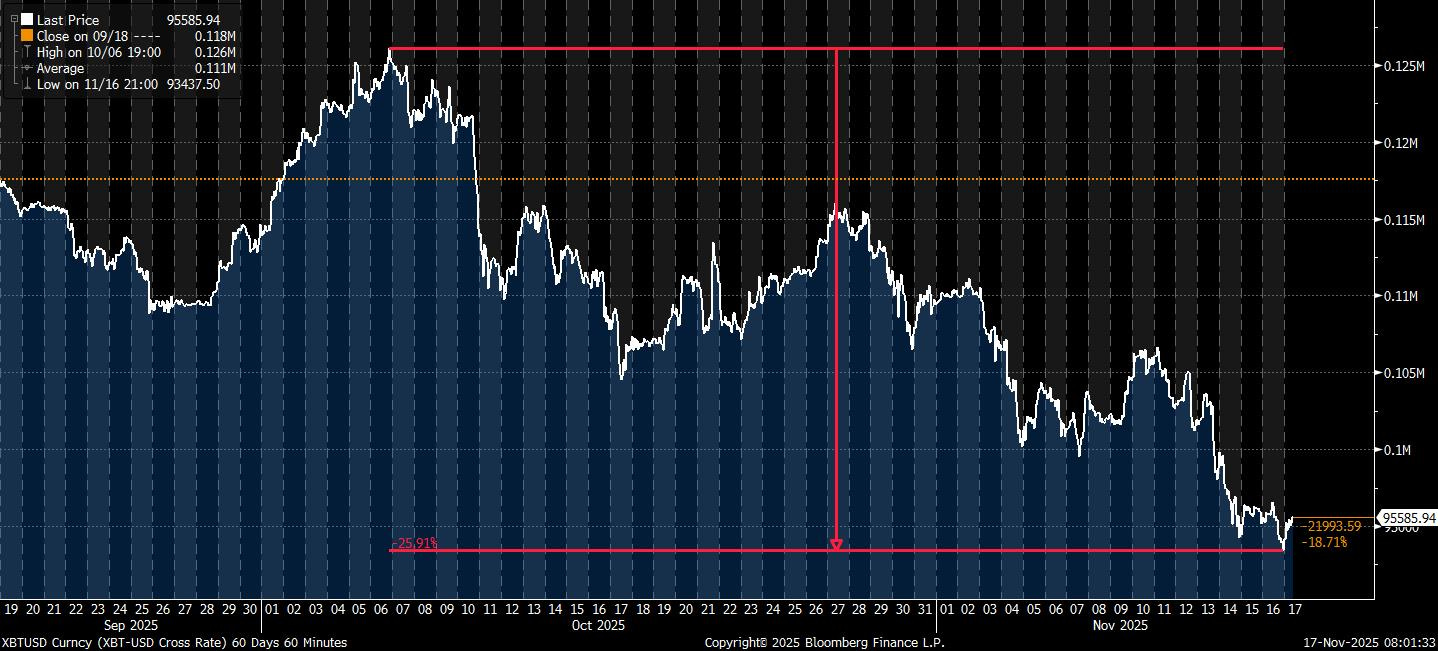

Health care and energy led, while consumer discretionary and rate-sensitive sectors lagged. The lack of fresh US data continued to leave markets adrift, depriving investors of the macro validation they’ve grown used to anchoring trades around. Meanwhile, crypto assets extended their recent drawdown, adding to a broader sense of cross-asset unease. Joe Weisenthal put it well: “Crypto has been trading like garbage lately. If you think that this space is kind of the tip of the spear for investor animal spirits and risk appetite, it’s probably worth paying attention to the fact that it’s been ugly in coin-land lately.”

Breadth remains the persistent worry. Last week’s bouts of weakness saw the Magnificent Seven underperform the broader index, a reversal of the trend that has defined most of the year. The spread between them and the rest of the S&P 500 remains enormous, but since late October, that gap has started to narrow.

Thursday’s selloff was particularly severe, a heavy hit to momentum and retail-heavy baskets. Bank of America’s High-Momentum Index fell 4.7% (its worst day since April), while Citi’s Retail Favourites basket sank 6%. Even heavily shorted names weren’t spared, as Goldman Sachs’ Most-Shorted Index dropped 5.5%.

(To step away from the serious for a brief moment, Michael Burry (we all know who he is and why he is famous, right?) closed his hedge fund, Scion Capital. If you think the market works in funny ways, Burry closing his fund as markets debate the AI bubble is a sign that the top is in. But we digress. Back to the serious.)

While further trimming its holdings in Bank of America and Apple, Buffett bought Alphabet… $4.9 billion of it.

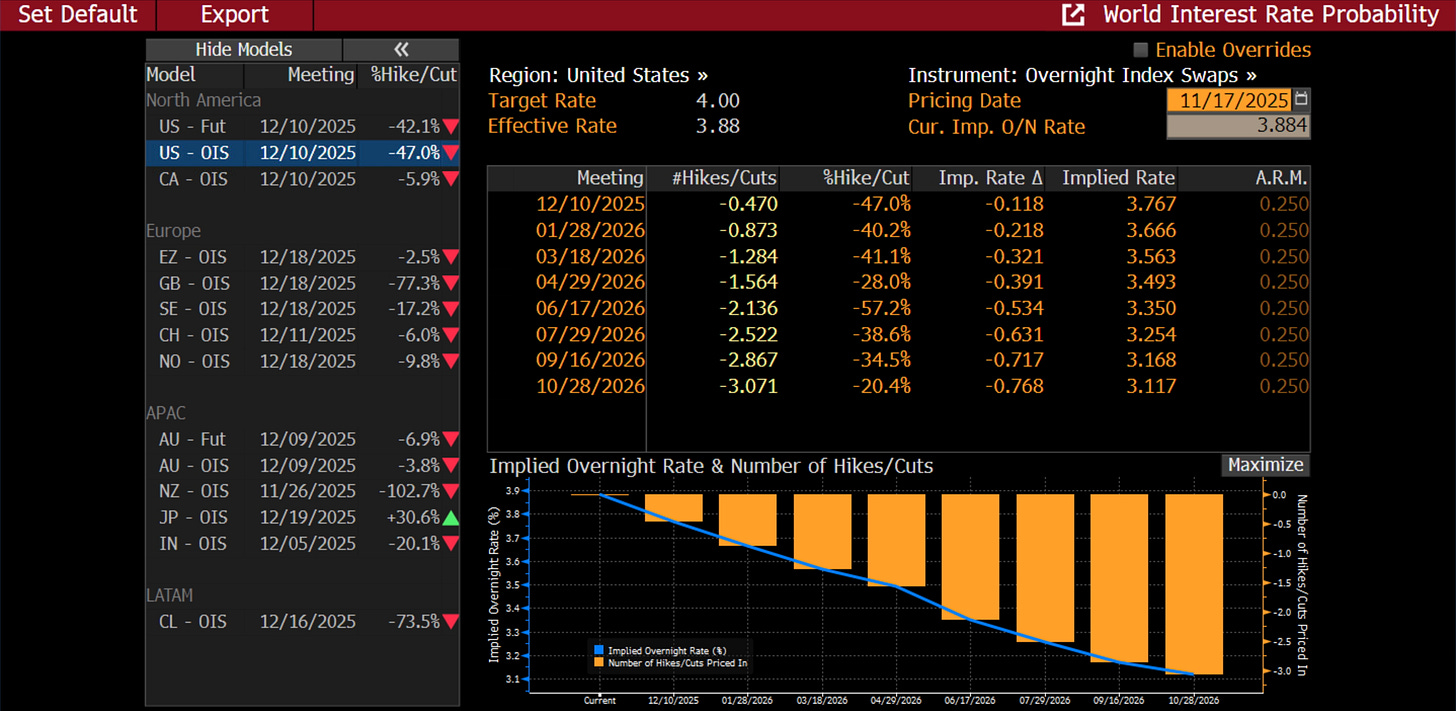

Traders attributed the moves to recalibrated Fed expectations: swaps now imply roughly a 50% chance of a December cut, down from 72% a week earlier. With policymakers showing little inclination to pre-commit, the market has begun testing how much of this year’s rally rests on rate optimism rather than earnings resilience.

Regarding economic data and Fed speak, after 43 days, the longest government shutdown in US history ended last Wednesday as President Trump signed legislation to reopen federal agencies. The impasse had crippled several core services and delayed the release of critical economic data. The BLS confirmed the September jobs report will be released on November 20th, while the October report will omit the unemployment rate altogether due to missing survey data.

Markets greeted that news with cautious relief. The shutdown’s end removes a near-term tail risk, though the resulting data vacuum leaves policymakers and investors effectively flying blind into year-end.

We discussed the Looming Data Deluge further in our weekend note. You can read that here, along with more short exposure we’re adding to our equity portfolio.

With the shutdown continuing to restrict official releases, even small data points moved markets. The new rolling four-week ADP report showed 11,250 job losses through October 25th, briefly rattling equities before the move faded into the close.

Fed officials struck a more hawkish tone overall, signalling caution about further easing. Musalem (voter) highlighted limited room to cut rates further, with a need to lean against inflation. Bostic (non-voter) favours holding rates until inflation is clearly moving toward 2%. Schmid (voter) said inflation concerns are guiding his thoughts into December.

The coordinated tone reinforced Powell’s last FOMC remarks that another cut this year is far from assured. Markets are now pricing roughly a coin-flip chance of a move in December, a significant shift from the consensus just two weeks ago.

In FX and FI, the dollar mirrored equity volatility, finishing marginally weaker after several sharp intraday swings. GBP/USD led directional moves amid renewed UK fiscal worries, while USD/JPY repeatedly tested 155.00 but failed to break decisively. With delayed US data set to return, positioning in major pairs is likely to remain cautious into December’s FOMC meeting.

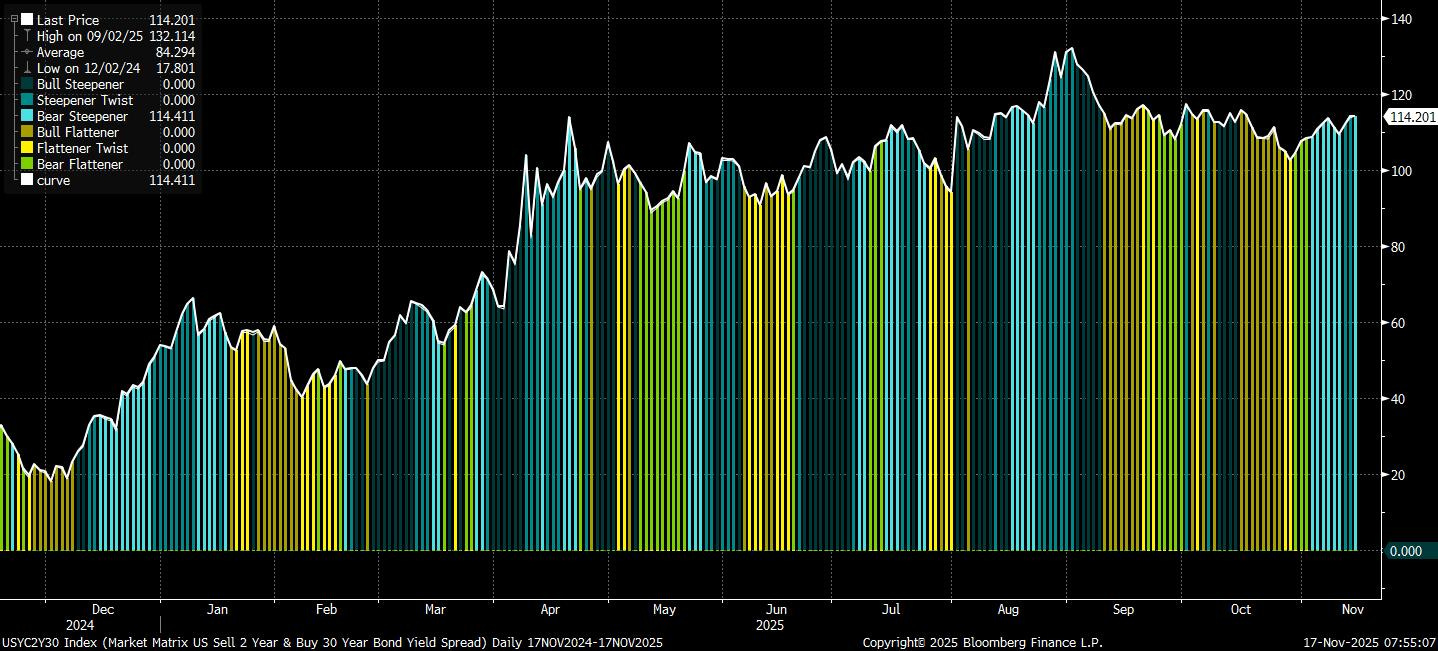

US Treasuries experienced mild upward pressure on yields, particularly at the long end, following soft demand at the 10-year and 30-year auctions. Both auctions tailed, and the resulting increase in funding costs reignited calls for the Fed to address balance sheet runoff more directly.

Equity weakness started to become a larger influence on rate markets compared to the last couple of months, with volatility likely to play an increasingly larger role as volumes taper off into the end of the year.

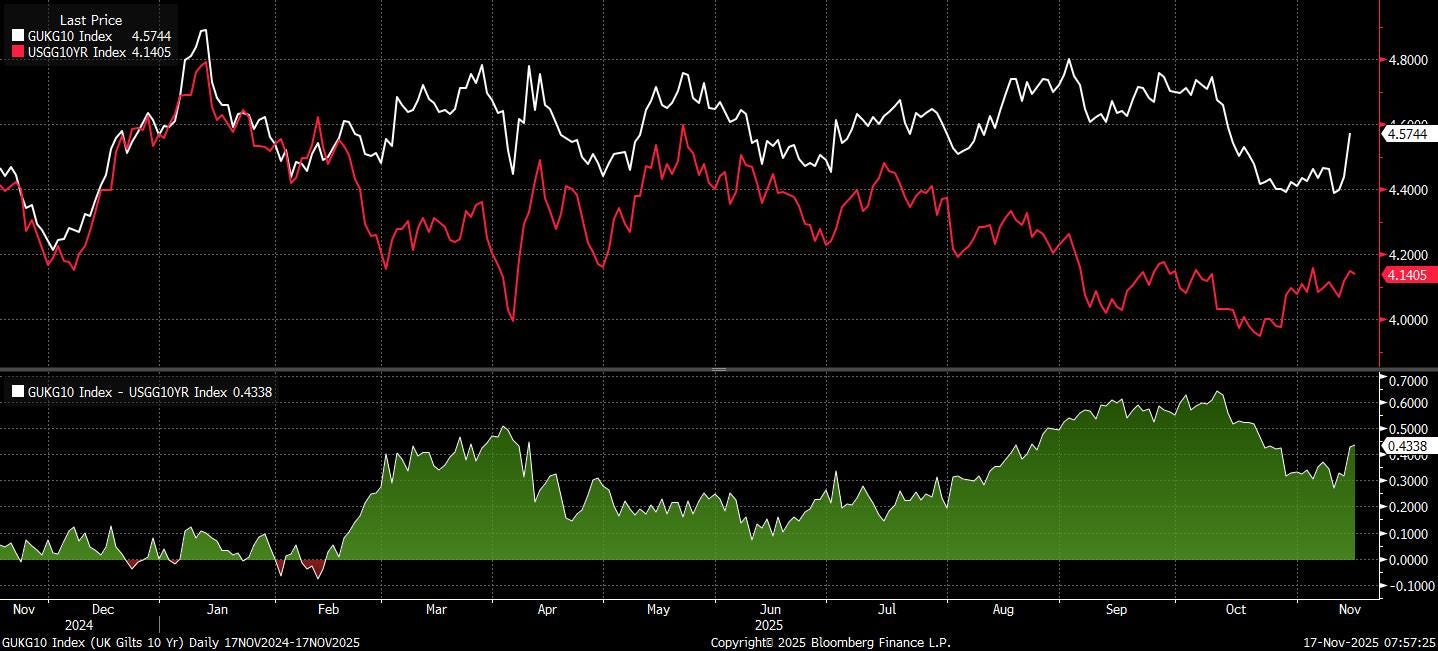

Locally, reports stated that the UK Labour government has dropped plans to raise income taxes, causing gilt yields to rise and sterling to fall.

The Economic Calendar

A quick rundown of what’s on the calendar for the next few days before we get started with our thoughts and positioning for cross-assets.

United States:

Nvidia’s earnings on Wednesday will once again set the tone for markets and the US economy (as the meme goes).

Walmart (Thursday), Home Depot (Tuesday), and Target (Wednesday) will round out a crucial set of consumer prints. With macro data still constrained by the now-ended shutdown, corporate guidance will carry extra weight. The long-delayed September NFP report is scheduled for next Thursday, and the return of data flow could reintroduce macro volatility ahead of the December FOMC meeting.

United Kingdom:

Focus in the UK will centre on any further commentary on possible measures at the autumn budget on November 26th, as well as UK inflation data for October on Wednesday.

In addition to the budget, inflation data will be key, as investors seek further evidence of whether the BOE will cut interest rates again next month, following recent weak jobs and gross domestic product data.

Money markets are currently pricing an 84% chance that the BOE will cut rates next month, LSEG data show, with some expecting that rates won’t be reduced until February.

Canada:

Canada releases its October inflation data on Monday. The minutes of the Bank of Canada’s last meeting in October noted that inflation exceeded the central bank’s expectations in September, rising to 2.4%. The BOC cut rates by 25 basis points to 2.25% at that meeting, but some policymakers pushed to hold off on another cut until a later date so they could have a better gauge of inflation risks and labour market weakness, the minutes showed. That means upcoming data, including Monday’s inflation report, will be key.

Japan:

Japan’s economy is expected to have contracted in the July-September quarter, with government data on Monday likely to show 0.6% quarter-over-quarter decline in real GDP, according to economists polled by data provider Quick. The contraction has been partly attributed to the impact of higher US tariffs.

Market participants will also be focused on Friday’s inflation data, which is expected to show that consumer prices excluding fresh food rose by 2.9% in October, matching the pace from September and remaining above the BOJ’s 2% price target. This persistent inflation could reinforce expectations that the BOJ may soon resume tightening, especially after recent indications that the central bank may be preparing to shift its policy stance.

The Bank of Japan (BoJ) is expected to make outright purchases of government bonds on Thursday, which could help support the domestic bond market. Meanwhile, the MOF will auction about 250 billion yen of 10-year inflation-indexed bonds on Monday, followed by a 20-year JGB auction on Wednesday. Investor interest may be stronger for the 30-year debt sale, where higher yields are expected.

APFX still believe the BoJ won’t raise rates in December, and is long the December TONA futures contract.

China:

Markets will turn their attention to the PBOC, which is set to announce the country’s benchmark lending rate on Thursday. With China likely on track to meet its full-year growth target and banks’ net interest margins near record lows, Citi economists expect the PBOC to leave rates unchanged in November. They forecast no further cuts for the remainder of the year, but anticipate a 20-basis-point cut in 2026.

From here, we dive into our cross-asset views, the trades we like, and how we’re positioning the portfolio into the week ahead.

The Week Ahead

Equities

The weight of the world lies on Nvidia.

The chipmaker will take centre stage on Wednesday. Still, it remained in focus last week after SoftBank sold its entire $5.8 billion stake to raise capital for future AI investments (likely companies that buy from NVDA, which seems strange if you ask us). The divestment triggered a 3% drop in Nvidia shares as investors interpreted the sale as a sign of potential saturation in AI-linked positioning. Upcoming earnings will serve as the next major test of whether the AI boom still has momentum.