Sunday Fed Thinktank

All eyes are on the Federal Reserve as inflation stirs and jobs falter.

Since Jerome Powell’s perceived pivot at Jackson Hole, markets have been biding their time for the next move. That wait ends Wednesday, when the Federal Reserve takes the stage.

It’s a tough backdrop: inflation is re-heating just as cracks spread through the labour market. Powell has to thread the needle, either cut too soon and risk fuelling prices, or wait too long and risk breaking jobs.

Here’s how we think the Fed will play it, what that means for cross-asset pricing, and a few of the sharper trade ideas we’ve seen doing the rounds this week.

Tolerable Inflation

One of the most important pieces of the Fed’s decision next week will be how it frames the latest inflation trends.

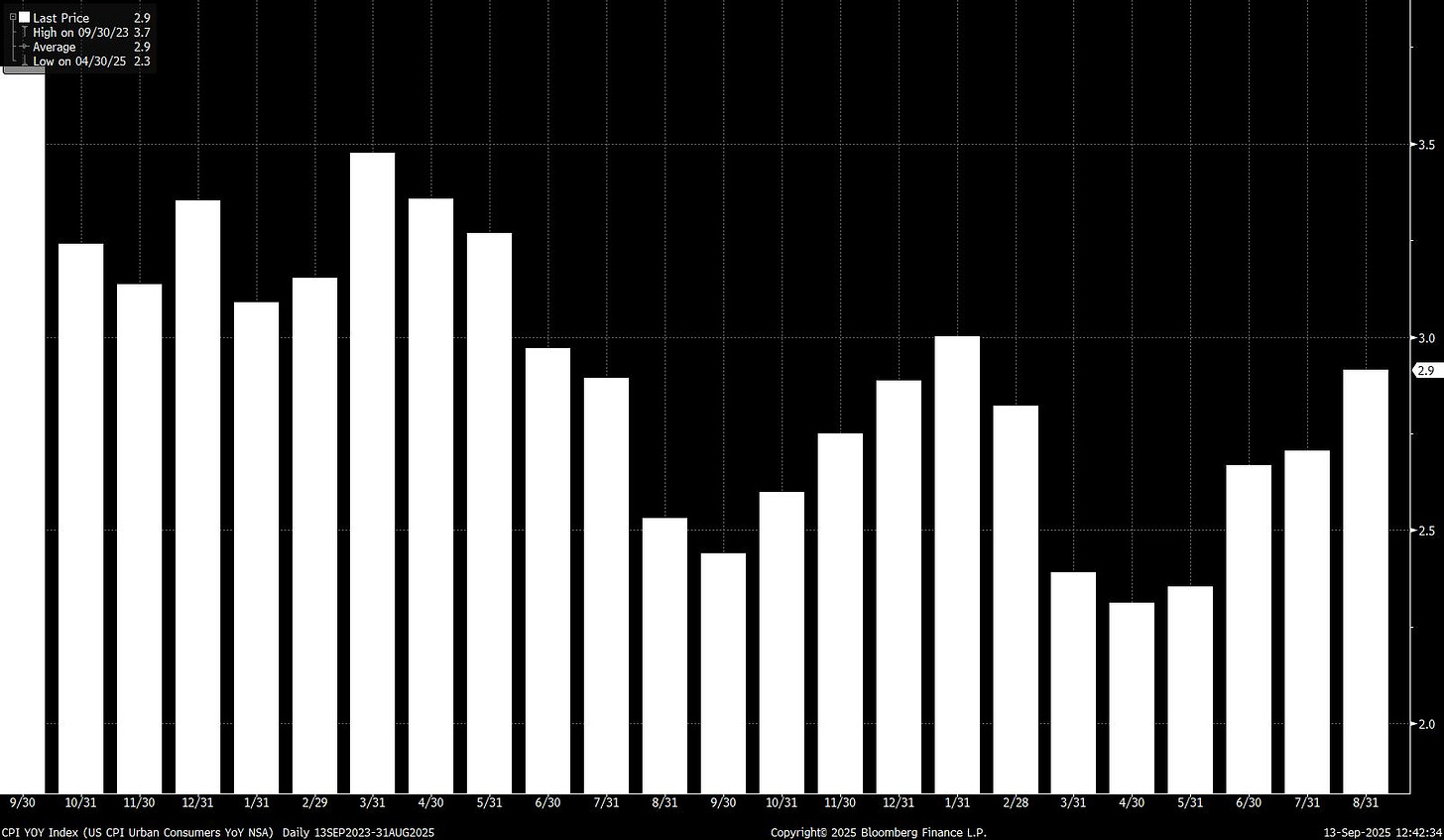

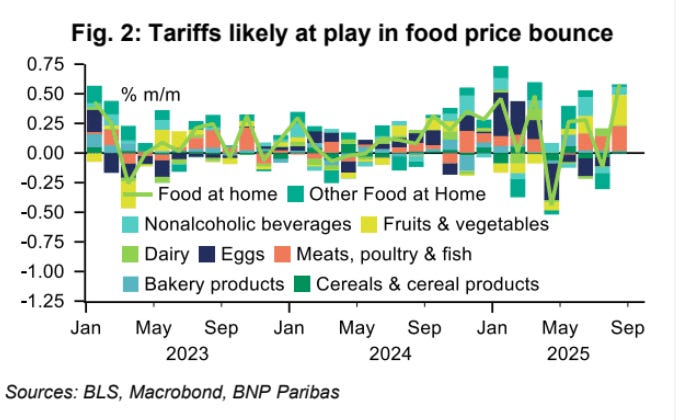

Headline CPI inflation on Thursday hit the highest level since January, in what some see as a clear trend higher, with the impact from tariffs starting to filter in, although in our view, this is going to be more of a gradual impact rather than an accelerated spike.

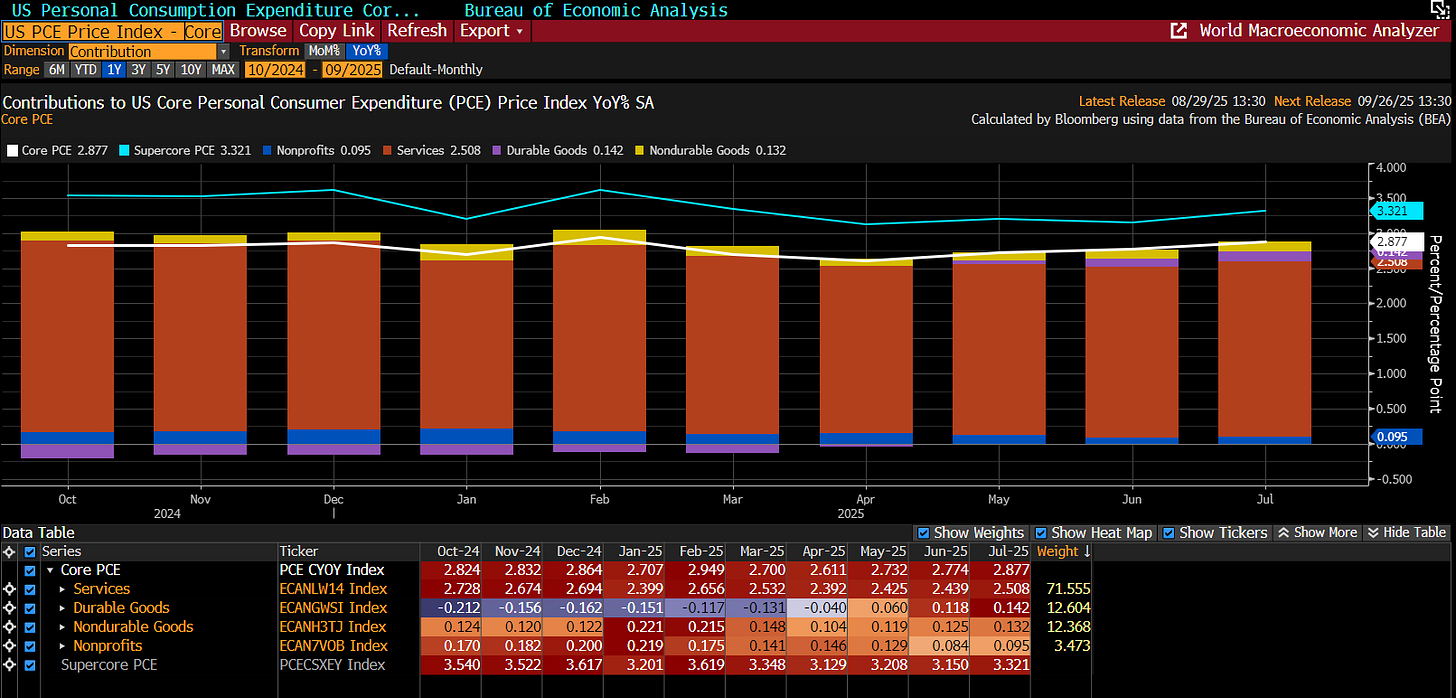

The FOMC may try to overlook this, framing the focus on underlying or “sticky” components. The key gauge here is core PCE…(don’t say it, don’t say it…) the Fed’s preferred measure of inflation.

Core PCE has been treading water this year in the 2.7-3% banding, with signs of persistence in areas like housing, healthcare, and other services. These categories are important for decision-making not only because they are less volatile than energy or food, but also because they tend to reflect deeper price pressures tied to wages and demand.

If the Fed sees core PCE moderating steadily, it strengthens the case for a more dovish path into year-end. From our perspective, we feel the Fed will even be happy to tolerate CPI, PPI and other gauges moving higher within reason and still commit to policy easing on the basis that they are helping the labour market.

Until inflation meaningfully kicks higher (we’re talking 3.5%+ on headline CPI), we feel the committee will be happy to tolerate the rising price level. As for next week, look for comments along the lines of ‘the rise in inflation has been noted’, or even a return of the classic ‘transitory’ rhetoric.

Labour Market Concerns Valid

We felt ING summarised the situation with the labour market well with the below snippet from a note this week from their FICC team:

“This narrative was borne out in the latest Federal Reserve Beige Book, which reported that ‘Most of the twelve Federal Reserve Districts reported little or no change in economic activity’ and that ‘across Districts, contacts reported flat to declining consumer spending’. It also commented that 11 of the 12 Fed Districts reported no hiring over the previous seven weeks with one reporting a decline. This was broadly in line with last Friday’s August jobs report, showing just 22,000 jobs added last month and unemployment rising to 4.3%. Meanwhile, Tuesday’s preliminary payrolls revisions to the 12 months to March 2025 show that the economy added less than half the jobs the Bureau of Labor Statistics had previously reported!”

It’s not just the headline jobs numbers that are causing problems, but revisions to previous releases. This causes several problems for the Fed. For one, these revisions imply that the labour market was already slowing earlier than most thought. Rather than a sharp deceleration recently, it seems there’s been a more gradual softening.

There’s also the concern that in past meetings, Fed officials have overestimated the strength of the labour market, whereas now the picture is different. It also feeds through to inflation, as future wage pressures may ease if demand isn’t that strong.

As was made clear by Powell and Jackson Hole, the Fed has more justification to ease the policy rate based on the labour market. They may emphasise that any future cuts depend on continued weakness in the labour market, which could unwittingly see them become committed to more extensive easing into H1 2026 should it indeed continue.

Although the case for cutting is stronger, the picture may cause some Fed officials to be more cautious about over-committing to large 50bps increments. Given the concern around data revisions (which can work both as a positive or a negative), we feel it’s unlikely that any jumbo cut at any upcoming meeting is justified.

BofA Offer Rates Trades

Bank of America’s rates desk says their economists now expect two cuts in 2025 and three more in 2026, front-loading what had been four 2H25 cuts and lowering the eventual policy trough.

They mark to this path with end-2025 targets of 3.3% for 2y Treasuries and 4.0% for 10y, and argue the mix implies a lower-vol backdrop with 1y10y sitting in an 80–95bp “fair” range and the left side underperforming as a soft-landing Fed gradually eases.

Translating that Fed path into trades, they add duration on dips (blend nominals and TIPS for stagflation protection) while keeping a cautious carry / short-vol stance and preferring synthetic duration via options given USTs’ weaker hedging utility versus equities.

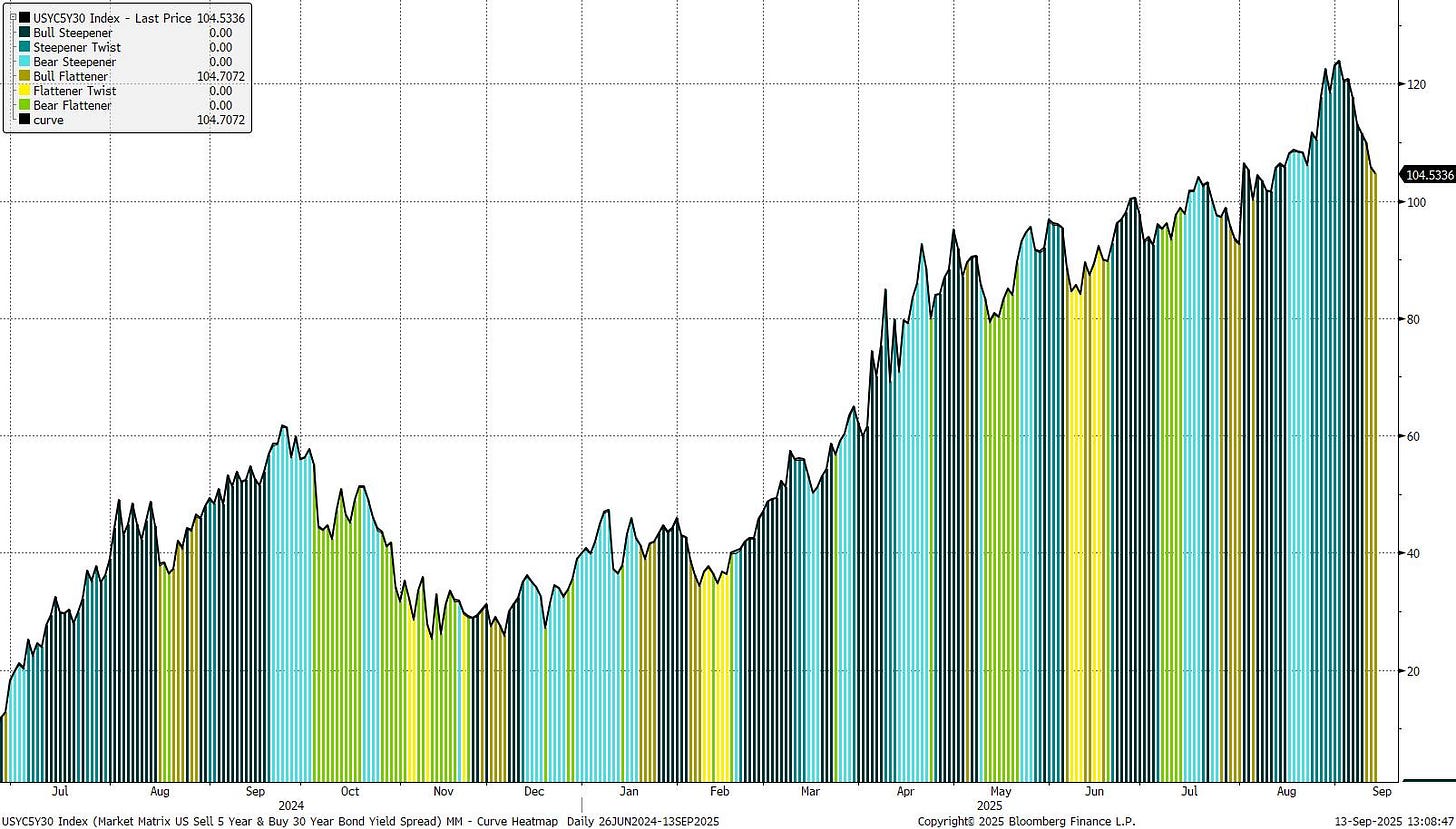

As structural hedges around the base case, they like 5s30s steepeners outright. Their take-profit is 160bps, with a 90bps stop (below shows it currently at 104bps). Tactically, with probabilities tilting toward a slowdown, they favour front-end receivers such as receive 5y OIS.

Goldman See Resilient Growth + Dovish Fed

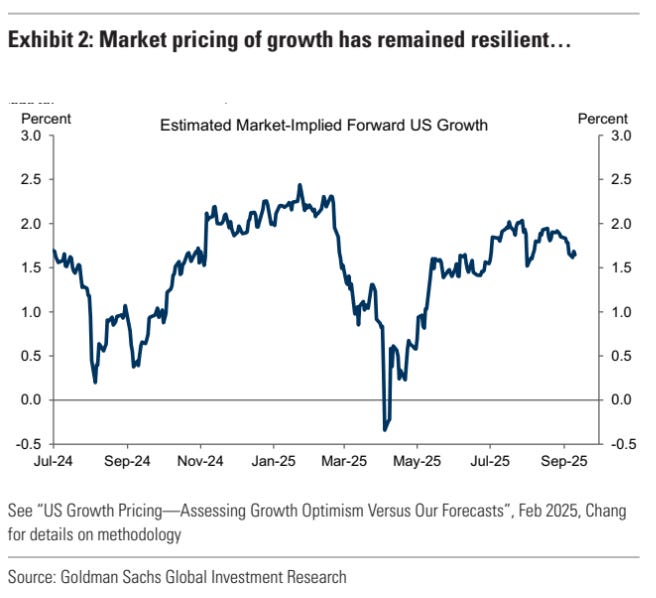

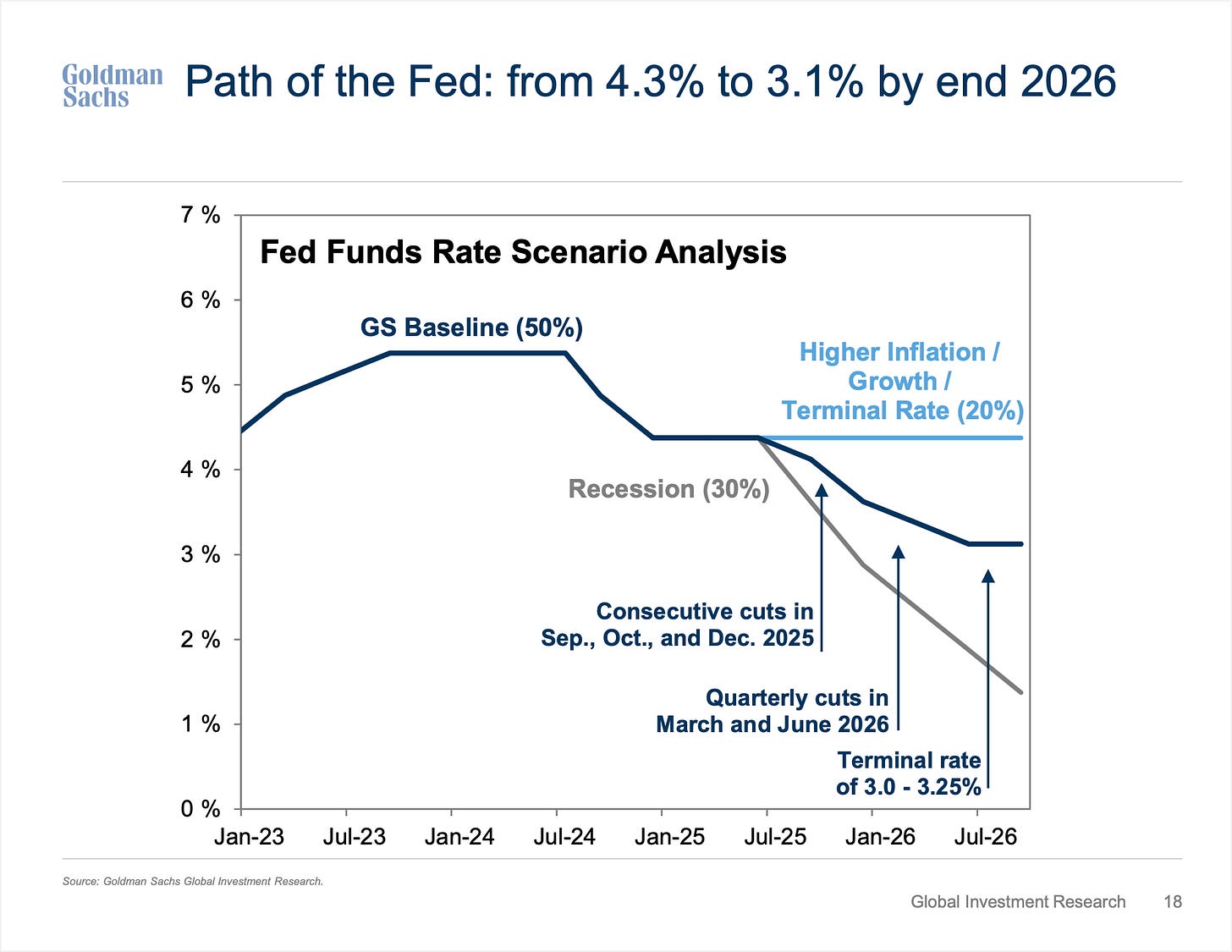

GS Economics expect the Fed to begin cutting at each of the three remaining meetings this year, then twice more in 2026, while growth gradually reaccelerates toward potential. Their macro decomposition shows growth pricing has stayed resilient—around 1.6% forward growth—and the real story is that weaker labour market data gave the Fed more leeway to ease without stoking tariff-driven inflation fears.

They warn, however, that this benign “resilient growth + dovish Fed” setup carries two risks. First, if the labour market slowdown deepens into a recessionary dynamic (especially via a sharper rise in unemployment), markets would likely pull forward rate cuts, but equities could sell off hard given their current pricing for resilience. Second, if growth holds up, investors could worry they’ve priced too much easing, leading to a hawkish policy shock that lifts rates and weighs on equities. Given that the market has not been pricing recession risk lately, positive data would be more likely to unwind the dovish policy shock than to spark growth upgrades.

GS concludes that the base case of gradual Fed cuts alongside steady growth remains friendly for risk assets, but recommends hedging both tails: front-end receivers to protect against a negative growth shock that pulls cuts forward, and belly payers (focused on late-2026 cuts and terminal rate pricing) to hedge against a hawkish Fed shock if growth stays firm.

AP Trade Thoughts

With the market still struggling to price the collision course between re-heating inflation and a cooling labour market, we’re thinking in three directions, all of which depend on what tone Jerome Powell strikes on Wednesday.