Super Micro Crash Incoming

Or 'Super Micro Compelling Investment?' Shorts and longs are piling into the hottest stock this year.

Super Micro Computer, Inc. (more easily referred to as SMCI) has been the hottest name this year. Regarding YTD performance, SMCI stands at a gain of 154%. Second and third place is taken by Screen Holdings and Arm Holdings, respectively, at just over 60%. Maybe it’s not surprising that all three names make their money in one sector: Semiconductors.

The outperformance from SMCI comes even after the stock price fell 34% across two sessions.

The company’s strong gains are creating a lot of talk about whether things have gone too far. Is it Super Micro Crash Incoming? Or Super Micro Compelling Investment?

The earnings that started this

Super Micro manufactures and sells computers to companies that use them as servers for websites, data storage and applications such as artificial intelligence algorithms. SMCI’s sales mostly depend on Nvidia’s allocation of graphics processing units, which are at the heart of the AI boom.

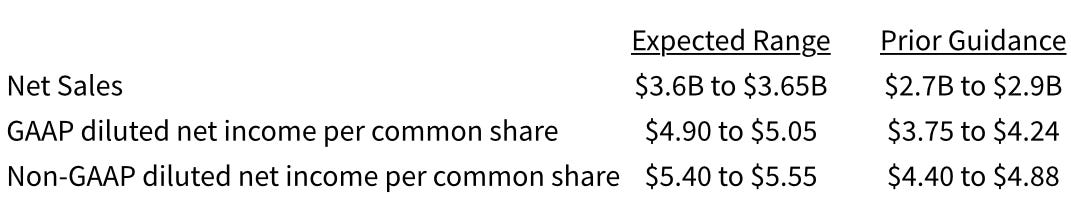

The company issued preliminary financial results on Jan. 18 that exceeded estimates.

Revenue for the fiscal second quarter, which ended Dec. 31, came in at $3.66B, well above prior guidance of $2.7 billion to $2.9 billion. Analysts, on average, were expecting revenue of $3.06 billion.

Adjusted earnings came in at $5.59 per share, higher than the previous guidance of $4.40 to $4.88 per share.

The ever-increasing growth of semiconductor names is continuing to outpace analysts. It was a similar story to Arm Holdings, which rallied 110% across three trading days following earnings.

We say “the earnings that started this” as the subtitle, but that may be misleading. Before the prelim report, SMCI was up over 800% from 2022 lows and 280% since the start of 2023. The stock has been a winner for some time. But really, the debate of “maybe this thing has gone too far” started to kick off after these earnings.

The sell

The past two days have been a very different story from the previous two years of excellence… and that’s by no fault of Super Micro. The stock price hit an intraday high of $1077.87 on Friday last week and has now fallen 34% (at the time of writing). It’s a classic example of the euphoric mentality that market participants often have.

“When things are really ripping like this, it isn’t institutions wanting to hold something as a long-term investment. It is a casino mentality for people playing momentum and taking shots,” said Michael Matousek, head trader at US Global Investors Inc.

“I’m sure some people are getting run over trying to short this thing, and while others have probably done well, catching something like this really comes down to luck.”

On Friday, traders who shorted the semiconductor company made a profit of $1.2 billion, capitalising on its largest drop since August. Despite these gains, the group of contrarian traders has still suffered paper losses of approximately $4.8 billion over the past year. Short sellers have increased bearish bets by 12% in the last 30 days. That equates to an additional $623 million against the AI company.

After the euphoric move up and the seemingly blindsided move back down, SMCI is starting to feel like a meme stock craze. Don’t confuse that sentence as “SMCI is a meme stock”. The company's underlying growth does support a move higher and seemed appropriate. But a combination of serious growth expansion and an AI-craze-wave really got things going… maybe too far.

Shorts start pilling in alongside the retail momentum to the long side, and we now have whipsaw price action. The previous five trading days saw +11.2%, +14.0%, +4.1%, -20.0% and -9.6%.

And we’re probably not done yet.