“Take A Simple Idea, And Take It Seriously.”

From being born in Omaha to teaming up with Buffett, Charlie Munger dislikes (but deserves) the spotlight.

Who is Charlie Munger?

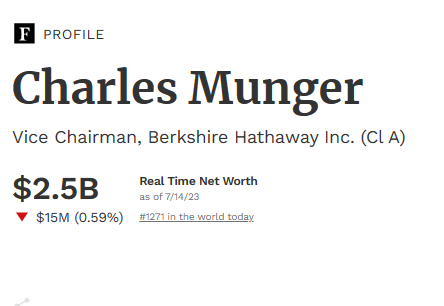

Charlie Munger is a highly influential figure in the world of investing and business. Born on January 1, 1924, Munger is an American investor, businessman, and philanthropist. He is best known as the vice chairman of Berkshire Hathaway, the multinational conglomerate led by Warren Buffett.

He was born in Omaha, Nebraska, and displayed a keen interest in reading from a young age. He attended the University of Michigan, where he studied mathematics, and later attended Harvard Law School, where he earned his law degree.

After completing his education, Munger started his legal career but soon shifted his focus to investing and business. In the 1960s, he formed a partnership with Warren Buffett, and the two developed a close friendship and working relationship that lasted for decades. Together, they transformed Berkshire Hathaway from a struggling textile company into a diversified conglomerate with a market capitalisation in the hundreds of billions.

His multidisciplinary approach to learning deeply influences Munger's investment philosophy. He believes in the power of mental models, which are frameworks that help people understand and solve complex problems. Munger draws upon a wide range of disciplines, including psychology, economics, biology, and physics, to inform his investment decisions.

One of Munger's most famous models is the concept of "latticework of mental models," which encourages investors to develop a broad knowledge base and connect ideas from different disciplines. Look at some of his best quotes below to get more of this flavour.

Some of his best pieces of advice

Beyond investing, Munger is recognised for his wit and straightforward communication style. He is known for his memorable quotes and speeches, often combining investing wisdom with broader life lessons. Here are three of our favourites:

“Knowing what you don't know is more useful than being brilliant.”

Different people have been quoted saying similar things, but given the life experience of Munger, we can take it from him that this is true. Understanding that you don’t know everything can prevent poor decision-making and overconfidence. Appreciating what you don’t know also allows you to take advantage of the qualities of humility and respect.

"The best thing a human being can do is to help another human being know more."

This quote reflects Munger's belief in the value of education, learning, and sharing knowledge. He believes that by helping others expand their knowledge and understanding, we contribute to the growth and well-being of society as a whole.

"Invert, always invert."

It might take a minute to understand what Munger is on about here fully. This quote encapsulates his belief in the power of mental models and the importance of thinking from different perspectives. He advocates looking at things from the opposite angle, often putting himself in someone else’s shoes. In this way, particularly when investing, it can help us all to be more objective and rational about our trading choices.

A very modest billionaire

Looking up Munger’s Forbes profile, you’ll note a rather splendid net worth;

Despite his remarkable success, Munger is known for his humility and avoidance of flashy displays of wealth. He lives a relatively modest lifestyle.

Top investments over the years…

Unlike some other investors or traders we’ve featured, we feel that Munger himself isn’t the type of person who would appreciate us sharing individual stocks and champagne-popping one-off deals.

Instead, we believe he’d like us to focus on the long-term compound returns from Berkshire Hathaway (a reflection of the portfolio return) versus a benchmark such as the S&P 500. So we do:

At this point, Munger would probably sit back with a smile on his face. The above performance shows not only his stock-picking skills with Buffett but the fact that he’s been able to help guide the Berkshire ship to above-average returns for decades.

More weekend reading…

Below are three Substack articles we enjoyed reading recently that you might also enjoy.

Demystifying the Eurodollar System by Concoda

Change your Mindset by Rajat Soni, CFA

100 Great Books for Life and Investing by Compounding Quality

Great read