Tariff Smoke and Market Fire

Musing the market’s reaction beyond the headlines.

Tariffs came in hard—arguably harder than many expected. With sweeping measures across multiple countries, the announcement was more aggressive than what had been priced in. Still, there’s an underlying belief in some corners of the market that these tariffs might not be set in stone and that they could ultimately serve as a negotiating tool rather than a lasting policy shift. But in the meantime, markets have to react. So far, it has been a “shoot first, ask questions later” type of move.

Vietnam saw some of the most severe tariff increases relative to its trade exposure, a move that could have serious implications for companies that shifted production there to avoid U.S.-China tensions. Gold, expected to thrive in the face of trade uncertainty, has barely budged, suggesting a deeper shift in market positioning. Meanwhile, the muted response in Chinese equities hints that investors are either bracing for policy support or simply don’t see this as a game-changer.

As we dive into these less-discussed stories, we’ll explore what’s driving the market’s quiet shifts, and why they might matter more than the obvious tariff headlines.

Vietnam Impact

One of the big things that struck us was that Vietnam was among the top countries in terms of the size of reciprocal tariffs placed relative to its share of U.S. imports.

A 46% tariff on imports with a 4.2% share is punchy. The country has been targeted because its trade surplus with the U.S. has expanded notably in recent years, jumping 18% in 2024.

There are allegations that some Chinese manufacturers reroute products through Vietnam to circumvent existing U.S. tariffs on Chinese goods. This practice, transhipment, has led to increased scrutiny of Vietnamese exports.

Despite this, significant damage could be done to some U.S. consumer goods stocks that have been shifting manufacturing operations away from China to Vietnam in recent years.

For example, we show below the double-digit percentage move lower in Nike, ON Holdings, and Deckers Outdoors. All three have been cited as having high manufacturing exposure to Vietnam.

In the fiscal year ending May 31, 2024, Vietnam accounted for approximately 50% of Nike’s footwear production and 28% of its apparel.

While specific figures are not readily available, it’s reported that ON uses Vietnamese manufacturing facilities for a significant portion of its production.

As for Deckers Outdoors, it has 68 supply chain partners in Vietnam, second only to its 125 suppliers in China.

The initial reaction to the stock prices has been telling. Yet what will be interesting to note from here is what these companies try to do next. Do they try and pivot manufacturing back to China, with the hope that some sort of trade deal gets struck here? Or even when running the numbers, for specific products it still might work out to be cheaper to go back to China anyway.

The other option is to diversify further into Asia and target other places such as Thailand, the Philippines, Indonesia, etc. However, this is not going to be a quick fix. The amount of investment and time needed to implement such a strategy shift could take a long time, long enough certainly for profitability to be materially hindered by the tariffs on Vietnam in this fiscal year.

We’ll be keen to watch for company announcements, likely in the form of trading updates. Nike’s gross profit margin was 41.5% in the latest quarter, with it anticipating a 4-5% hit for the coming quarter which was partly attributed to factors such as higher tariffs on imports from China and Mexico. Given the other tariffs will now need to be factored in, the exact modelled impact on overall earnings will likely provide a clearer picture as to whether or not this knee-jerk reaction is warranted.

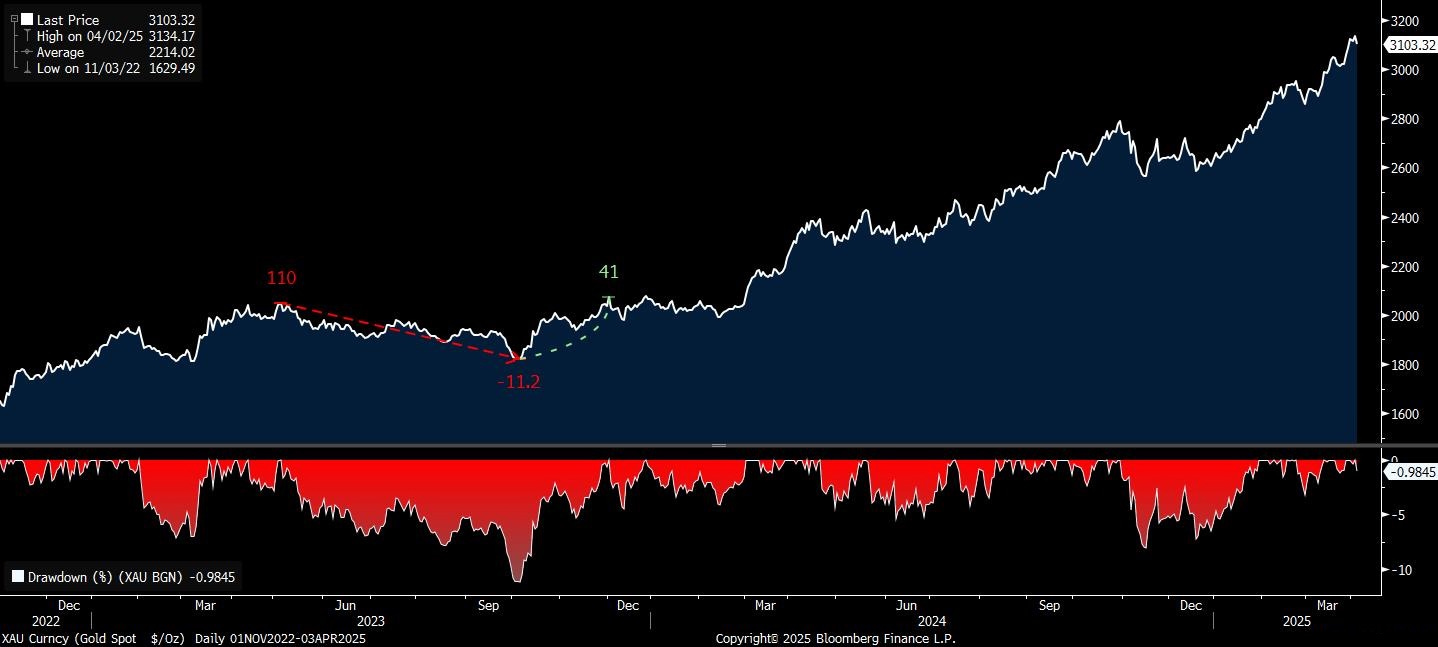

Gold Topping Out

Despite the sharp losses that those who were long USD experienced, those long gold (XAU/USD) would have been almost as disappointed to see the precious metal struggle to make any material gains following the tariff announcement.

The fact that gold is lower now (circa $3,000) than before the announcement indicates that the YTD rally could be due for a breather and correction lower. Like most, we have been bullish on gold, but the reaction over the past 24 hours is starting to change our minds for the short term.

As is generally the case, retail can be slow to any move. It’s no different with gold this time. Just earlier this week, we read this excerpt.

“Retail traders have been unusually absent in the rally, but that is now changing. They, too, are joining the gold rush, with holdings of the largest gold ETF, GLD, picking up notably in recent weeks.”

To follow our gut, gold may be due for a correction. Since November 2022, it has been up nearly 100% without much volatility. Retail inflows as the tides change wouldn’t be an unfamiliar story.

$2,950 represents about a 6.5% decline from highs.

In terms of being tactical, a one-month $3050 / $2950 Put spread using a spot reference of $3113 has a max payoff of 4:1, which we feel is a nice way to consider playing this for those who do not want to take the risk of trading at spot.