Tech: Earnings Review Are A Mixed Bag, But Does The Market Really Care?

Good numbers from Meta and Amazon see the stocks rise, yet reaction is more muted for Alphabet and Apple despite a underwhelming set of results.

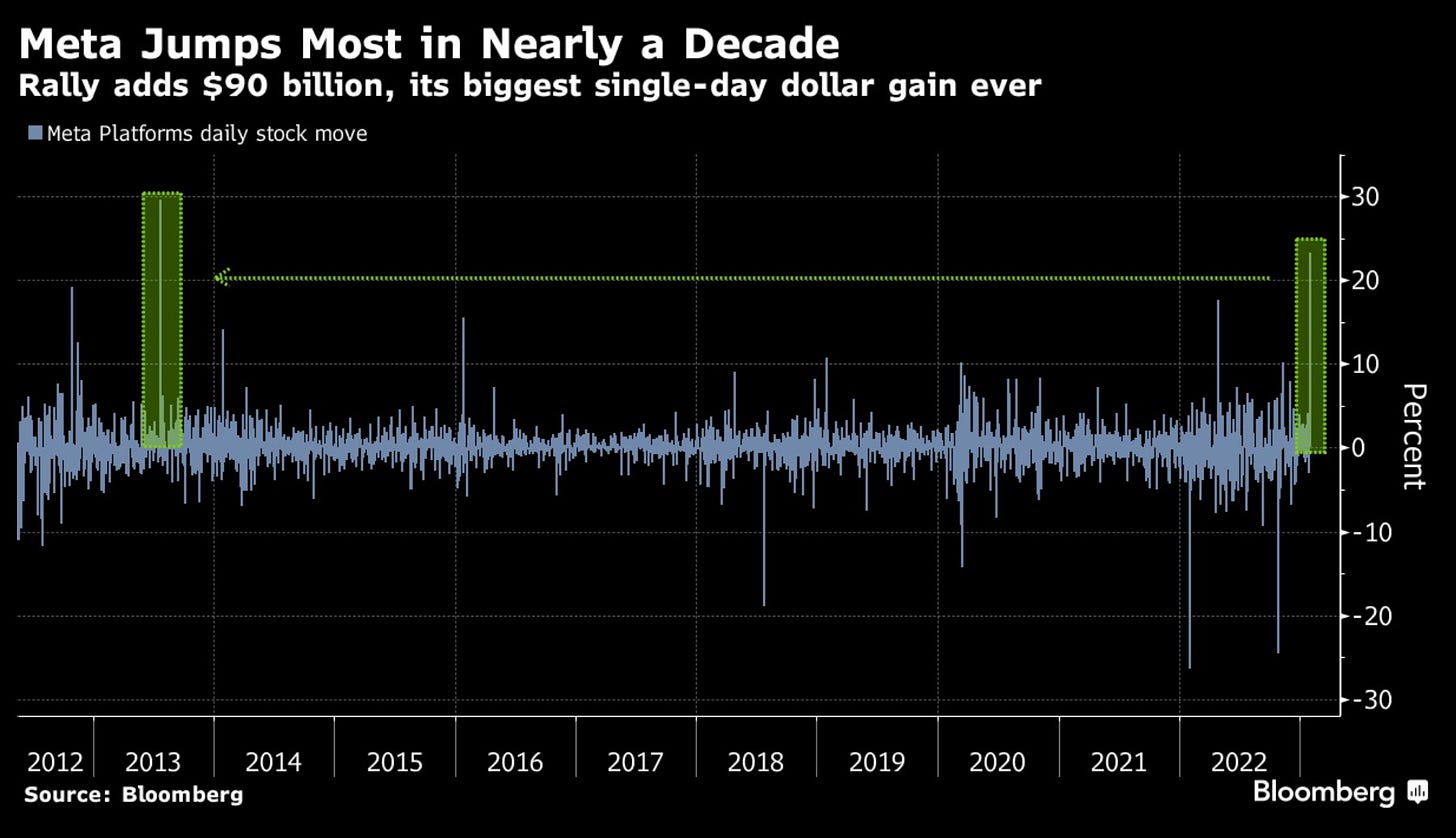

Investors happy with Meta cost-cutting forecast, pushing stock up 23%

Alphabet and Apple both disappoint, but price action is mixed

Broader market sentiment and short-term correction could render results redundant

In our preview piece for the week ahead, we flagged up the importance of the Q4 results being released from the major tech players this week. With most now in the public sphere, we wanted to provide our take on the numbers, along with the market reaction.

Meta storms ahead with chatter on efficiency

Meta Platforms released earnings after market close on Wednesday, leading to a jump overnight which carried through on Thursday. The gain of 23% was an incredible move, shown by the below chart.

Investors were happy for several reasons. The large cost-cutting measures should yield a fall of $5bn in 2023, with further reductions across the board being a key focus. Zuckerberg came up with his catchy phrase of this being the year of efficiency.

A $40bn share buyback scheme and the breaking of the 2bn daily active users on Facebook also helped to light the fire under the share price.

Full results can be read here.

Amazon Still Growing Sales

Net sales for Q4 at Amazon grew by 9% to $149.2bn. The continued growth even as the company reaches a more mature stage is impressive. Amazon Web Services (AWS) is also continuing to outperform, with segment sales up 20% in Q4.

Net income did fall drastically to $0.3bn versus $14.3bn from the same quarter last year, but a good amount of this can be put down to the revaluation of the investment in Rivian. It fell from a gain of $11.8bn to a loss of $2.3bn. Ouch.

On the other hand, the forecast for the following quarters isn’t great, with slowing financials and caution being stressed by the business.

The share price traded from $112 up to $117 before moving down to $108 on release. We wait to see how the stock trades on market open today.

Full results here.

Apple Showing Signs Of Cracking

On the face of it, the quarterly revenue and net profit figures from Apple (shown below) were nothing for investors to get particularly concerned about when looking at historical figures.

However, the key element was that the figures missed analyst expectations. For example, revenue of $117.1 billion missed the $121.1 billion expected. Further, forecasts were missed on iPhone, Mac and Wearables sales. IPhone sales are now down 8% over a broader year-on-year comparison.

With Tim Cook talking about having to “continue to navigate a challenging environment”, investors clearly don’t want to be with him for the ride.

Apple shares are down 2% in pre-market trading.

Alphabet Misses Expectations

In a similar way to Apple, revenue and profits for 2022 weren’t anything to be overly concerned about. Alphabet revenue for the full-year 2022 was $283bn, up 10% year-on-year.

However, the figures missed expectations, even though some could argue that the bar was set quite high.

YouTube ad spending missed expectations which is a cause for concern going forward. Yet another issue was the rhetoric coming from the CEO. He commented of the “journey to re-engineer our cost structure in a durable way”. This sounded a lot like the same chatter from Apple.

Shares are down by 3.35% in the pre-market.

Full results can be read here.

Market reaction

The difficulty in identifying the true market reaction to the earnings is due to the sharp rally in the NASDAQ 100 over the past couple of weeks. Risk sentiment has been extremely positive, with US indices breaking out of the 2022 downward trend.

As a result, could it be that the Meta share price move was stoked by the fact that investors were buying everything on Wednesday/Thursday as the index pushed towards being in a bull market?

Or could it be that the results of Apple, Amazon and Alphabet deserved to push the stocks down even further, but positive risk appetite meant that the falls were modest?

We’re not sure, but the below chart is very telling. If the NASDAQ 100 does have a correction from here, it’s likely that all of the above stocks could see larger short-term falls. Whether the subsequent falls are based on investors digesting the results (or are simply following technicals) is one for everyone to make their mind up about.

Stay up to date

We bring you market updates on stock sectors and commodities every Wednesday and keep you in the FX loop every Friday. These articles can be accessed for free by subscribing below. We would love your support and look forward to bringing you more content.

If you found this article interesting, please tell us what you thought below in the comments and share with friends and colleagues.

Interesting Nasdaq signals