The 5 Minute Guide On How To Hedge

We're not talking about your manicured garden.

During one of our regular content brainstorming sessions, we set upon the idea of setting aside a weekend piece dedicated to breaking down in layman’s terms how to hedge an investment portfolio easily. Not only this, but appreciating why it can be key to hedge from time to time so that it can be a help and not a costly hinderance.

Hedging can be complicated by Wall Street experts with jargon that isn’t needed. As a side note, we dropped on X earlier this week our first volume of ‘Demystifying Wall Street’.

This free PDF runs over everything from the basis trade to the carry trade, breaking it down for everyone to understand. You can download this for free by clicking here.

“A hedge is a trade that is made with the purpose of reducing the risk of adverse price movements in another asset.”

Why you would need to hedge

We see three main reasons why an investor/trader would want to hedge. In each case, we apply the scenario to a person that has bought Nvidia shares.

Reduce risk - this is by far the main reason that hedging could and should be used for. For example, Nvidia recently announced quarterly results. This was released to the market after the session had closed, meaning that an investor couldn’t buy or sell the stock in the immediate aftermath.

This could be risky, especially if a large move was expected (hint, it was). This doesn’t just apply to the current earnings, but rather for each quarterly release, along with other key days when market-moving company specific information is released.

Reduce vol - bringing down the volatility of a portfolio is another reason to consider hedging. With Nvidia, the Options market was implying an 11% move based on the results. This could have been in either direction depending on the results, so taking out some hedges to protect against this volatility would have been wise.

As it happens, the volatility favoured those long the stock, with it surging to post the biggest single day market cap gain:

Reduce correlation - hedges can also be used to complement an existing portfolio. For example, if someone just owned Nvidia shares but wanted to add another stock, it wouldn’t make sense to own AMD or another chip manufacturer.

Rather, a partial hedging trade could be to buy shares in a different sector, such as utilities or banking. The share price returns of this versus Nvidia shouldn’t really be correlated, helping the investor if Nvidia underperforms going forward.

To further reduce correlation, one could also look outside of the stock market completely, and turn to buying a commodity.

Become a premium subscriber to access all of our content, including our flagship Monday Trade Ideas. Here is a 14-day free trial to be able to see all of our content over the coming weeks. We want you to see the value we bring to ‘AlphaPicks on Wall Street’, so join the team now.

How to hedge

Below are some of our favourite ways to hedge trades:

Options - using derivatives to protect against adverse movement is probably the most common way that we use. When buying an Option, the known cost of the hedge is presented upfront. For example, if I buy a Call option that costs £100, I know that this is the cost of the insurance.

This makes it easy to assess the extent I need to hedge my existing trade and figure out the risk and reward potential.

A case from this week

As a recent example, our AlphaPicks Portfolio was long AMD Call Options. However, with the Nvidia earnings due out, we were concerned that AMD would be impacted by the results and wanted to protect ourselves.

Buying a Put option (that stands to gain if the price of the underlying falls) seemed like a smart idea. But Nvidia Puts were too expensive to have as a hedge, so we settled on buying some cheap Puts on the NASDAQ 100 index.

Ultimately, results came out strong, with the AMD share price rallying. Even though our Puts are now worthless, it presented a smart way to hedge our original trade.

Hedging via Options with zero cost

Options don’t just have to be expensive to use. They can also be used to supplement a trade without being costly.

For example, let’s say a trader is long GBP/USD at 1.25. The market is now at 1.266, with the trader in profit. At this point, he might want to protect himself.

He could look to enter into a risk reversal Option structure, via selling a 1.27 Call Option and buying a 1.26 Put Option. Given he is both buying and selling an Option, the cost is smaller, potentially even zero.

With a zero cost, there are two scenarios. Either the market pulls back and heads lower. In this case he profits from the Put option, but loses some of the profit from his original trade. These should balance out (hence the hedge).

Or the market shoots higher, and he’s in more profit on his trade but this is offset by the loss on the Call option.

Offsetting trades - for retail traders that use CFD or spread betting accounts, opening an offsetting trade can be an easy hedge which has zero upfront cost.

If a trader is long Gold at £10 per point, entering a second trade (remember to turn off auto-netting) to sell Gold at £10 per point will perfectly match off the risk from the original trade.

This means that whatever the profit or loss is on the original trade, it will stay the same from then on.

This can be useful to do over economic data releases, central bank meetings or other volatile events that could move the price of the asset you have a trade on.

To remove the hedge, simply sell off the second trade entered. This will realise the profit or loss of the hedge, and leave the original trade as an unrealised profit or loss.

Negative correlation trades - this can be a harder way to hedge, as finding a perfectly correlated asset to the existing one you own is very difficult. However, there are scenarios where this can be a handy tool.

A case in point would be using safe haven currencies to offset a stock market crash. Traditionally, investors used to sell CHF and JPY to buy higher yielding (and higher risk) currencies during good times. This also includes buying USD and piling into US assets, such as stocks.

When stocks tumble and investors get scared, the FX trade needs to be closed out. This entails buying CHF and JPY.

So for an investors that is long stocks (particularly in the US where we are hitting all-time highs), a hedge could be to buy CHF or JPY. Then if we saw a sharp swift correction in stocks, the loss from here would be partially offset by the appreciation of the currencies owned.

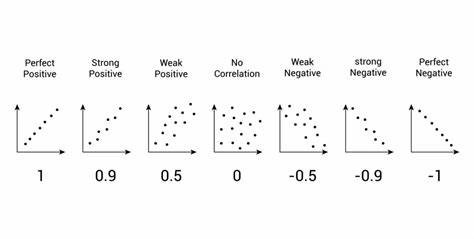

When studying the correlation of two assets together, a perfect negative correlation co-efficient is -1. In reality this is impossible to find, but any form of strong negative co-efficient is helpful.

Inverse ETF’s - these exchange traded funds are geared more around long only investors that don’t want to get involved in margin trades or derivatives.

There exists a wide pool of ETF’s that give the investor the inverse performance of an asset. At a basic level, an investor that is long the NASDAQ 100 index could buy an inverse NDX ETF. If it was bought in the same size as the original trade, it would hedge against a fall.

As a note, inverse ETF’s often use synthetic exposure to replicate performance, so holding these for a long period of time can lead to losses simply from the cost of structuring the ETF.

Below shows the inverse NASDAQ (QQQ) ETF over the past year. Shout out to all the bears out there…

Bringing it all together

We said we’d be brief, and give you a no frills rundown of why and how to hedge. As you can appreciate, we have just scratched the surface here, with plenty more on the table to delve into detail on.

Yet what it ultimately boils down to is helping any investor to protect profits and reduce volatility.

See you tomorrow for our Monday Trade Ideas.