The $50m Investment In OpenAI Is Now Worth $4bn

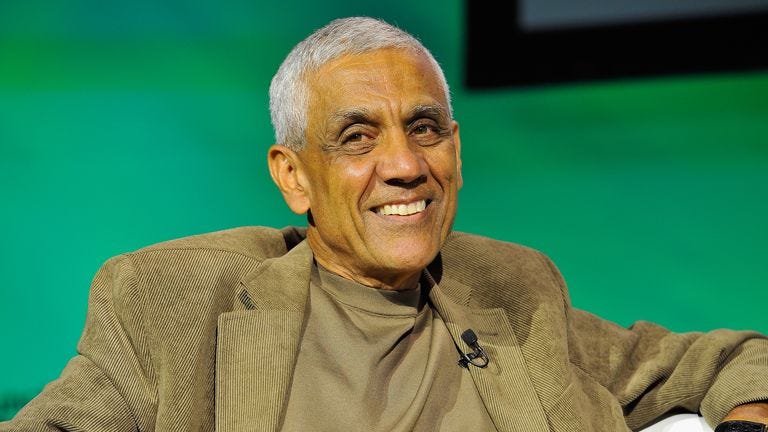

We deep-dive into the successful career of venture capitalist Vinod Khosla.

A popular request we’ve had in recent weeks is to take a look into some of the shrewd investors from the world of venture capital. These investments into early stage companies with the hopes of them becoming the next Amazon can be very lucrative. Yet with the high failure rate, only the best managers have any survival rate worth considering.

One that has cropped up from our research is Vinod Khosla. The number of big success stories that surround him make him very worthy of inclusion in our weekend piece. With a self-made fortune of $6.4bn from venture capital investments, let’s take a look.

Who is he?

Vinod Khosla, was born on January 28, 1955, in Delhi, India. He spent his formative years in an good environment, as both of his parents were accomplished academics. His father, Jitendra Khosla, was originally an officer in the Indian Army, and his mother, Renu Khosla, was a biochemistry professor at Delhi University.

From an early age, Khosla exhibited a keen interest in technology and innovation. He was a bright student and pursued his education at the Indian Institute of Technology (IIT) in New Delhi, where he earned a bachelor's degree in electrical engineering. In 1978, Vinod Khosla enrolled at Stanford University to pursue a master's degree in biomedical engineering. However, his trajectory took a significant turn when he crossed paths with fellow Stanford students.

In 1982, he founded Sun Microsystems with Andy Bechtolsheim, Bill Joy, and Scott McNealy (all shown together below). Sun Microsystems developed computer workstations and servers, establishing Khosla as a notable figure in Silicon Valley. Within five years, Sun made $1 billion in annual sales.

After achieving success with Sun Microsystems, Vinod Khosla set his sights on venture capitalism. In 1986, he joined the venture capital firm Kleiner Perkins, where he became a general partner.

In 2004, Khosla founded Khosla Ventures, a venture capital firm that focuses on clean technology and internet companies. This is the entity through which he continues to operate.

Famous investments

Khosla invested in OpenAI back in 2019, with $50m in funding. This funding round valued the company at $1bn at the time.

OpenAI has since taken the world by storm, particularly in recent weeks with the controversy surrounding Sam Altman and the rest of the board. Despite all of the noise, the value of OpenAI continues to rise.

Microsoft invested $10bn this year which put the value at $29bn, but from the latest estimates the value of the firm sits at a staggering $86bn.

This would make Khosla’s stake worth over $4bn, an incredible return over a relatively short period of time.

Khosla was again early to the party with DoorDash, investing a decade ago in the same year that the business was founded.

The growth of the food and drink app since then has been huge, culminating with an IPO back in 2020. Shares opened at $182 on the New York Stock Exchange, significantly above the IPO price of $102 apiece and closed at $189.51.

The 80% pop on the day alone netted the VC legend a large payday, with even more made as the firm was taken public via a SPAC.

The firm was valued at $71bn at that point. We don’t have exact figures on what value was placed on the firm back in 2013 when the first funding was provided, but we can’t imagine it was north of $1bn.

Granted, since then the share price performance has been poor, with it trading down at $94, but we can’t find any information that would indicate that Khosla Ventures still owns a meaningful stake in the firm.

GitLab is a single platform that automates software delivery, boosts productivity, and secures end-to-end software supplychain. It’s a classic case of a tech firm that would easily catch Khosla’s eye.

It is another example of a firm that Khosla successfully exited in the IPO back in 2021. He invested back in 2015, and again in 2018 helped to raise funds for the business.

The 2018 funding round was done with a value of $1.1bn, while the IPO at $77 valued the firm at $11bn. From this, Khosla easily netted at least a 10x return from his initial investment.

Key investing principles

Risk-Taking and Innovation: Khosla has a reputation for being an advocate of high-risk, high-reward investments. Khosla is particularly interested in technologies that have the potential to bring about significant change and reshape industries. This is well noted from the key message from the VC homepage:

Long-Term Vision: Khosla's investment thinking often extends beyond short-term gains. He is known to have a long-term vision, investing in technologies and companies that may take time to mature but have the potential for substantial impact in the future. This can be noted from the investments we covered above, such as OpenAI.

Clean Technology and Sustainability: Khosla has a strong commitment to clean technology and sustainability. He recognizes the importance of addressing environmental challenges and has invested in companies that focus on renewable energy, energy efficiency, and other sustainable solutions. This is financially shrewd as well, given the shift in focus towards this sector in recent years.

Interdisciplinary Approach: Khosla's investment thinking is often interdisciplinary, drawing from various fields of expertise. He looks for opportunities at the intersection of different industries and technologies, recognizing that breakthroughs often come from the convergence of ideas and capabilities from different areas.

Quotes to live by

"The clean energy industry is about to be the largest economic opportunity of the 21st century."

This quote reflects Khosla's strong belief in the potential of the clean energy sector. He sees the transition to clean energy not only as a crucial step for environmental sustainability but also as a significant economic opportunity for investment.

"In venture capital, it’s all about the outliers."

Khosla talks about the importance of identifying and investing in companies that have the potential to be outliers – those that can significantly outperform others in the industry. This mindset aligns with his inclination toward high-risk, high-reward investments and transformative technologies.

"I’d rather take the risk of some of the newer technologies because I think that’s where the big breakthroughs come."

The high fail rate of early businesses might put some off, but not Khosla. He recognises that within this space there’s the potential for large winners.

"People are very strange about failure. I’ve failed a lot, and I’m proud of it. Every failure has taught me something. It’s made me stronger."

Khosla's perspective on failure underscores the importance of learning and resilience. He encourages an entrepreneurial mindset that embraces failure as a natural part of the journey.

"It’s not that we don’t need answers, but we need a different kind of answer. We need innovation."

Instead of merely seeking solutions to existing problems, he advocates for a mindset that generates entirely new approaches and technologies to address challenges.