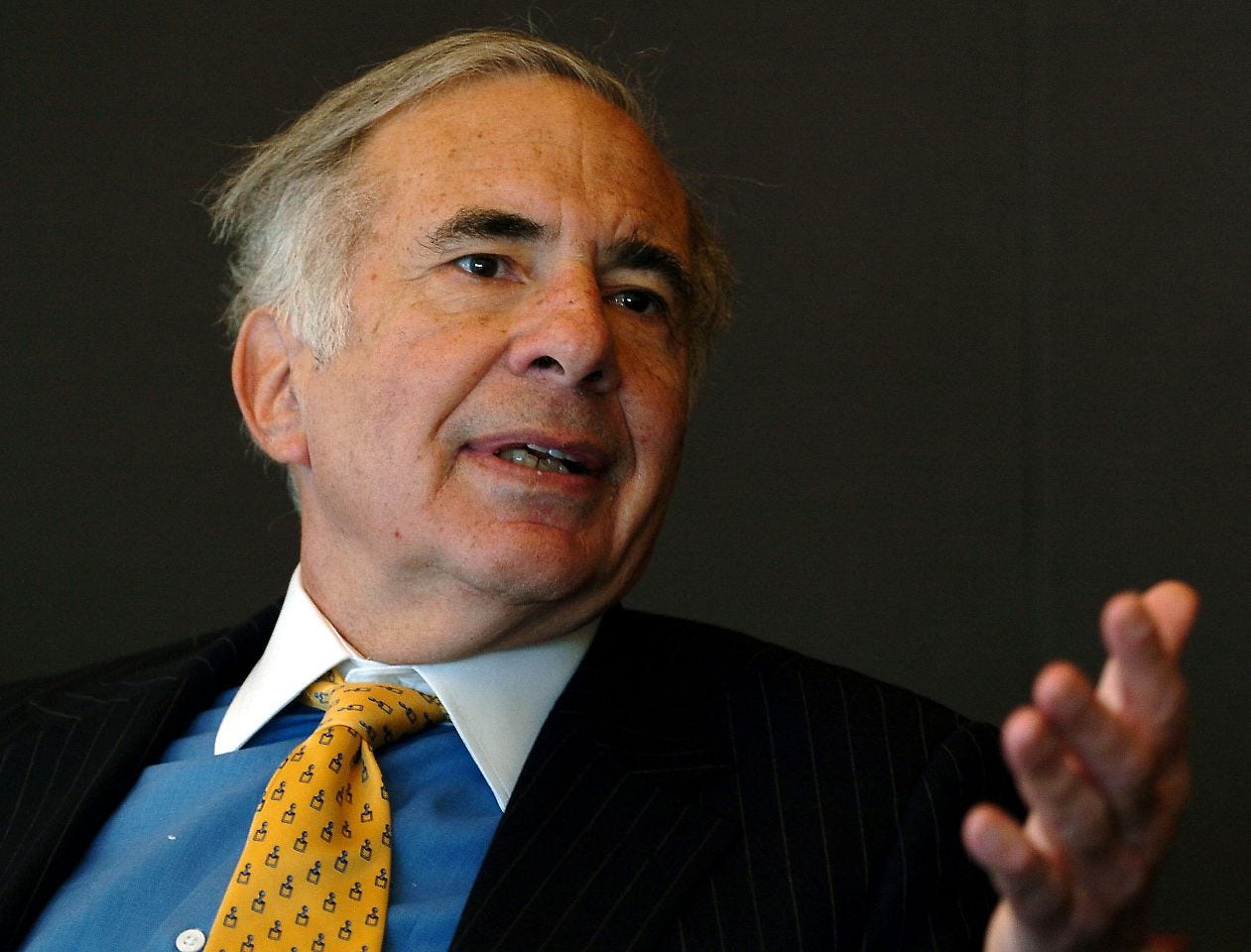

The Activist Icon That Is Carl Icahn

“I enjoy the hunt much more than the 'good life' after the victory.”

This weekend we go down the rabbit hole of activist investing, which involves taking a large enough stake in a company that you believe to be undervalued and that can be improved from changes in corporate policy.

One of the most iconic and prolific investor in this regard is Carl Icahn, who has enjoyed big wins (and some losses) over his career. Yet with a personal net worth that’s over $5bn, it’s clear that his wins have outweighed any losses.

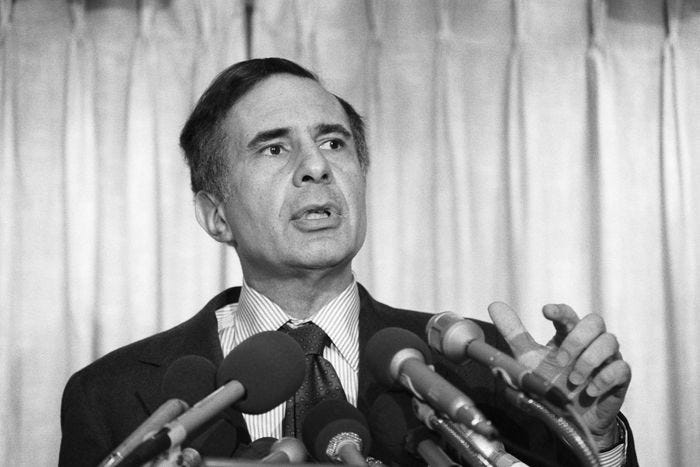

Who is Carl Icahn?

Carl Icahn, born on February 16, 1936, in Queens, New York, was born to a middle-class Jewish family. His father, Michael Icahn, worked as a teacher and opera singer, while his mother, Bella, was a homemaker.

Icahn attended Far Rockaway High School in Queens, where he demonstrated early signs of entrepreneurial spirit by running a vending machine business. After high school, he enrolled at Princeton University, where he studied philosophy. This has continued to be of interest to him throughout this career.

Despite his initial pursuit of a career in philosophy, Icahn went on to attend New York University School of Medicine. However, he did not complete his medical degree, choosing instead to focus on Wall Street.

He started his career on Wall Street in the late 1950s. He began as a stockbroker and later moved to trading Options. It wasn’t until 1968 when he bought a seat on the NYSE that his trading and investment activity really took off.

Carl then went on a roll over the following decades, finding a niche in buying out companies or taking controlling stakes in them, turning the company around and flipping it for a profit.

Investing style

Some call him a corporate raider, others an activist out to garner economic value. Whatever you think, Icahn has a definite style in how he sets out to make money:

Firstly, Icahn typically acquires substantial stake in the companies he targets. This can either be built up over time or done in one go.

By amassing a significant ownership position, often in the form of common stock, he gains the leverage needed to influence corporate decisions and have a seat at the table when it comes to key strategic discussions.

Second, he uses this leverage to push through changes at a company level that he believes will enhance the overall value of the firm. This might include some bold steps, such as large redundancies to cut costs, or the selling of the business assets (known as asset stripping). The goal of this part of the process is to identify and address underperforming aspects of a business to unlock hidden value.

Third, Icahn waits to see the fruitage of his changes in the firm, with the aim of increasing the shareholder value (of which he is one!). At a point at which he feels his investment has reached a peak in value, he’ll then offload his stake (either from selling stock on the public market or via a private offering) to realise a profit.

This is different from simply buying a stock and waiting for it to rise in value. Icahn is vocal and hands-on with his investments, which can make him unpopular with criticism of management or aggressive policy changes.

Famous investments

Icahn (via his company Icahn Enterprises), has bought and exited a large amount of investments over almost six decades. Here are three we noted:

RJR Nabisco: One of Carl Icahn's most famous and lucrative investments was his involvement in the RJR Nabisco deal in the late 1980s. Icahn took a significant stake in the company and became involved in a high-profile bidding war for control of the firm against KKR. While he did not emerge as the ultimate winner, his moves and battles over the course of a year and a half meant that when he sold his 7.3% stake for $732 million in 1997, he netted a profit estimated at no less than $100 million.

The deal was immortalized in the book "Barbarians at the Gate."

Apple Inc.: In 2013, Carl Icahn publicly disclosed that he had acquired a large stake in Apple Inc. Icahn was vocal about his belief that Apple's stock was undervalued, and he actively lobbied for the company to increase its share buyback program. His activism played a role in Apple's decision to repurchase billions of dollars in shares, ultimately benefiting shareholders. Icahn said his profit was “within a few bucks” of $2 billion when he sold in April 2016.

Netflix: Icahn initiated his Netflix position in the third quarter of 2012 at an average price of $58 per share. His 2012 Q3 filing showed 1.2 million shares position worth $321 million or 9% of the company.

As Netflix's fortunes turned around, and its stock price surged, Icahn sold his stake for a substantial profit of circa $2bn.

He was quoted as saying that “as a hardened veteran of seven bear markets I have learned that when you are lucky and/or smart enough to have made a total return of 457 percent in only 14 months it is time to take some of the chips off the table,.”

Quotes to takeaway

“I enjoy the hunt much more than the 'good life' after the victory.”

"In takeovers, the metaphor is war, and the secret is reserves. When you have reserves, you can attack. When you don't have reserves, you must defend. In corporate wars, those who have the most resources always win."

"I look at companies as businesses, while Wall Street analysts look for quarterly earnings performance. I buy assets and potential productivity. Wall Street buys earnings, so they miss a lot of things that I see in certain situations."

"You learn in this business: It you want a friend, get a dog."

"Some people get rich studying artificial intelligence. Me, I make money studying natural stupidity."

If you haven’t already heard, we’re launching our own stock screeners in just a couple of weeks. We feel these will add huge value to our subscribers - check out all the details below:

We've Built Our Own Stock Screeners

We started writing our views about stocks on Substack to 0 subscribers back in January. We’re now writing to more than 2,100. Even though we’ve had good feedback on our commentary and research, one question crops up a lot. “When are you guys going to provide us with a list of the stocks you like and show us the ones you’re investing in?”

![[Identify] Carl Icahn's watch on the cover of Time Magazine : Watches [Identify] Carl Icahn's watch on the cover of Time Magazine : Watches](https://substackcdn.com/image/fetch/$s_!RBeD!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F9bd2ba9f-45b8-4c75-b682-2604032d068f_2363x3150.jpeg)