The IPO Within Arms Reach

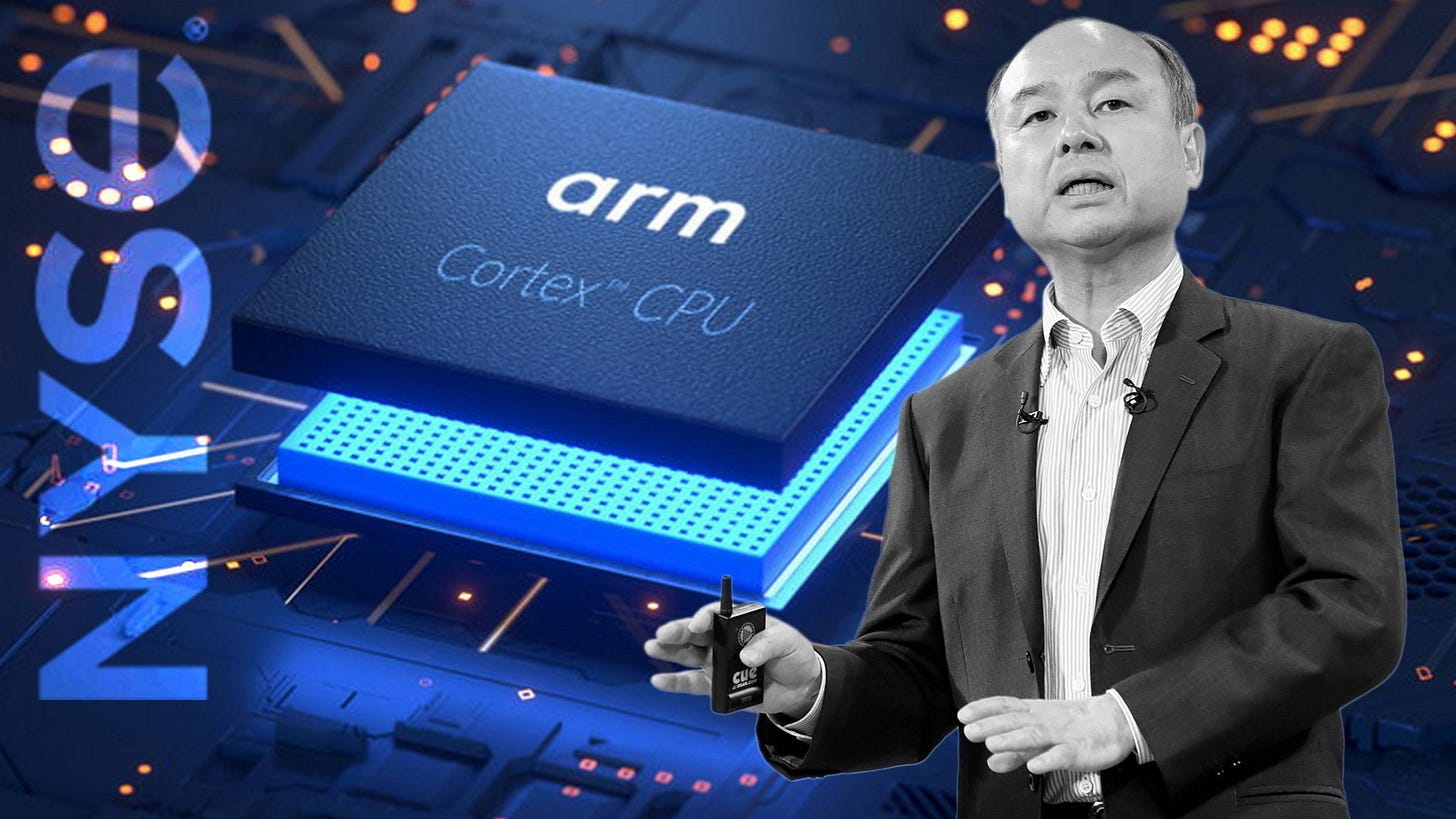

Set to be released in Thursday's trading, Arm's IPO has big expectations. But there are a few reasons to pass this one by.

Arm, the semiconductor and software design company, is set to launch the biggest IPO of all time, coming in at over twice the value of the previous record holder, Saudi Aramco.

Arm, owned by SoftBank Group, received enough backing from investors to secure at least the top end of the price range in its initial public offering, which would command a $54.5 billion valuation on a fully diluted basis.

Arm may price its IPO above the indicated price range of $47-$51 and will decide on how much it will sell its shares for today, a source with knowledge of the matter said. The shares are scheduled to start trading in New York on Thursday.

The IPO’s design has been both unconventional and conservative at the same time. SoftBank is only looking to float up to 10% of the shares, which could cause a scramble by investors to get their hands on the stock.

The price Arm has been requesting is lower than the $64 billion price at which SoftBank last month bought a 25% stake.

Yet even with this lower valuation, SoftBank would still perform better than its $40 billion deal to sell Arm to Nvidia, which it abandoned last year in response to antitrust regulators' objections. SoftBank took Arm private in 2016 for $32 billion.

Arm has already signed up many of its significant clients as cornerstone investors in its IPO, including Apple, Nvidia, Alphabet, Advanced Micro Devices, Intel and Samsung.

On Tuesday, TSMC, the world’s largest contract chipmaker, said it approved an investment in Arm of up to $100 million when ARM goes public.

If all goes well, the debut could boost the reputation of Masayoshi Son, SoftBank’s founder, chairman and chief executive officer. Despite Son’s bold proclamations of having a centuries-long investment horizon, nearer-term success has often eluded him, with many of the IPOs his firm has backed stumbling.

Arm’s plan to expand

Arm CPUs are the leading smartphone processor IP on the market today. 99% of premium smartphones are powered by Arm.

Weak mobile demand during a global economic slowdown has caused Arm's revenue to stagnate. Overall sales totalled $2.68 billion in the 12 months to the end of March, compared to $2.7 billion in the prior period.

The cloud computing market, of which Arm only has a 10% share and therefore more room to grow, is anticipated to increase at an annual rate of 17% through 2025, partly because of developments in artificial intelligence.

The automotive market, which commands 41%, is forecast to expand by 16%, compared with just 6% growth expected for the mobile market.

Arm also told investors its royalty fees, which account for most of its revenue, have been accumulating since it started collecting them in the early 1990s. Royalty revenue came in at $1.68 billion in the latest fiscal year, up from $1.56 billion a year before.

An area of scrutiny for investors has been Arm's exposure to China, given geopolitical tensions with the United States that have led to a race to secure chip supplies. Sales in China contributed 24.5% of Arm's $2.68 billion revenue in fiscal 2023.

In the rest of this article, we take a look at:

Some reasons why this IPO is worth skipping in the long term

The US market IPO performance YTD