The Curious Case Of The SPAC King

Chamath Palihapitiya released his annual letter to shareholders this week, and it was honestly very bizarre

After the plunge in valuations of SPAC’s in 2022, the annual letter was a chance for Chamath to explain what went wrong in detail.

Instead, he spoke of pretty much everything but the problems with previous investments.

His detachment from the companies in a ‘them-and-us’ rhetoric left us scratching our heads.

Chamath Palihapitiya started his fund (Social Capital) back in 2011. However, he only really shot to mainstream fame in the financial community in 2019, when he used a Special Purpose Acquisition Vehicle (SPAC) to help send Virgin Galactic public.

Through 2019 to 2021, Chamath pioneered the use of SPAC’s in raising capital and helping companies to go public in a more unconventional way.

Things unravelled in 2022 (which he discusses in his annual letter), putting him now in a position where valuations have fallen significantly. For example, Virgin Galactic listed at $10, and now trades around $3.

Virgin Galactic Share Price Chart

We’ve been waiting to get some clarity from the man himself about what reasons he gives for the capitulation of ‘IPO’s 2.0’.

You can read it for yourself here , and we outline some of our musings below.

He gets the core reasons correct

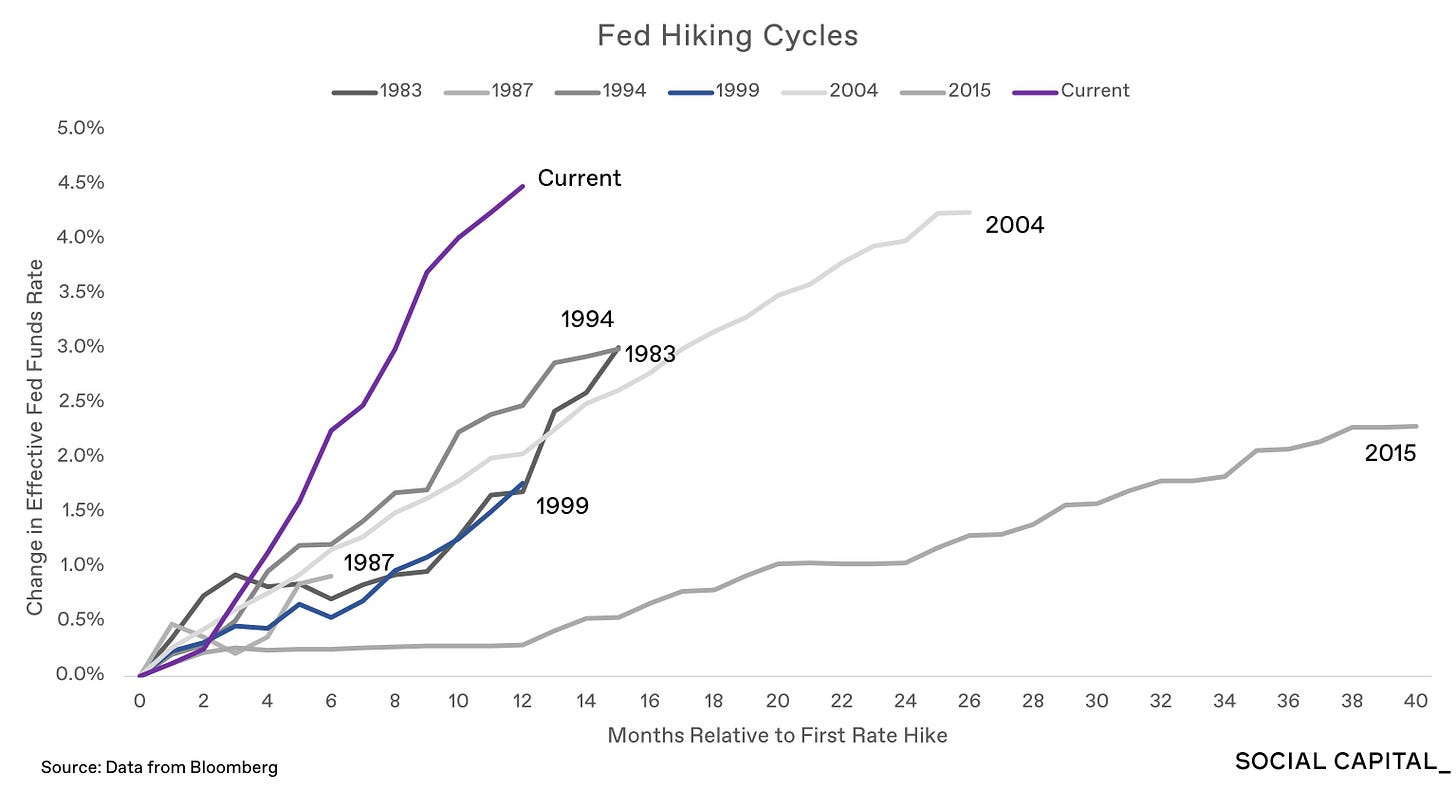

Chamath reels off several reasons why 2022 was difficult for stocks. To be honest, there’s nothing ground breaking about what he chats through. The impact of Covid-19, the end of cheap money supply, the pace of rising interest rates from the US Fed (see below), a pivot from growth to value stocks etc etc.

For investors that have been with him for a while, it’s at least comforting to know that he hasn’t stuck his head in the sand when it comes to appreciating reality. We’ve seen it before when an underperforming fund manager sees the world as he/she would like it to be seen to support their underlying losing bets.

This doesn’t help anyone. Yet as an outspoken character in the past, Chamath does stick to the script here in noting valid and proven reasons for why his SPAC’s and the companies within them had a balloon pop moment last year.

Yet this is where the logic finishes.

A U-turn needed, but for who?

Next Chamath seems rather detached in the below comment;

What does this mean for founders of technology companies and the investors that fund them?

While the previous market regime rewarded growth at any cost, the message to companies has now taken a u-turn. Our advice to founders: profits and cash flows matter again, and growth must be balanced with attractive margins to create sustainable business models that will endure the test of time.

To us, this seems a bit of a head scratcher. Social Capital is the investor that funds the companies. It is directly involved with founders of start-ups. In the past, Chamath has sat on the boards of these companies and worked with them. Not as a them-and-us approach, but a we’re-all-in-this-together attitude.

But now we get a complete pivot. The following paragraphs read very much like Chamath is distancing himself from the companies specifically. To us, it sounds like he is trying to offer advice, when it should be him taking the advice. It’s Social Capital that needs to do a u-turn in it’s investment approach!

Talking through the good stuff

In most annual letters from fund managers, there’s a balanced view of some of the good investments from the past year, and the bad.

Chamath skips over talking about some of the large drawdowns, SPAC closures, handing money back to investors etc.

Rather, under the section ‘A look at some of our recent bets’, he chooses to focus on the success stores. Don’t get us wrong, we would all have a bias to report our winnings more than our losers.

Yet given that SPAC’s IMPLODED last year (at least five of the tickers are down by at least 40%) we feel it was reasonable to have some commentary on the specific issues these companies face and what the plan is going forward to try and drive a recovery.

We didn’t get any of this, with lengthy write-ups instead on the likes of Saildrone, Early Is Good and Mitra Chem.

A swing and a miss

Perhaps the most bizarre element of the letter was the finishing notes. After quoting Theodore Roosevelt, he finishes with:

While 2022 was a challenge, the valor and lessons learned came from actually being in the arena, not commenting from the sidelines. We view the years ahead as our moment to keep experimenting and trying. We’re focused and grinding everyday.

This contrasts to the bulk of the report, which does offer (in our opinion) a very detached view of the valuation demise of various blank-cheque listed companies under Chamath’s empire last year.

Spare us the irony of us commenting on Chamath from the sidelines, but we really feel he missed the mark on this one.