The Curious Case Of The Strong GBP

We explain why the British Pound (GBP) has outperformed...for now

On Friday, GBP/USD traded to its highest level since this time last year. EUR/GBP went one step further, closing just below the 0.8400 handle, the lowest price since August ‘22. CFTC speculative long positioning in GBP rose earlier this month to six year highs.

Frequent readers of our musings will know that we have been bearish GBP for several months now. Of course, our view hasn’t played out (yet), but in our conversations with other professional investors and in reading the research of institutional desks, we’re not alone in thinking that GBP looks overvalued at current levels.

That’s why we call it a curious case of recent GBP strength. So to close out the week we wanted to run over why GBP has rallied recently, but why we still hold to our view that the bubble could burst later in H2.

A QUICK REMINDER: Our prices for premium subscriptions will go up to $20/month from Monday (this only applies to new subscriptions, so if you are already a paying reader, you’ll stay on the same plan).

However, if you join now you can benefit from the current plan of just £10/€12/$13 per month forever (annual plans are even better value). To make the offer even sweeter, we’re offering a 7-day free trial as well. It wouldn’t be fair to ask you to sign up without letting you see what value we offer first.

Why GBP Has Done Well

The least worst option

Part of the outperformance has come at a relative level. What we mean by this is the pound has been favoured by traders over alternatives such as the EURO, US Dollar and other G10 currencies.

As any currency trade is a make up of being long one currency and short another, the expression of what you want to own also comes with a view on what you don’t want to own.

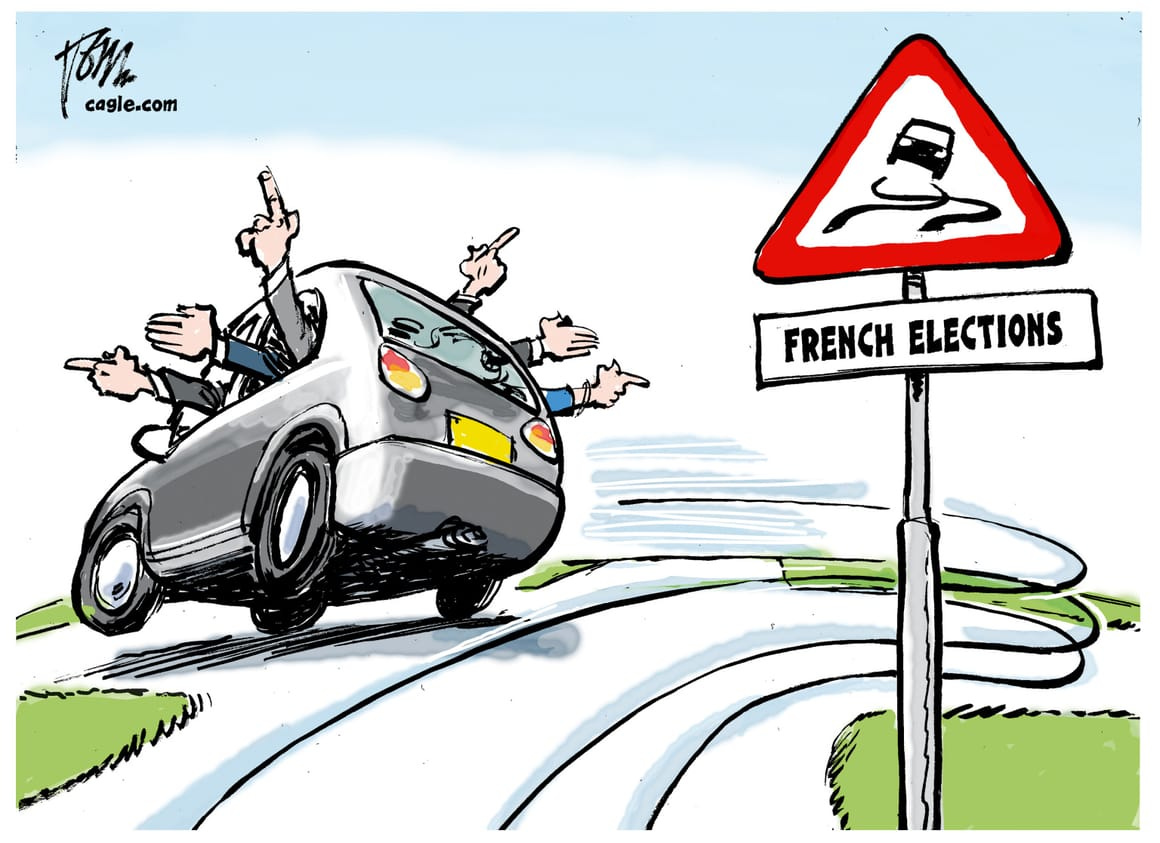

Take EUR/GBP as a case in point. Particularly in recent weeks, traders have looked to short the EUR in order to express their view of concern around the snap election call from President Macron, and then further due to the uncertainty of the first and second round of actual results.

Even now, we’re in a situation where no party has enough seats to command a majority. Although you could argue this outcome is less EUR negative than a majority of either the right or the left, we are unsure that many want to get outright long EUR right now.

What this means is that EUR/GBP has moved lower (EUR weak / GBP strong) more from the weak EUR leg than from the strong GBP leg. Or put another way, people are happier to hold GBP than EUR.

So is this outright bullishness on GBP or more a case of it being the least ugly sister?

A stronger UK economy

The economic data out from the UK has been a definite factor that has helped the pound to rally in its own right. This was evident on Friday, where the release of May GDP data showed a gain of 0.4%, doubled the 0.2% that had been forecasted.

Considering that the UK was in a technical recession earlier this year from the negative quarterly readings from Q3 and Q4 2023, this growth spurt is certainly welcome.

Although we’ll dwell on this more later, we also feel that the moderation of inflation is another pillar of strength for GBP. Should the 10%+ readings have spiralled out of control towards the danger of hyperinflation, GBP could have been eroded in value very fast. Yet the ability for the central bank to have got it under control will be seen as a positive in some circles.

Political stability

When it comes to politics, traders don’t like outcome uncertainty. There was little case for this with the general election here in the UK earlier this month. The Labour party held a clear lead in the polls for a long time, and the result was broadly in line with expectations.

Yet the reaction to GBP was very telling to us on sentiment, in that it did actually rally in the hours after the exit poll.

We believe that some of the gains since then are attributed to the positive sentiment that the change of ruling party is going to be good for the economy. Of course, there is a clear line in the sand in not getting involve in monetary policy. But by fiscal stimulus, or even from invoking the message of ‘change for the better’, GBP appears to have bought into this story of a new period of political stability under a Labour government.

Consider some of the comments from the new Chancellor, Rachel Reeves, in a speech she delivered earlier this week. She outlined her plan to rebuild the economy by focusing on stability, investment, and reform. Key initiatives include launching a National Wealth Fund to drive private investment, implementing planning reforms to expedite infrastructure and housing projects, and maintaining fiscal responsibility.

Reeves said that growth ‘is our national mission’ and that ‘there is no time to waste. We have promised a new approach to growth – one fit for a changed world. That approach will rest on three pillars – stability, investment, and reform.’

Pricing out interest rate cuts

Finally, Wall St analysts have been forced to push back their calls on when the first rate hike from the Bank of England will be. This has coincided with various H1 BoE meetings when the rhetoric has been a case of wanting more time to get inflation back to target, and even then to ensure that its sustainably low in order to be able to start cutting.

An August rate cut was becoming increasingly likely, but earlier this week BoE chief economist Huw Pill suggested that he was not yet ready to change his vote in favour of a rate cut.

This means that the implied probability of a cut in August is now down to 50/50, which could be pushed back even further.

Given the nature of how this has kept being pushed back in recent months, GBP has gained as the high yield it offers is attractive to those putting on carry trades. For example, with the SNB already having started the cutting cycle, selling CHF and borrowing at a low rate and buying GBP and enjoying the 5%+ yield has done very well.

Why We Remain Bearish

The above factors have definitely helped in driving the price higher in several GBP crosses. However, we feel that H2 could start to see the long GBP trade unravel.

Underlying economic drivers are weakening

GDP figures from last week were cheered on, but lets zoom out a little. The below chart shows the quarterly change in GDP over the past few years, just coming out of the boom and rebound from 2021. You can see that for the best part of two years, the economy has flatlined: