The Emerging Market Mosaic

Q4 brings liquidity tailwinds, but country-by-country dynamics will drive performance.

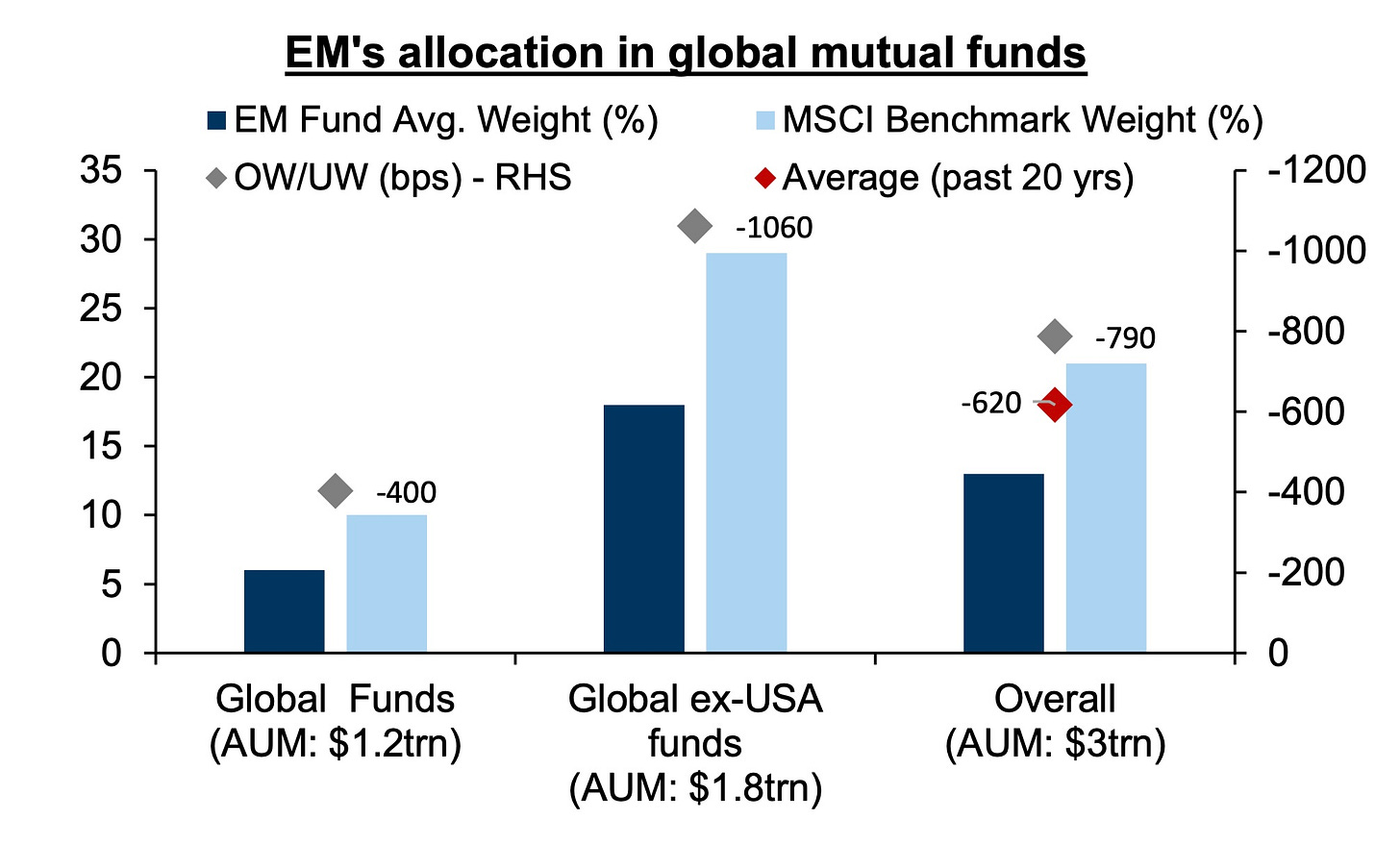

Emerging markets live in the gap between fragility and opportunity. Right now, that gap is widening. A softer Fed and a weaker dollar are breathing life into battered valuations, even as political risk keeps everyone honest. After a lost decade of underperformance, EM is finally benefiting from liquidity rotation out of the US and Europe. Investors are still structurally underweight, and that under-ownership leaves plenty of room for flows to do the heavy lifting.

It is not a single story but a kaleidoscope of moving parts. Equities are the headline, but the real drivers are scattered across FX carry, local rates, and sovereign credit. The common thread is dispersion. Some markets are thriving on global liquidity, others remain hostage to politics, and a few offer both at once.

So Far, So Good

Emerging markets have quietly stitched together one of their best runs in a decade. After eight straight monthly gains through August, the MSCI EM index added another +6% in September, taking YTD gains to +25%. The backdrop has been classic “risk on”: the Fed delivering its first cut since December 2024, AI optimism spilling over into equity multiples, and foreign investors finally re-engaging with an under-owned asset class.

The leadership has been clear. Tech-heavy North Asia and China have surged on semiconductors, hardware and internet stocks. South Africa has outperformed on miners, especially gold. The strength has been led by improving earnings sentiment, a critical confirmation that the rally has more than just liquidity behind it.

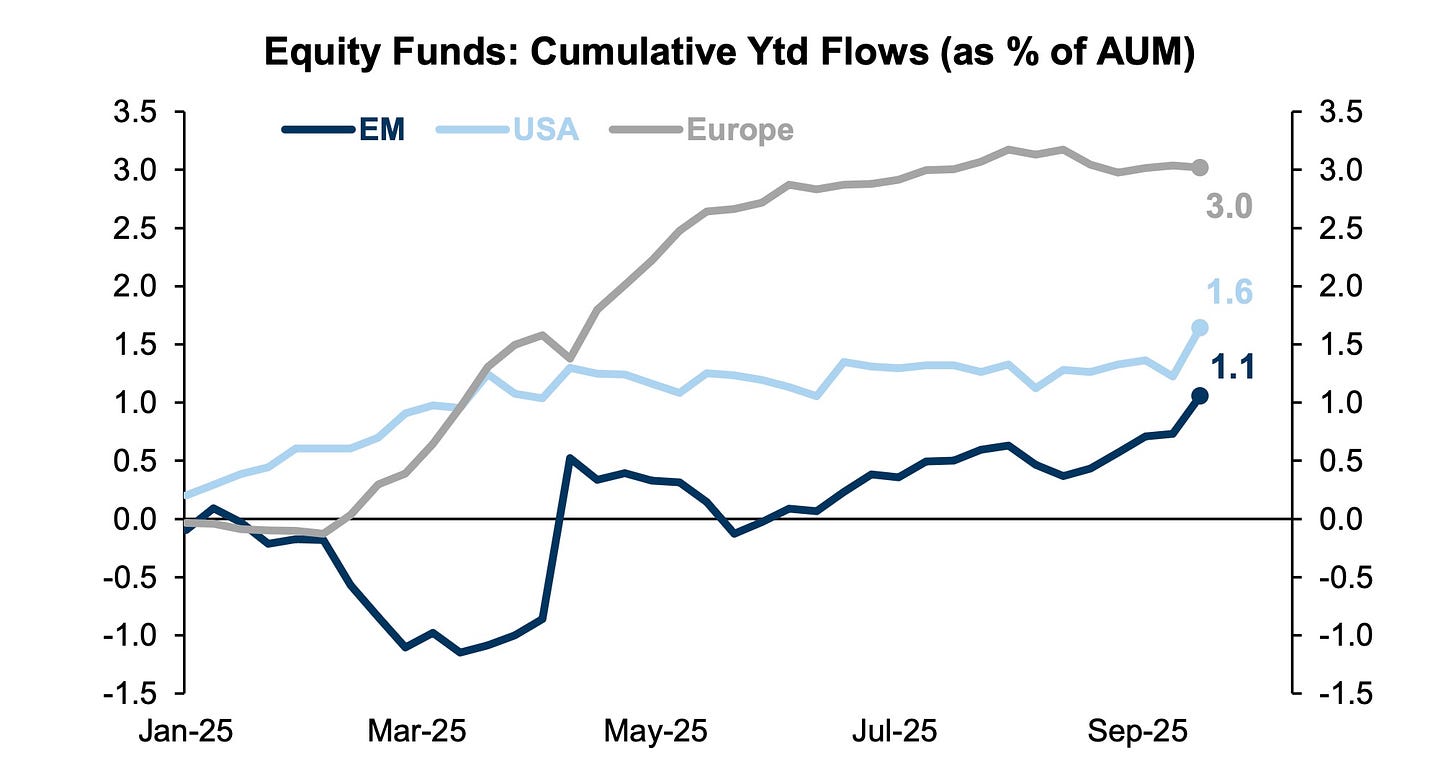

Looking ahead, the drivers remain in place. Fed easing is set to continue into year-end, the dollar is on the back foot, and flows into EM remain light relative to history. While inflows in Europe-focused funds have moderated after a strong 1H, EM funds have seen accelerating fund inflows in recent months as investors continue to diversify regionally.

Our view: In short, the EM rally can extend into year-end, but it won’t be a blanket trade. The opportunities lie in the dispersion. China is riding AI, Brazil offers a clean carry and commodity leverage, South Africa is finally finding momentum, and India is still a growth story but priced for perfection. Argentina, meanwhile, remains hostage to politics and is more a tactical trade than a structural allocation, and Saudi Arabia is a quiet outlier. Beyond equities, currency and rates markets add another layer of opportunity—themes we explore within this note.

In this article, we’ll review:

Key EM markets we’re watching

The macro drivers shaping them, from currencies to politics

Where the trades lie, across equities, FX, rates, and credit

La Albiceleste, “The White and Sky Blue”

To start with, let’s consider Argentina and President Milei.

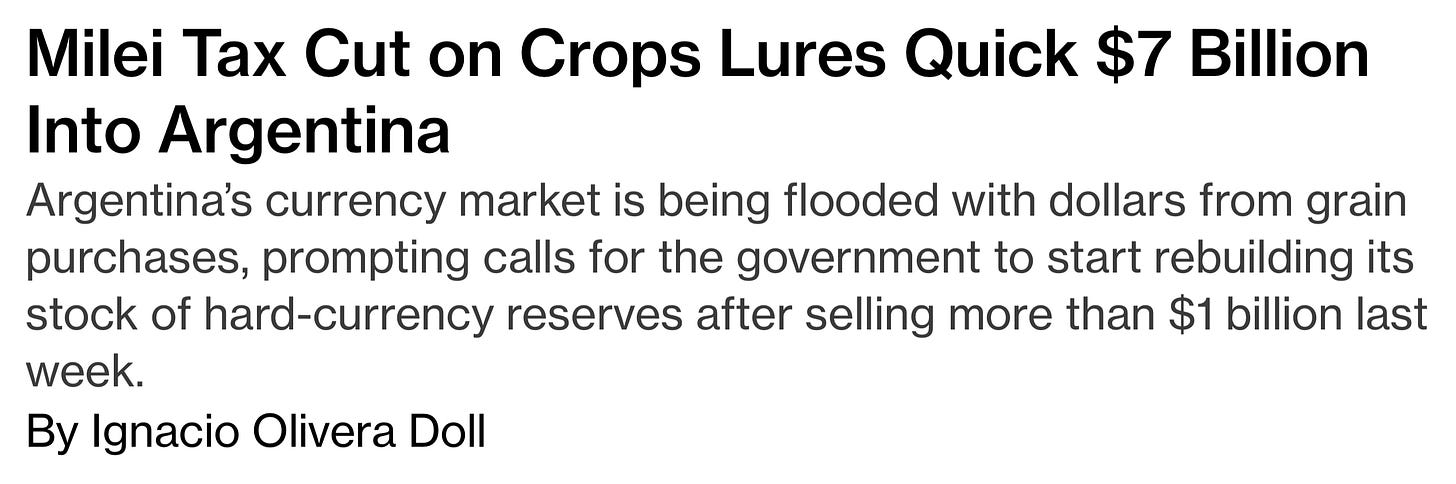

Argentina’s rebound has slipped into a holding pattern. The promise of a $20bn US lifeline and a temporary export tax windfall stopped the bleeding (news headline below), but neither has resolved the imbalances. The peso is already back under pressure, forcing interventions just days after its sharp rally. Bonds, briefly stronger, have resumed sliding. Words can reset sentiment, but sustainability demands details.

Milei has secured an impressive array of facilities: a $20bn IMF loan (frontloaded with $14bn), a $20bn swap line from the US Treasury’s Exchange Stabilization Fund, and accelerated disbursements from multilaterals. On paper, this looks like overwhelming support. In practice, it is a patchwork of short-term lifelines with little policy conditionality. Argentina’s reserves are thinner than reported, much of them tied up in yuan or bank requirements, leaving perhaps $7bn of usable cash. The danger is that fresh dollars get spent propping up an overvalued peso rather than rebuilding a credible external position.

The US package is particularly striking. Unlike past Treasury rescues (Mexico in the 1990s, for example), Washington has offered support without hard conditions. That gives Milei room to maneuver, but it also heightens the risk that funds are quickly depleted if policy does not shift. Without real exchange-rate flexibility or stronger reserve accumulation targets, Argentina risks burning through dollars and ending up back in the foxhole.

Politics sharpens that uncertainty. October 26 midterms are the fulcrum. Milei governs with thin margins, and a Peronist sweep would leave his reform agenda boxed in. His recent outreach to Mauricio Macri hints at a search for broader alliances, while cabinet changes after the vote are already being floated. These moves may stabilise his standing, but they also underline the fragility of his political base.

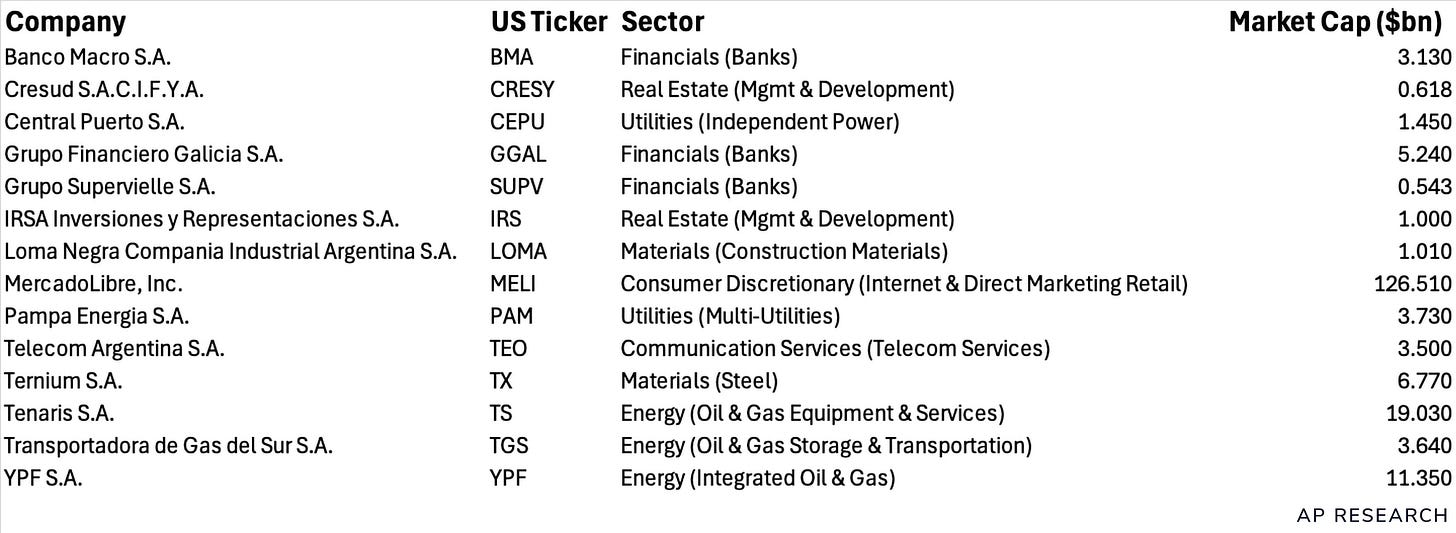

That makes this trade one against the clock. Carry remains attractive, and ADRs have offered a liquid proxy for those willing to ride the swings (a list of ADRs is shown below). But the market has already tested the limits of sentiment-driven rallies. Without political momentum and clarity on external financing, the peso will stay vulnerable and bonds capped.

Market Takeaway: From our perspective, Argentina is drifting back toward volatility. Milei has bought time, but not stability. The October midterms are the hinge, and until then, every peso move and policy signal is a referendum on whether the US backstop is real or just rhetorical.

Trade Idea:

YPF has been a high-beta Argentina vehicle, leading the post-election rally in November 2023 with a 40% gain versus ARGT’s 13%. Its recent pullback from late March to early April highlights its dual role: as a vertically integrated energy company, YPF is also a play on oil. With OPEC+ considering accelerated output hikes and US stockpiles building, crude faces headwinds on thin technical support. A sub-$60 CL print is not implausible near term.

Against this backdrop, we like YPF as a short if Milei falters in this month’s midterms.

Those following Argentina more closely will know the story doesn’t stop at sovereign bonds or ADRs. The peso’s violent swings this month highlight just how unstable the FX setup remains.

For our institutional clients, we’ve written separately on ways to position around that volatility, including relative value expressions against Brazil and tactical plays in NDFs. The full note is available below.

The trade ideas in that piece are high-octane, but the core takeaway is simple: without a credible FX policy, Argentina remains reliant on other people’s money, and that leaves ARS skewed toward devaluation risk. For most investors, equities and bonds are already a high-risk punt. For those running dedicated EM macro books, the peso is the cleaner volatility trade.

If Argentina is the perennial cautionary tale, Brazil is the counterpoint next door—same neighbourhood, same political tensions, but very different outcomes.

Pindorama, “Land of the Palm Trees”

Brazil remains one of the cleanest stories in EM. It offers high carry, deep local investor demand, and commodity leverage in a world where both growth and inflation are diverging. The BCB’s cautious turn toward easing keeps real rates among the highest globally, anchoring the real as one of the best-performing EM currencies this year. For FX investors, BRL is not just a carry play, but a defensive one when global sentiment wobbles. The combination of yield and resilience has kept it at the top of EM currency performance tables in 2025.