The End of the US-China Détente

A weekly look at what matters and how to trade it. (August 11th)

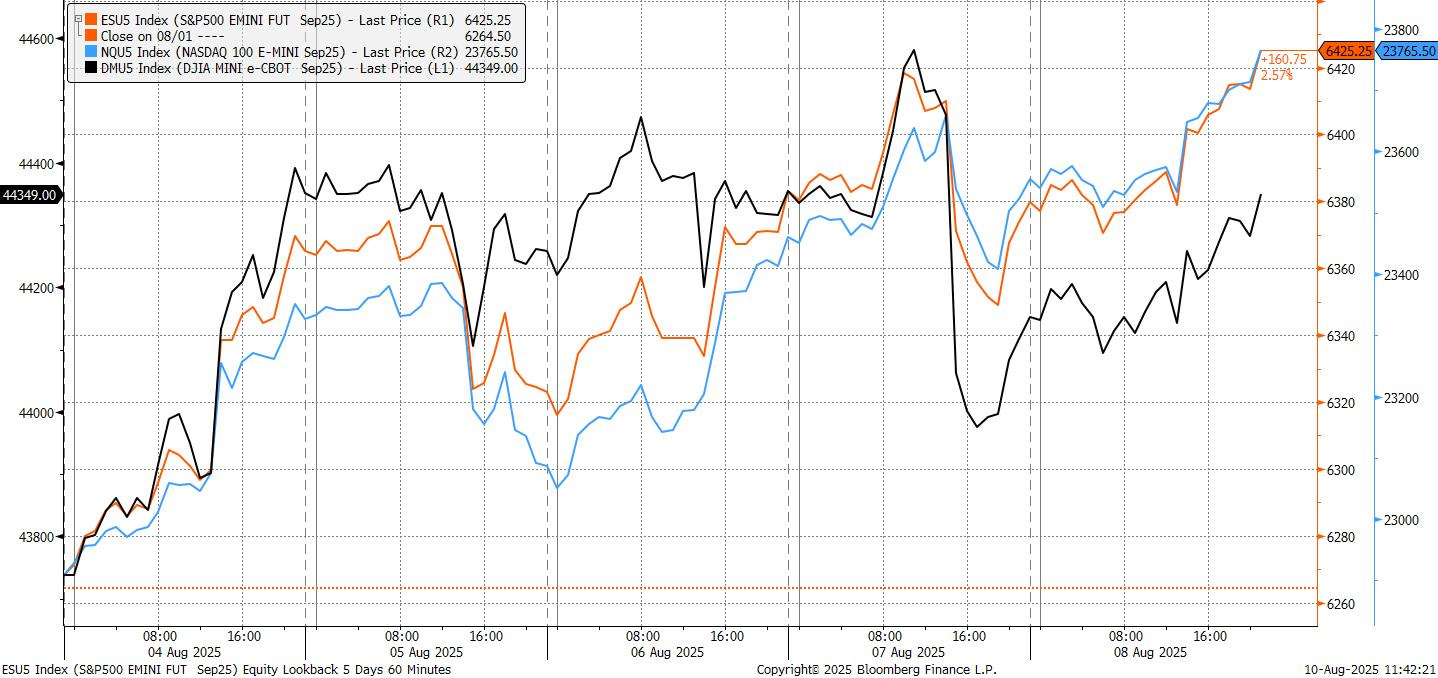

US equity markets finished the week near their highs, with technology leading the charge as investors shrugged off the latest round of tariff hikes, which took effect just after midnight in New York on August 7. Apple was the standout, accounting for roughly a third of the S&P 500’s weekly gain after unveiling a $100bn investment in US manufacturing—an initiative that should help offset tariff costs over time. The energy sector lagged, pressured by a more than 5% drop in WTI crude as OPEC+ moved ahead with production increases. Consumer-related names found support from strong individual earnings, with some positioning ahead of this week’s key US inflation data.

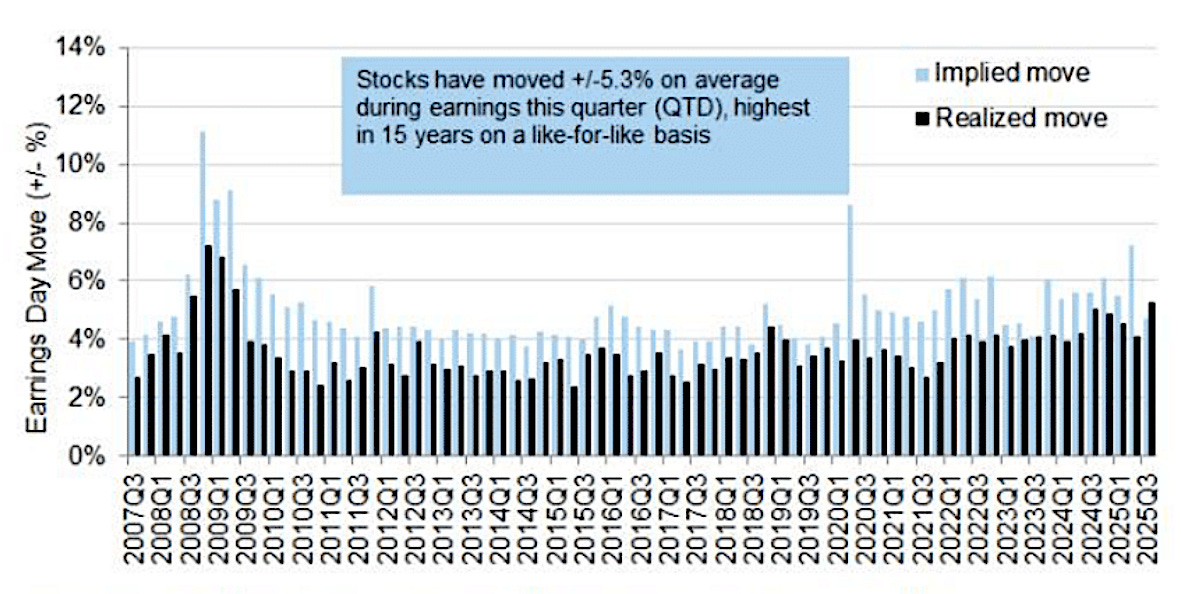

Earnings season is drawing to a close, but Goldman Sachs noted that the average post-earnings move for S&P 500 constituents exceeded options-implied expectations for the first time in at least 18 years—a rare sign of upside surprise outpacing market pricing.

The S&P 500 rose 2.4% for the week, the Dow gained 1.4%, and the Nasdaq 100 outperformed with a 3.7% advance. IT, Consumer Discretionary, and Commercial Services led, while Energy, Healthcare, and Real Estate underperformed.

Tariff headlines dominated the macro backdrop. President Trump announced a 100% tariff on imports containing semiconductors, offering exemptions for firms shifting production to the US. The move was paired with Apple’s manufacturing investment. Trump also signalled tariffs on pharmaceutical imports “within the next week or so,” starting small but potentially rising to 150% and then 250%. Pharma stocks slumped, weighed down further by a 14% plunge in Eli Lilly after trial results for its weight-loss pill came in weaker than expected.

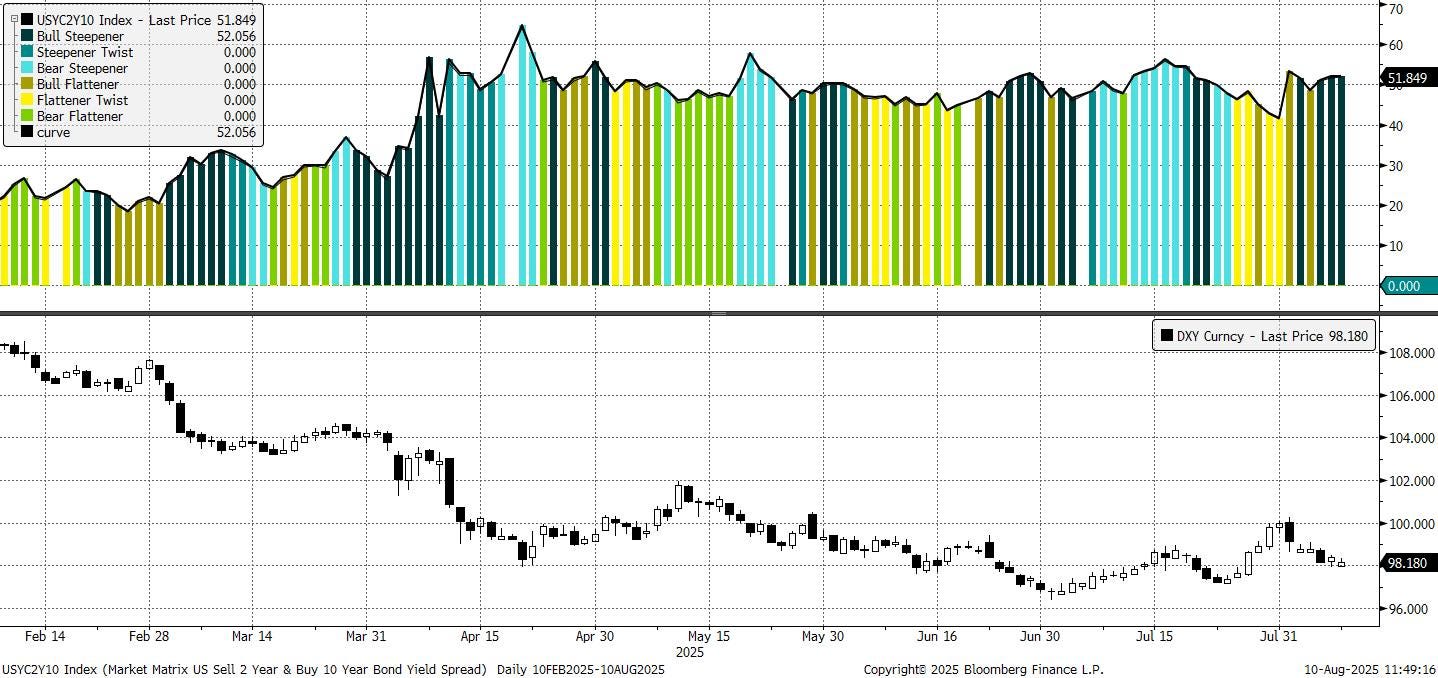

Economic data offered a soft note. July ISM Services missed expectations at 50.1 versus 51.5, with prices paid hitting the highest level since October 2022 and both new orders and employment declining. The report briefly knocked equities to session lows and underscored risks heading into a heavier data slate next week. Fed commentary was light, but speculation grew over potential changes to the FOMC’s composition, with Governor Waller (a known dove) seen as a frontrunner to replace Powell. Trump also nominated CEA Chairman Stephen Miran as a Fed governor, a move analysts say could steepen the curve.

In other markets, the dollar edged lower, retracing part of last week’s NFP-driven gains. The Treasury curve finished little changed, though there was a slight sell-off in the belly and all three major auctions (3-year, 10-year, and 30-year) tailed, an unusual occurrence. Gold futures ended the week at a record after the administration unexpectedly ruled that gold bars would be subject to tariffs, reversing assumptions of an exemption.

The Week Ahead

Markets enter the week with eyes fixed on the US data calendar, where the inflation and consumption picture will heavily influence expectations for the September Fed meeting. Tuesday’s July CPI print is the marquee release, with consensus looking for a 0.3% monthly gain in both headline and core. The composition will matter—used car prices, hotels, and airfares are seen driving the acceleration, while tariff pass-through remains modest so far. Producer price data follows on Thursday, offering further insight into pipeline pressures, and Friday brings July retail sales. Headline sales will be flattered by Prime Day promotions and auto purchases, but control group momentum is likely softer once inflation is factored in.

US data will be read alongside fresh trade headlines, as the preliminary US–China tariff truce is set to expire on Tuesday. Markets will watch closely for any extension or escalation after reciprocal duties came into effect on August 7. Labour market signals will also be monitored, with Thursday’s jobless claims still showing a gradual upward drift in continuing claims.

In the UK, the data flow could recalibrate BoE expectations after last week’s finely balanced rate cut. Tuesday’s labour market report and Thursday’s GDP and industrial production numbers will be key, with investors watching whether evidence of economic slowdown outweighs lingering inflation risks.

The euro area offers a lighter schedule, with Germany’s ZEW survey on Tuesday and June industrial production and Q2 GDP revisions on Thursday as the highlights. While headline prints are unlikely to shift ECB policy views meaningfully, sentiment indicators will provide colour on the trade and tariff backdrop.

In Scandinavia, Norges Bank delivers its rate decision on Thursday, with markets expecting an unchanged 4.25% policy rate and a reiteration that while cuts are likely later this year, restrictive settings remain appropriate for now. CPI readings from Norway (Monday) and Sweden (Thursday) will provide the inflation context.

Japan will release its Q2 GDP figures on Friday, with modest growth expected despite trade headwinds, while Australia will be in focus on Tuesday as the RBA meets. Markets are leaning toward another cut following last month’s surprise hold, with Governor Bullock’s tone critical for the rates path.

Among emerging markets, China’s Friday data dump—retail sales, industrial production, and fixed asset investment—will give the clearest read yet on July’s economic momentum. The release comes as Beijing weighs whether to extend its trade truce with Washington.

Equities/Indices

Equity markets show an interesting mix of positioning heading into next week. Speculators have been active in SPX futures, with 24k contracts bought last week, while simultaneously selling 13k Russell contracts—marking the largest small-cap short since October 2022. This shift in sentiment suggests a preference for large-cap stocks over their smaller counterparts, as traders anticipate further strength in broader indices. At the same time, over 19k VIX futures were sold, pushing the short position in the volatility index to the highest level since September 2022.