The Fed Whisperer

The man who knows what the Fed will do before they do it.

Few voices on Wall Street command more respect than Nick Timiraos. While many catch headlines for the wrong reasons (notably Kontranovic’s recent sacking over the stubborn nature of his bearish stance), when Timiraos speaks, people listen.

On Wall Street and in Washington, the chief economics correspondent for The Wall Street Journal has been referred to as the “Fed Whisperer”, “Chairman Timiraos”, and “Nickileaks”, and well deserves the cognomens.

His reputation precedes him

The increased attention on Timiraos began when he accurately predicted that the Fed would start scaling back its pandemic stimulus in November 2021, almost two months ahead of time. However, his recognition picked up significantly just before the Fed’s mid-June meeting. Timiraos wrote an article forecasting a 0.75-percentage-point rate rise when the consensus among global investors was only for a half-point increase. At that time, the Fed had been in a blackout period for over a week, during which its officials do not communicate with reporters. Timiraos’ prediction turned out to be accurate as the Fed subsequently raised rates by three-quarters of a point.

Since then, he has consistently predicted the Fed’s subsequent moves, influencing the predictions of Wall Street odds-makers on the way.

September cuts

Why are we here writing about a banking journalist?

Well, one of his most recent articles highlights the case for a September cut being the likely move from the Fed. There were two standout paragraphs from his article:

“For the Federal Reserve, Friday’s report provides further evidence that the labor market appears to have come into better balance. A hot labor market makes it more difficult to lower rates, while the central bank is also mandated to keep the job market as strong as possible without triggering inflation.

…While July may be too early for a rate cut, a mild inflation report next week could lead to Fed doves who are more worried about labor-market weakness to argue that it is time for the central bank to tee up a September rate cut.”

If Timiraos is the all-seeing, all-knowing insider at the Fed, then we can take this report as a reason why a September cut is, as much as it can be, set in stone. Keep that in mind for the inflation gameplan later.

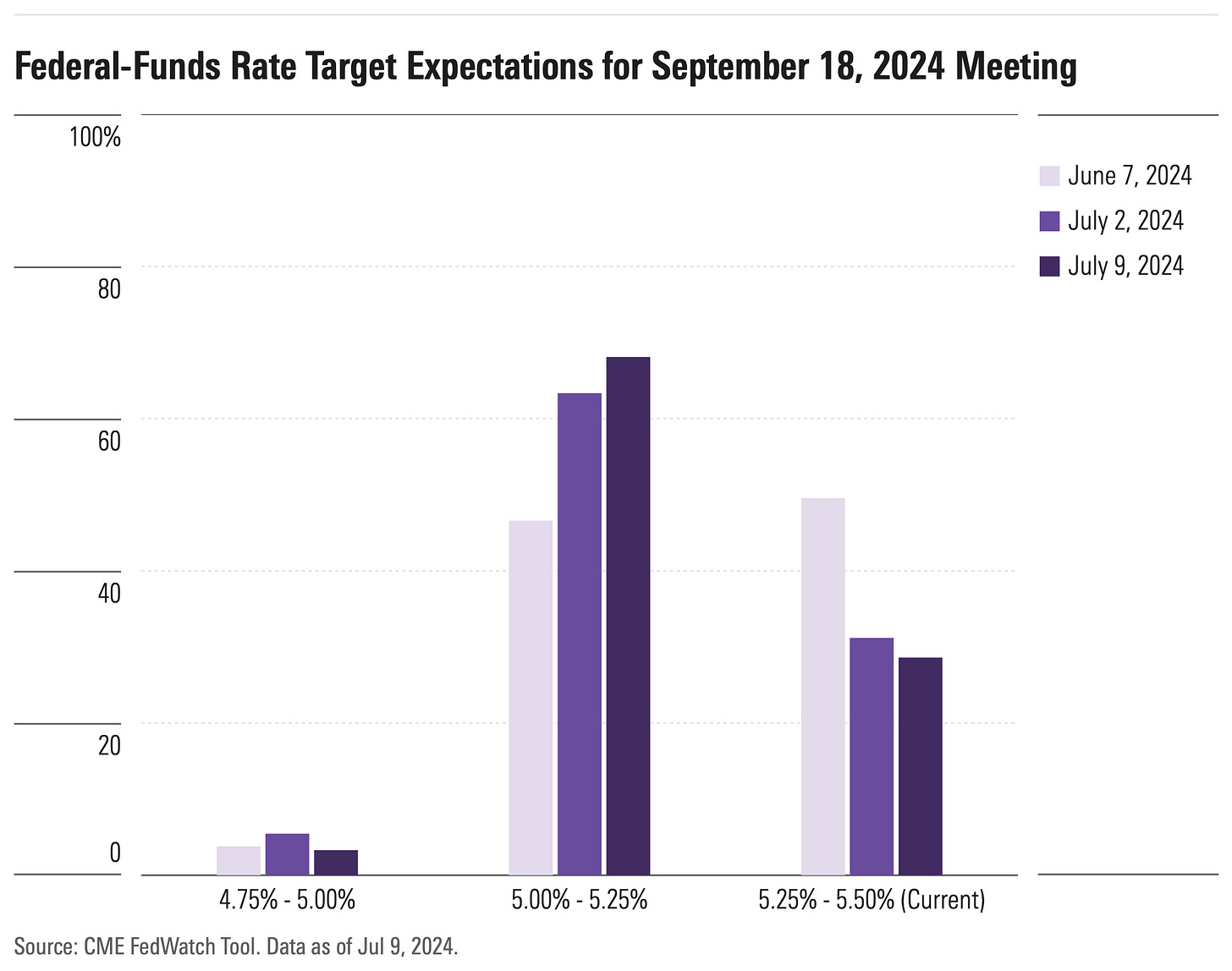

Markets are beginning to agree with him. September expectations have grown over the last week, and are 21.5 percentage points higher from a month ago.

A QUICK REMINDER: Our prices for premium subscriptions will go up to $20/month from Monday (this only applies to new subscriptions, so if you are already a paying reader, you’ll stay on the same plan).

However, if you join now you can benefit from the current plan of just £10/€12/$13 per month forever (annual plans are even better value). To make the offer even sweeter, we’re offering a 7-day free trial as well. It wouldn’t be fair to ask you to sign up without letting you see what value we offer first.

Inflation issues

The most recent economic projections suggest that the majority of Federal Reserve officials anticipate reducing interest rates once or twice this year if inflation decelerates and growth remains steady but not exceptional. The next scheduled meeting is on July 30-31, and markets are eagerly anticipating any indications from officials at that meeting that they might consider lowering rates at their following gathering in September.

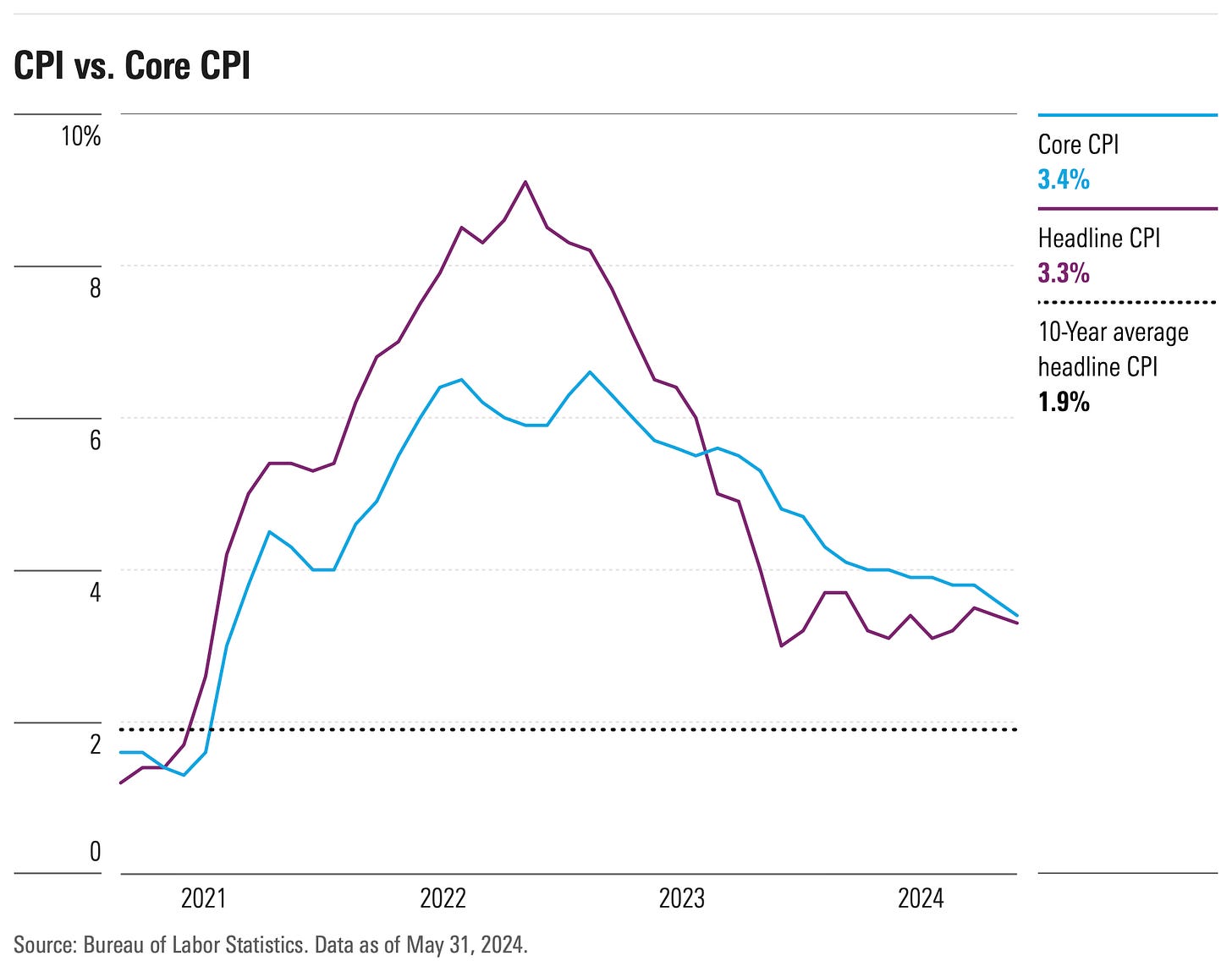

Will tomorrow’s inflation be a bump in the road? It’s unlikely. Economists anticipate that consumer prices rose 0.1% on a monthly basis in June after remaining flat in May That would bring the inflation rate down from 3.3% to 3.1% on an annual basis. Core inflation, which excludes volatile food and energy prices, is expected to remain slightly higher. Analysts are anticipating 0.15% to 0.2% growth on a monthly basis in June and 3.4% growth on an annual basis.