The Fog of Corporate Forecasting

Wall Street likes a good story, but it worships a confident narrator.

As earnings season kicks off, the usual rhythm returns: beats and misses, margins and multiples. But this quarter carries an undercurrent—something more psychological than cyclical. In an environment where macro noise is deafening and policy risk lingers, the question isn’t just what companies earned. It’s whether they’re willing to say anything about tomorrow.

Guidance, once a dry appendix to earnings calls, has taken centre stage. Investors are caught between rate volatility, election-year jitters, and a softening consumer, listening less for numbers and more for conviction. And conviction, in moments like these, is either a badge of clarity or a costly bluff.

We’ve seen this before. During Covid, firms that continued guiding markets, however cautiously, were rewarded with valuation premiums. Those who withdrew into silence found themselves punished. Now, in 2025, the same tension is surfacing. Some firms, like United Airlines, are hedging their optimism, offering base-case and downside scenarios in a kind of narrative straddle. Others will stay quiet, hoping the silence isn’t interpreted as weakness.

What happens next depends not just on earnings, but on the psychology of guidance in a murky world. The market, after all, doesn’t just price facts—it prices confidence.

Radio Silence Penalty of ~300bps

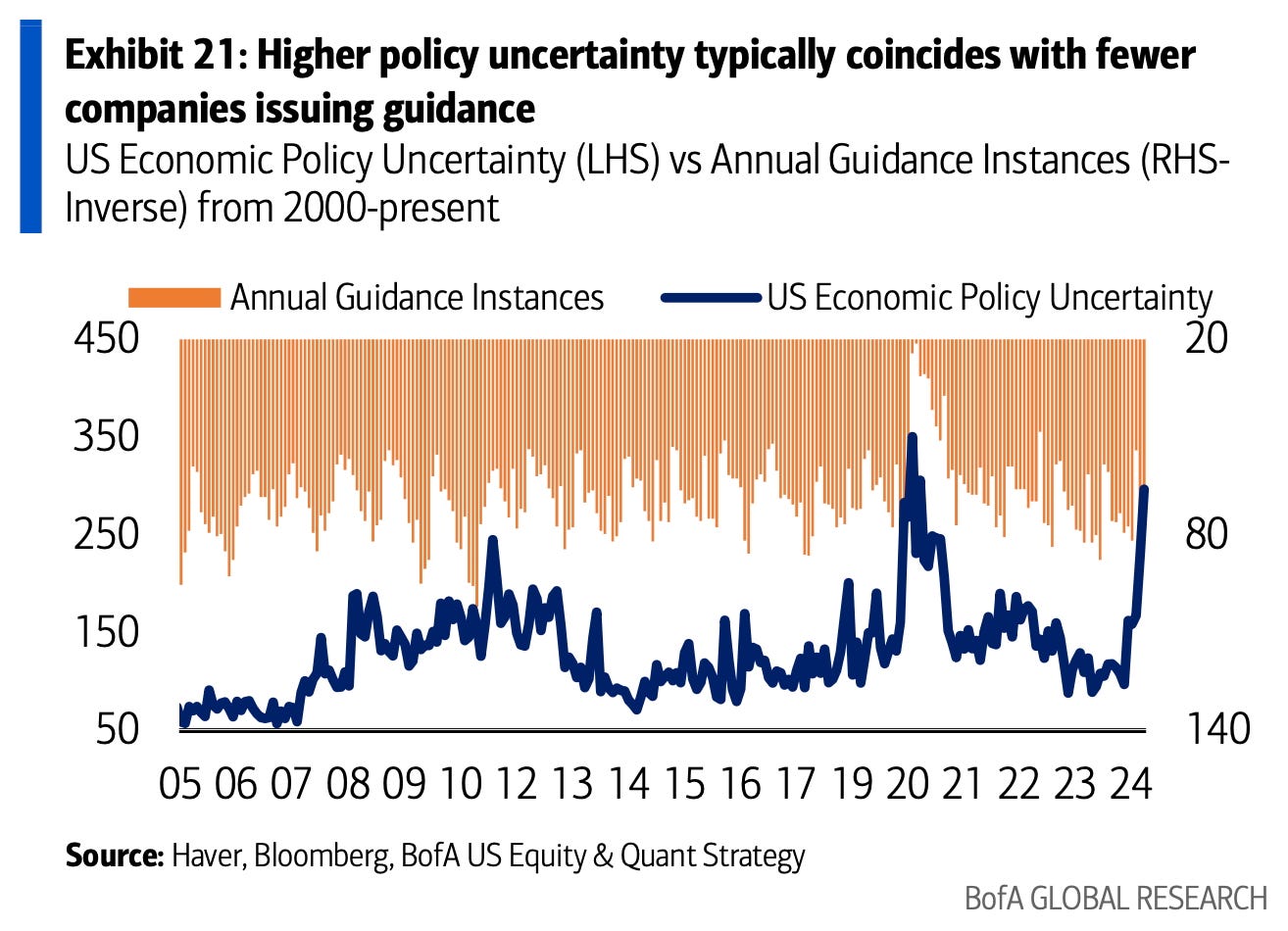

Amid macro uncertainty and policy risk, the first casualty is often corporate transparency. We touched on this topic in our last Word on the Street, but felt it was an intriguing and important consideration to write more about and keep in mind over the coming weeks.

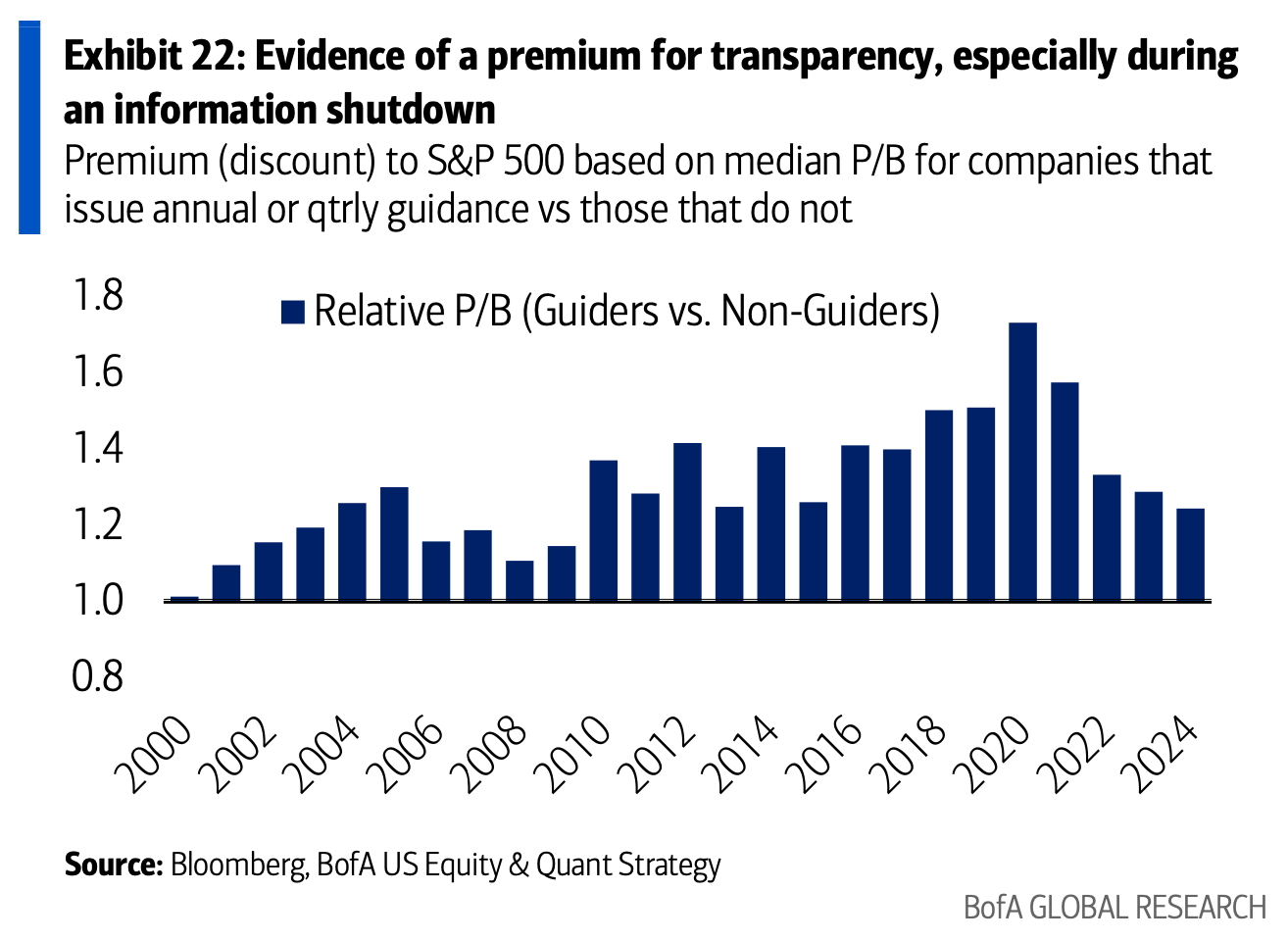

Historically, companies that provide regular guidance have commanded a valuation premium. That premium widened meaningfully during COVID, when only 10% of companies issued annual guidance in Q2 2020, down from 40% in the preceding four quarters. Those that maintained guidance outperformed peers, while companies that withdrew saw an average relative drawdown of ~3 percentage points from the time of silence to reinstatement.

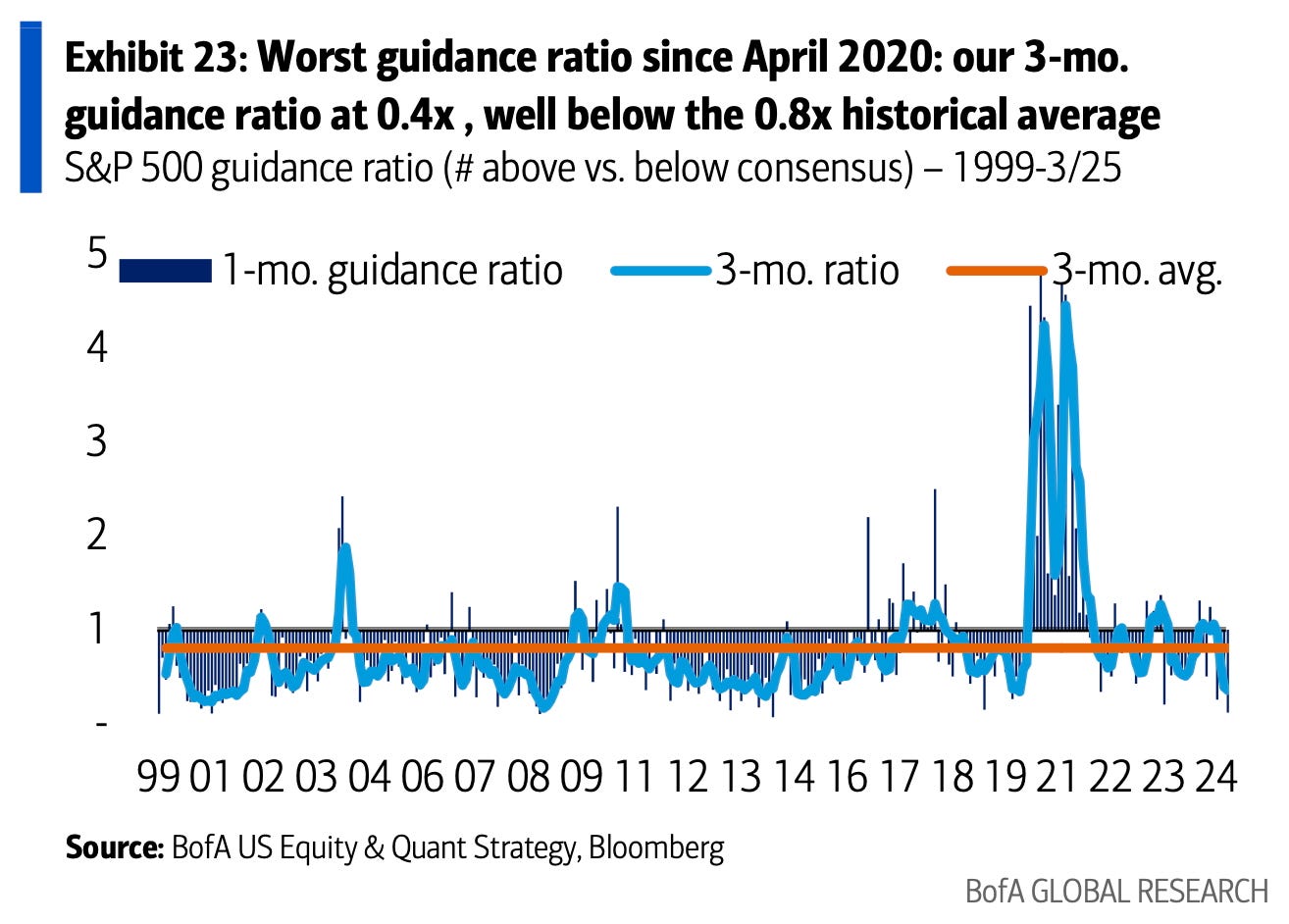

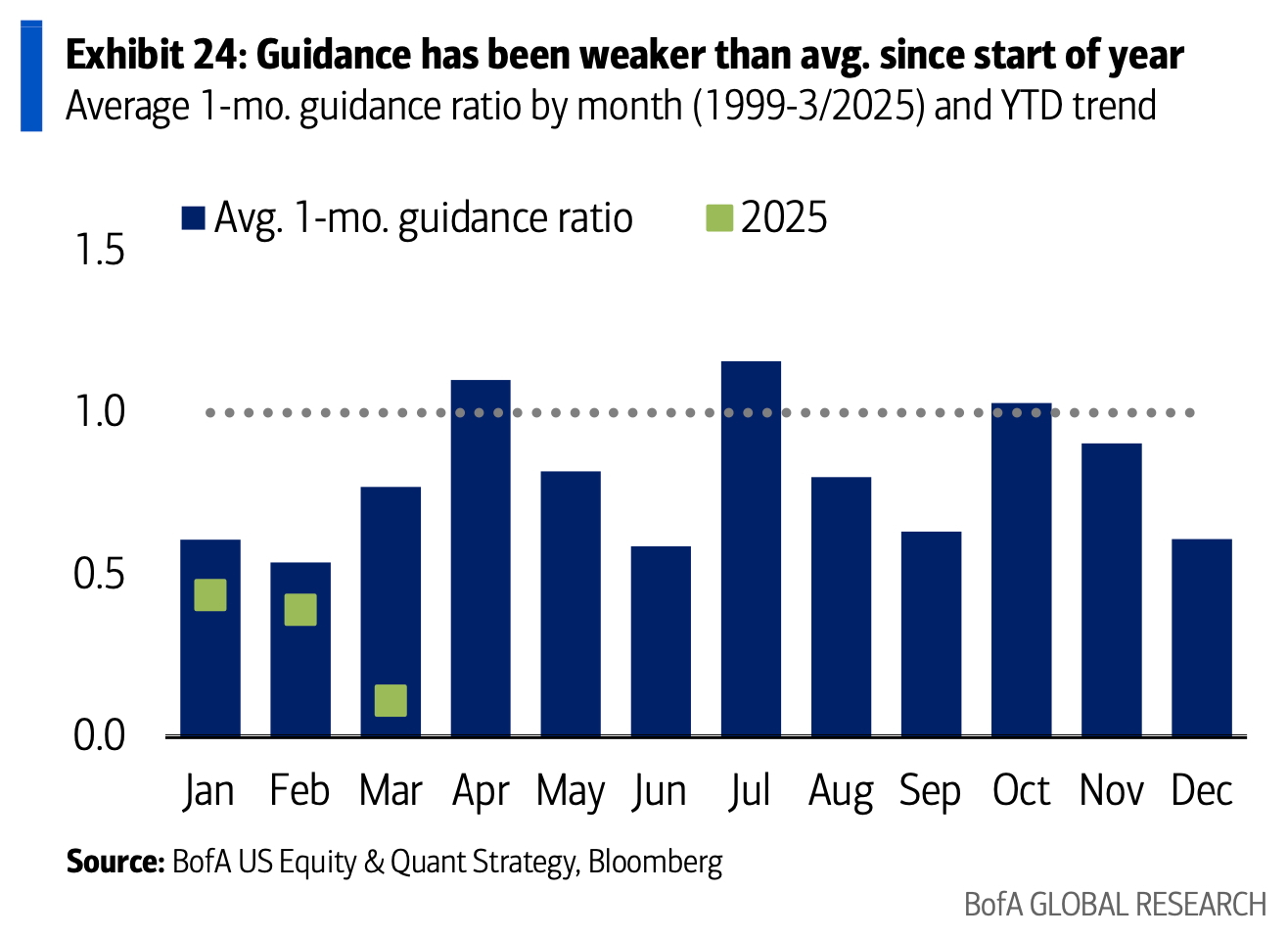

We’re seeing echoes of that pattern now. The 3-month guidance ratio (the number of above-consensus guides vs. below-consensus guides) has dropped to 0.4x. That’s the weakest since April 2020 and well below the long-term average of 0.8x. While January and February are seasonally soft for forward commentary, even March came in significantly weaker than historical norms.

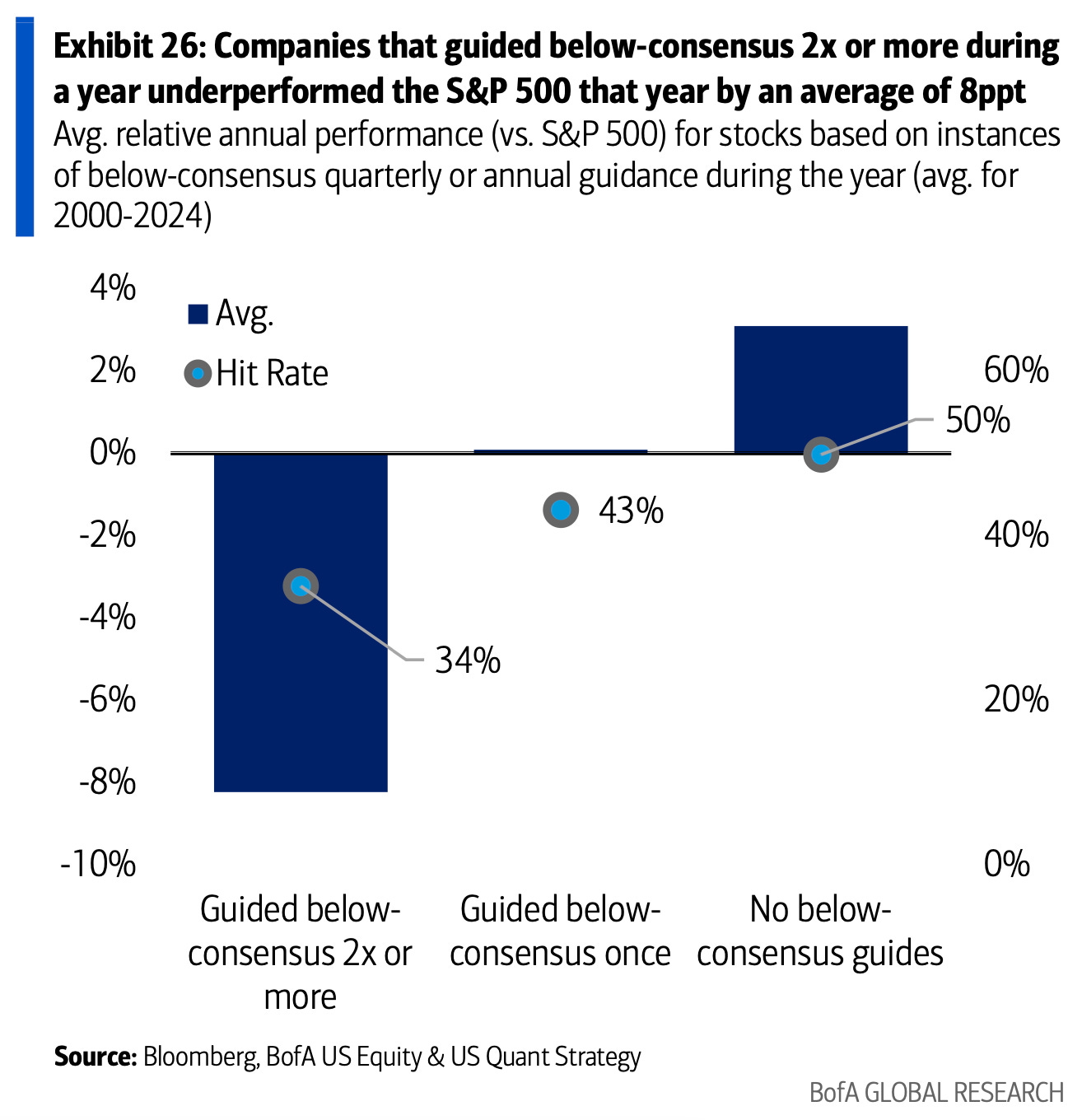

Markets may tolerate a single soft guide. But miss twice, and the penalty compounds. Companies that guide below consensus more than once underperform by an average of 8 percentage points over the year. Fewer than one-third of those names manage to claw their way back to benchmark leadership.

In this environment, the absence of guidance isn’t treated as caution—it’s interpreted as opacity. And markets don't like to price what they can’t see.

Guidance Withdrawal: The New Contagion

Delta and Frontier have already scrapped full-year guidance. United Airlines opted for a hedge, issuing dual profit scenarios under the disclaimer that 2025 is “impossible to predict.” Levi’s is still calculating the tariff math. JD Sports went further, explicitly warning analysts not to even ask. A growing number of management teams are choosing discretion over clarity.