The Game(don't)Stop

Meme-mania is back like it never left. Will it be different this time?

Who would’ve thought? Over 1,200 days later, we’re back. GameStop’s legion of meme stock traders have come roaring to life. Why?

Because of one tweet.

Keith Gill, known more famously by his online alias “Roaring Kitty”, posted his first tweet in three years. A cryptic one, to say the least. But meme stock traders don’t need hard and fast rules about what to do. This was enough.

After two days of trading, GameStop is up 180%, and AMC is up 130%.

All hell has broken loose.

The recent surge might seem similar to the 2021 frenzy, but this time, the increase is much lower. In 2021, the surge was as high as 2,000%. Additionally, the percentage of GameStop shares being sold short is currently only 24%, far less than the 140% during the 2021 rally. This means that short sellers are not as overexposed as they were during the previous rally, which was one of the main drivers of the move.

Pandemic stimuli has become a high interest rate environment. Everyone is in anticipation of another meme rally, compared to the surprise move that happened in 2021 that caught many off guard.

History may not repeat itself. But it does rhyme. GameStop mania won’t pack a punch like it did in 2021. But irrational trading can still do some damage.

Let’s look at the data.

GameStop

There’s a great graph below that looks at the timeline of GameStop so far. Although the recent price change is way below the original move, it does stand out on the timeline.

As things stand, the short float % is 24.12, and the S3 Squeeze rating is 60.

GameStop options skew is shared on the next image. This looks fairly normal, so there isn’t much to highlight here.

AMC

For AMC, short float % is 20.13%, and the S3 Squeeze rating is 15.

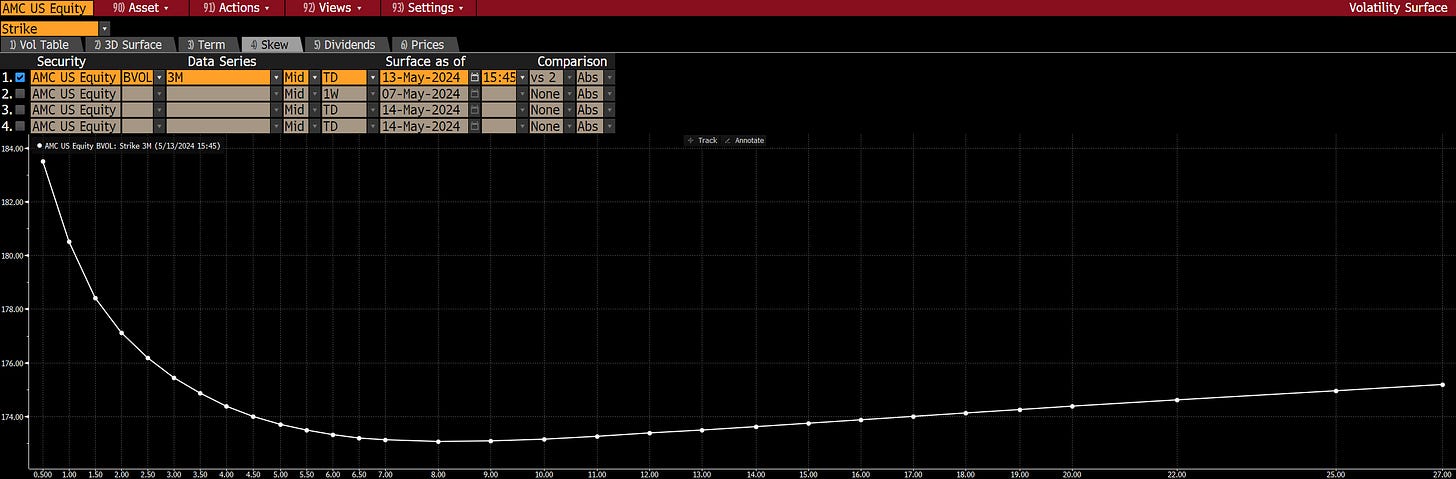

AMC option skew is below. This looks more bearish, with no right hand side pickup, indicating much more demand for puts.

Other Shorts

As is the case with meme stocks, traders look towards names that have high short interest, as they feel they are at a war with Wall Street. The list is below:

The most-hated stocks tracked by Goldman Sachs has jumped 8.7% in the best day since November 2022. A separate gauge of money-losing technology companies tracked by Goldman Sachs jumped 6% on Monday, outperforming the Nasdaq 100 Index by the most since December.

The Thing With Mania

John Maynard Keynes, one of the greatest economists ever, wrote about the trading game. Keynes believed that investors don’t just pick stocks based on their intrinsic value but rather on what they think other investors will value. Stock prices are driven by sentiment and psychology as much as they are by fundamentals.

This is the case with many of the manias that the world has seen over time. The tulip squeeze is one example.

‘Tulip mania’ refers to a period during the Dutch Golden Age in the 17th century when the prices of tulip bulbs soared to incredibly high levels before dramatically collapsing. It occurred between 1634 to 1637.

Tulips, introduced to Europe from the Ottoman Empire, became a status symbol among the Dutch elite. Speculation in tulip bulbs became widespread, leading to a speculative bubble in which prices far exceeded the intrinsic value of the bulbs. At their peak, some rare tulip bulbs were traded for the equivalent of a house or more.

However, the bubble eventually burst in 1637, causing the prices to plummet dramatically, leading to financial ruin for many investors. The tulip mania is often cited as one of the first recorded speculative bubbles in history and serves as a cautionary tale about the dangers of irrational exuberance in financial markets.

There have been other examples between the events in Europe in the 1600s and today’s GameStop rally. It shows that human nature will always want to speculate. GameStop is the outlet for our modern day.

The thing with bubbles is that they pop. There’s no knowing when the backside of the move will come or how fast it will unwind. “The end of a speculative boom can be inevitable but not predictable.”

But humans always have and always will be willing to speculate.

In February of 2021, Morgan Housel, the famous author of ‘The Psychology of Money’, wrote a short article titled, ‘When Everyone’s a Genius’. It’s worth a read. A link to the article is here.