The "Great Bear Of Wall Street" You Didn't Know About

Jacob Little participated in everything from market manipulation to short squeezes, earning himself the title "The Great Bear Of Wall Street".

The “Great Bear of Wall Street” was an American investor from the early 19th century who was also one of the first and most successful stock market speculators. Jacob Little, who was raised in Massachusetts, relocated to New York City in 1817 and started work as a clerk for Jacob Barker (a financier and lawyer) at first. He later opened his own business in 1822, and in 1834, he established his own brokerage.

A market pessimist, Little made his wealth “bearing stocks”, at turns short selling various companies and at others cornering markets to extract profits from other short sellers. Through his great financial foresight, Little amassed an enormous fortune, becoming one of the wealthiest men in America and one of the leading financiers on Wall Street in the 1830s and 1840s. Still, his speculative activities irritated his peers and earned him few admirers.

Little lost and remade his legendary fortune multiple times before losing it for good in 1857; although many owed him enormous debts, he was a generous creditor and never collected them, and at his deathbed in 1865, Little was penniless. Although well-known on the stock market in his time, he was quickly forgotten after his death, and today has been relegated to relative obscurity.

His years in the market

Little entered the stock market when stock brokerage and banking were developing from a supportive activity to a profit-driven industry. However, a large part of this growth came not from “solid” investors—those interested in the business ventures they funded—but from speculative “wheeler-dealers” who would manipulate prices to profiteer from their holdings or, just as often, from those of others. Wall Street had hundreds of these speculative brokerage firms by the time of the American Civil War. Rival cliques of bulls and bears would frequently artificially raise and lower prices, respectively, often using shady means that enraged more reputable stockbrokers.

Little was one of the earliest and most successful practitioners of market manipulation, making his fortune by leveraging both short sales and short sellers. In the former, he would sell stocks to other traders under contract to purchase them at a later date, betting that the market value would go down in the future and he could pocket the difference. In the latter, he would execute the opposite manoeuvre, corner a market by buying up all of the bonds of a particular company or sector, up-ticking the price to make a profit at the expense of any short sales based on those stocks. Hardworking, highly ambitious, and with his eyes set on the very top from the beginning, Little commonly spent twelve hours a day working on such manoeuvres in his office and a further six during the evening engaged in currency speculation.

Short squeeze

His first great coup was when in 1834, he successfully bought out the Morris Canal and Banking Company, machinations which pushed its stock price from $10 ($293 today) per share in December 1834 to $185 ($5,423 today) a share in January 1835, at which point Little chose to collect his debts. Although theoretically, he could have asked for more (he was, after all, in total control of the company), Little chose not to force the issue because he feared the resulting bankruptcies would destabilise the market and potentially cause a collapse.

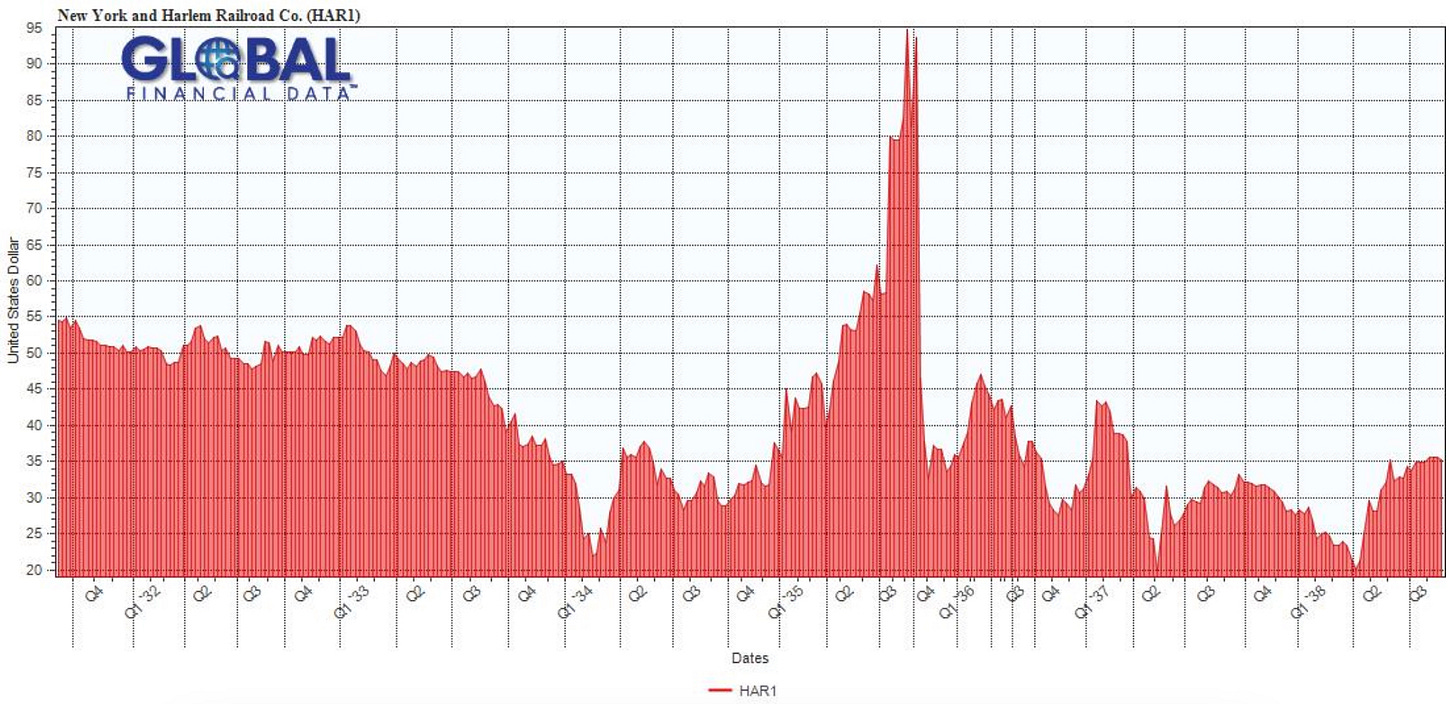

He repeated this feat in September of the same year, cornering stocks for the construction of the Harlem Railroad. Approximately 60,000 shares had been sold short by that time, but only 7,000 shares had yet been issued; needless to say, Little prospered immensely.

Does this remind you of any recent events in the market…?

A wise trader

As a trader, he was unscrupulous and serendipitous. In one instance, he promised a group of Bostonian traders that he would not sell his holdings in the Norwich and Worcester Railroad below the price of 90 dollars a share, but promptly did so soon after when he noticed its price slipping, earning him much condemnation and lasting outrage from other traders. But he was also known for his practised judgement, the promptness of his dealings, and his great financial foresight.

Little was able to predict Andrew Jackson's campaign against the Bank of the United States (and the resultant Panic of 1837) and was able to protect his interests during the financial debacle by short-selling his own holdings. This lucrative operation earned him his most lasting title: “The Great Bear of Wall Street.” Little often stated he was in the business of “bearing stocks” in the tradition of the bear market.