The Last Week That Matters in 2025

A weekly look at what matters and how to trade it. (December 8th)

In this week’s report:

A recap of what moved markets last week

Robotics, the preferred AI upside

Copper upside and notable activism

US Treasury and FOMC comments

A few extra ideas in FX to end with

US equities extended their upward drift through the week, shrugging off pockets of intraday volatility as the S&P 500 closed higher for a fourth straight session. The AI complex continued to provide lift at the margin, with semiconductor names such as Microchip (MCHP US) and NXP (NXPI US) adding incremental fuel to the thematic bid that has anchored risk appetite for most of the year. Energy stocks topped the leaderboard as crude regained momentum, offering a counterbalance to weakness elsewhere.

A second driver was political rather than fundamental. Markets leaned into the rising odds that Kevin Hassett will be the next Fed chair after President Trump’s favourable comments. The prospect of a more dovish regime change (paired with the 86% expectation of a cut at this week’s meeting) gave equities another tailwind. Still, there’s an undercurrent of fatigue. Barclays flagged the diminishing market impact of Fed policy moves, a reminder that easing alone is no longer the dominant catalyst it once was.

Netflix agreed to acquire Warner Bros. Discovery at a $72bn equity valuation, with Warner spinning off CNN, TNT and other cable networks before the sale of its studio and HBO to Netflix is finalised.

Meta signalled a meaningful pivot away from its metaverse ambitions. Zuckerberg is weighing cuts of up to 30% for the division, potentially including layoffs as soon as January, as the company refocuses on businesses with clearer returns. Markets rightfully loved it. The stock rallied 3.4% as investors rewarded the re-emergence of cost discipline, a theme that has repeatedly defined Meta’s valuation trajectory.

Data releases were mixed and, because of the delay, somewhat stale. The clearest signal came from ADP, where employment fell 32k versus expectations of a 10k gain, reinforcing signs of labour-market softness. Employment components in both ISM surveys remained below 50.

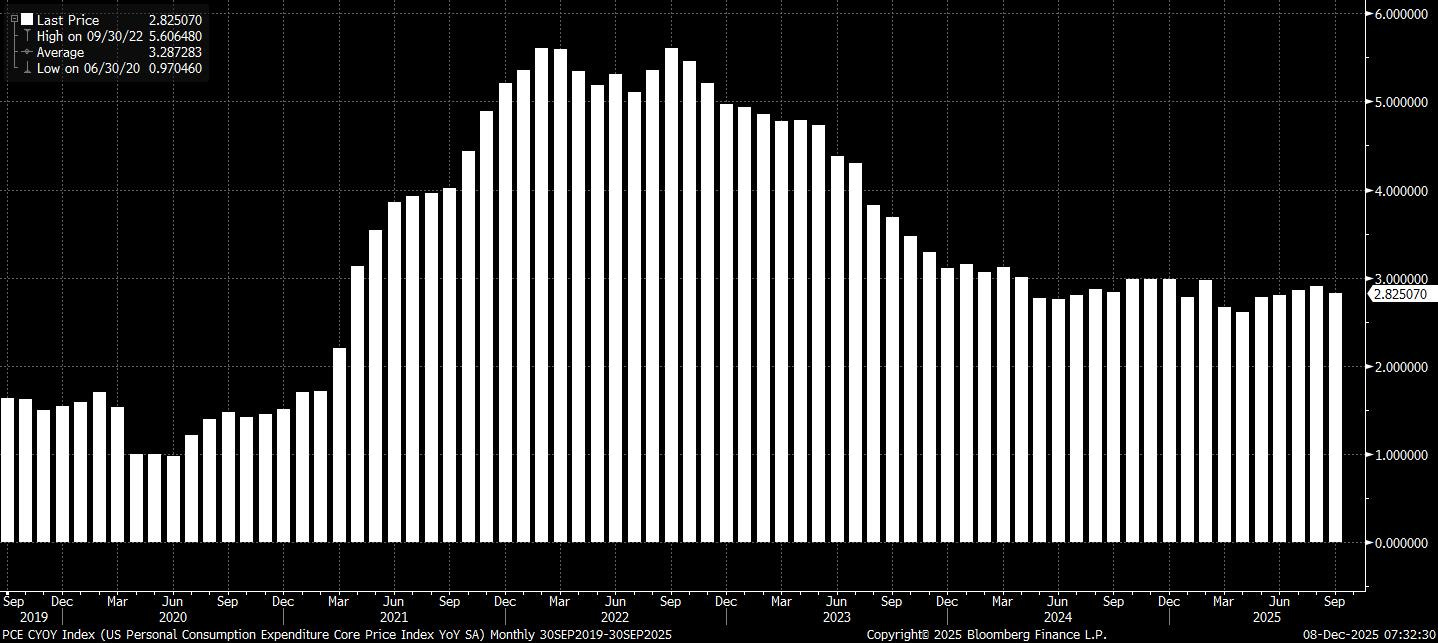

On inflation, the delayed September Core PCE print offered mild relief at 2.8% y/y, with University of Michigan short- and long-term expectations falling to 11-month lows.

The Fed is now in blackout, leaving markets without guidance ahead of this week’s meeting. As has always been the case, Fedspeak guided markets back towards pricing a cut to avoid leaving them offside, so a cut is what we will see.

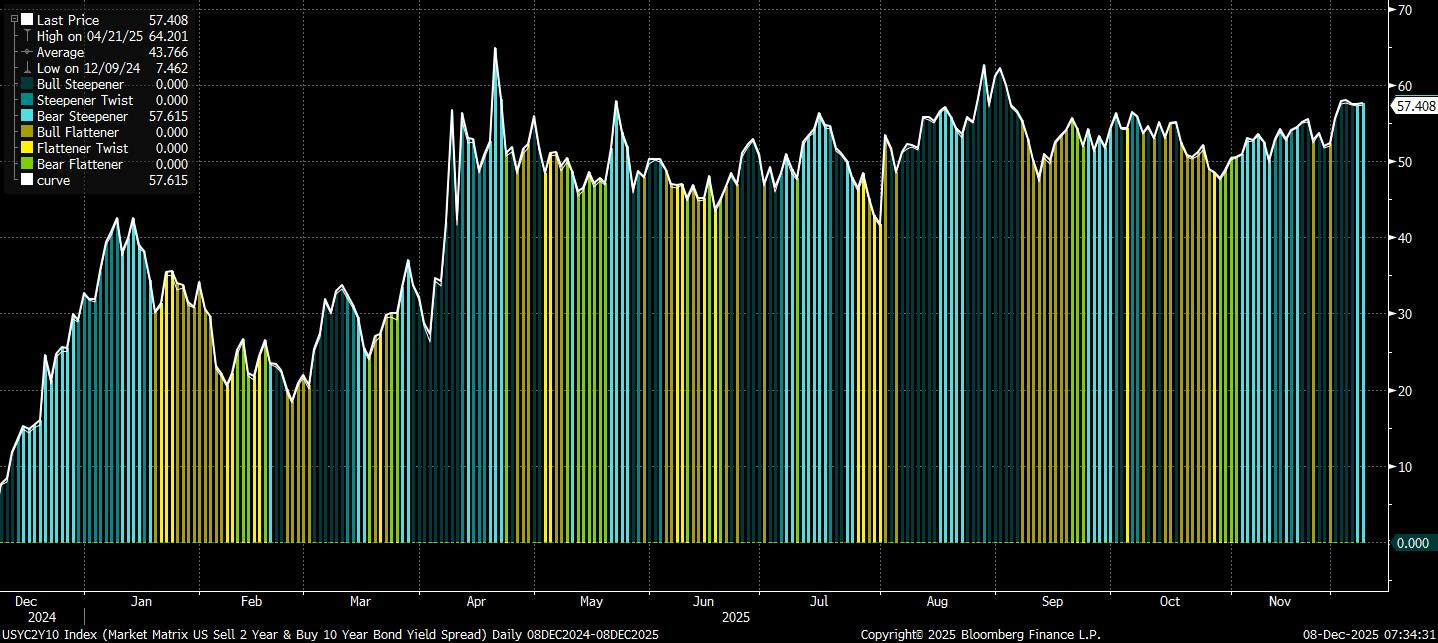

Treasuries saw a more dynamic week than usual. The front end rallied as traders priced a more dovish future Fed chair, and SOFR butterflies caught the volume, most notably the Dec27/Mar28/Jun28 fly. The long end sold off as futures positioning was unwound, steepening the curve modestly after several weeks of parallel shifts.

The Week Ahead

The biggest focus of the week ahead will be the FOMC meeting, which will likely be the final event that markets fully care about as desks wind down for the seasonal holiday. But there are a few other topics on our mind ahead of this new week, such as copper and some activism in Barrick Mining Corp, and the robotics arm of the AI trade. We’ll start with the latter, which includes several names that we put into an initial “robotics basket.”

Access all research by becoming a premium reader.

“Robotics Oversight & Build-Out Taskforce” (ROBOT)

We may have made that task force up, but it doesn’t seem far-fetched. The current administration has continued the CHIPS Act, refocused resources on securing critical mineral supplies, and is now focused on robotics, with Commerce Secretary Howard Lutnick stating they are “all in” on accelerating the sector’s development, according to sources.