The Long End's Long Winter

Bond markets are sending a message, and it's getting louder.

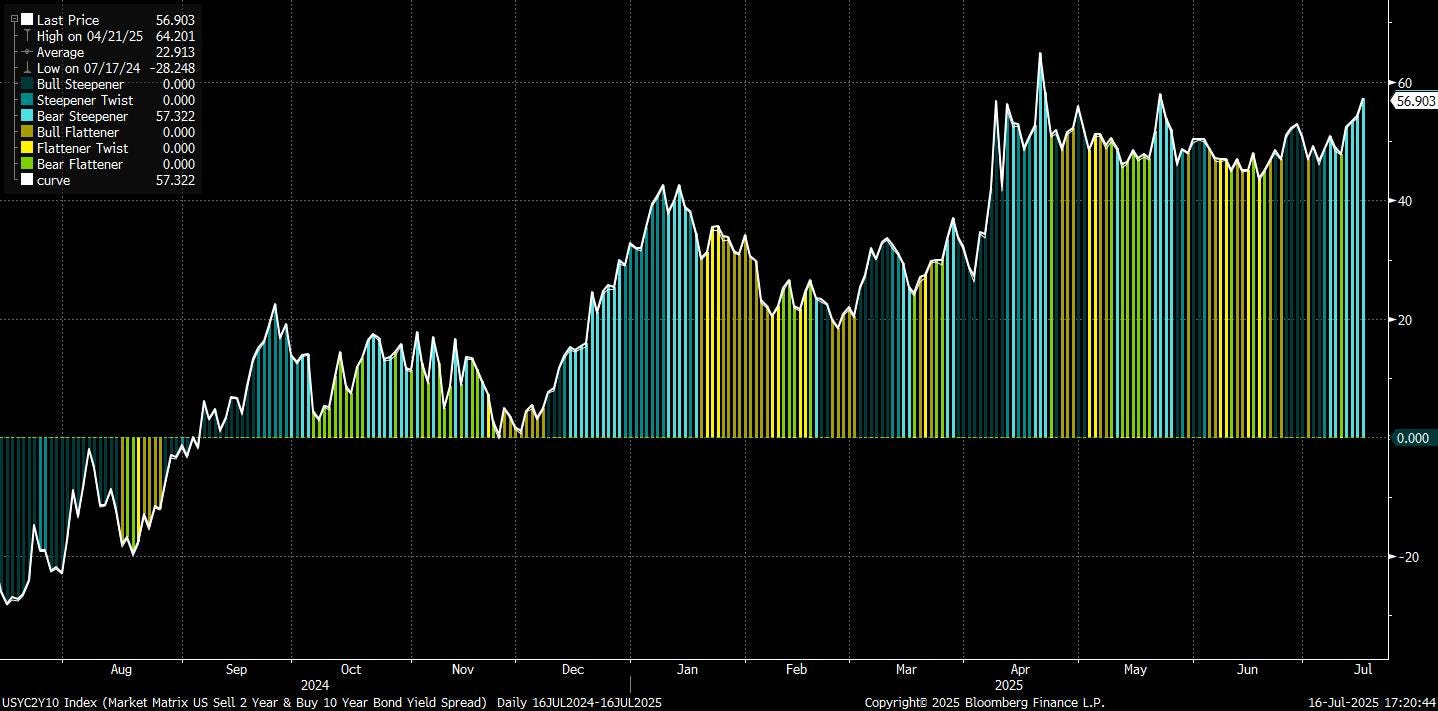

Long-end Treasuries are under siege again, continuing their long winter of underperformance. The 30-year yield breached 5% this week, and derivatives markets lit up with fresh downside bets. For a while, the prevailing view was that softening inflation and a near-term Fed pivot would pull yields lower. But that narrative is fracturing. Trade protectionism, fiscal expansion, and the politicisation of monetary policy are reawakening fears of entrenched inflation and sovereign risk. The result: a deepening bear steepener in US rates, led by the long bond.

Markets are increasingly uncomfortable with the macro mix of populist fiscal impulse and institutional decay. If that discomfort accelerates, the long end still looks too expensive. We think it’s time to fade duration again and position for further steepening.

A Global Fiscal Revival and the Bond Market Backlash

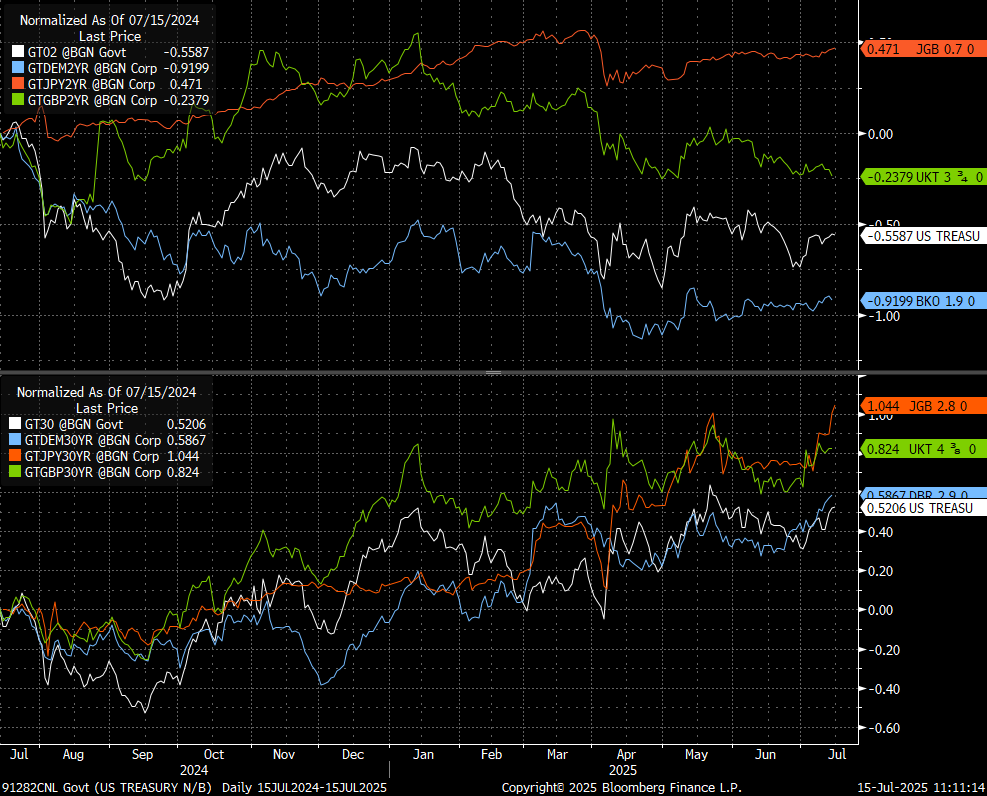

Across the globe, policymakers are leaning into spending. The front end is all over the place across markets, while the long-end bond distaste is global.

In Japan, investors are bracing for a new round of fiscal stimulus in the wake of the upper house elections. The reaction has been swift: yields on 10- to 40-year JGBs have spiked, reawakening memories of the May selloff when global fixed income took a synchronised hit.

In the US, it’s tariffs that have tilted the narrative. The June CPI print was largely in line (soft on headline, sticky on core), but it failed to resolve fears about the inflationary consequences of Trump’s proposed trade levies. Investors responded by trimming bets on near-term Fed cuts and pushing yields sharply higher, particularly on the long bond. The 30-year now yields more than 5%, and option markets are bracing for more.

The theme tying these moves together is fiscal policy. Whether it’s protectionism in the US or stimulus in Japan, bond markets are reappraising long-term inflation and supply risks. And they’re not liking what they see.

Positioning Unwinds and Bearish Flow

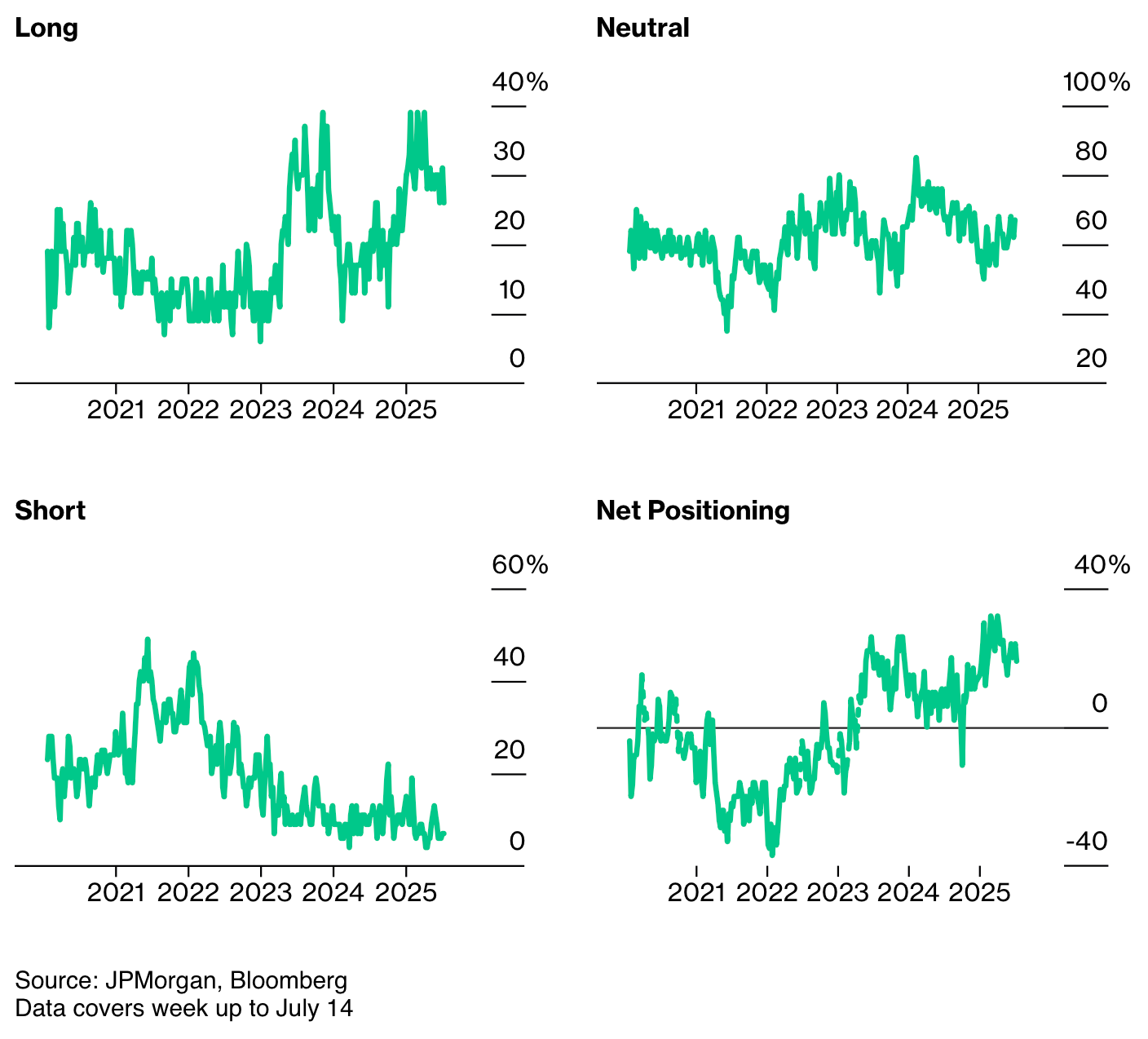

The tone shift isn’t just macro. It’s visible in positioning and flows.

JPMorgan’s latest Treasury client survey shows net long positions fell to the lowest level since early June, down five percentage points to a neutral stance. That marks a clear retreat from prior bullishness and coincides with a jump in outright option hedging activity.

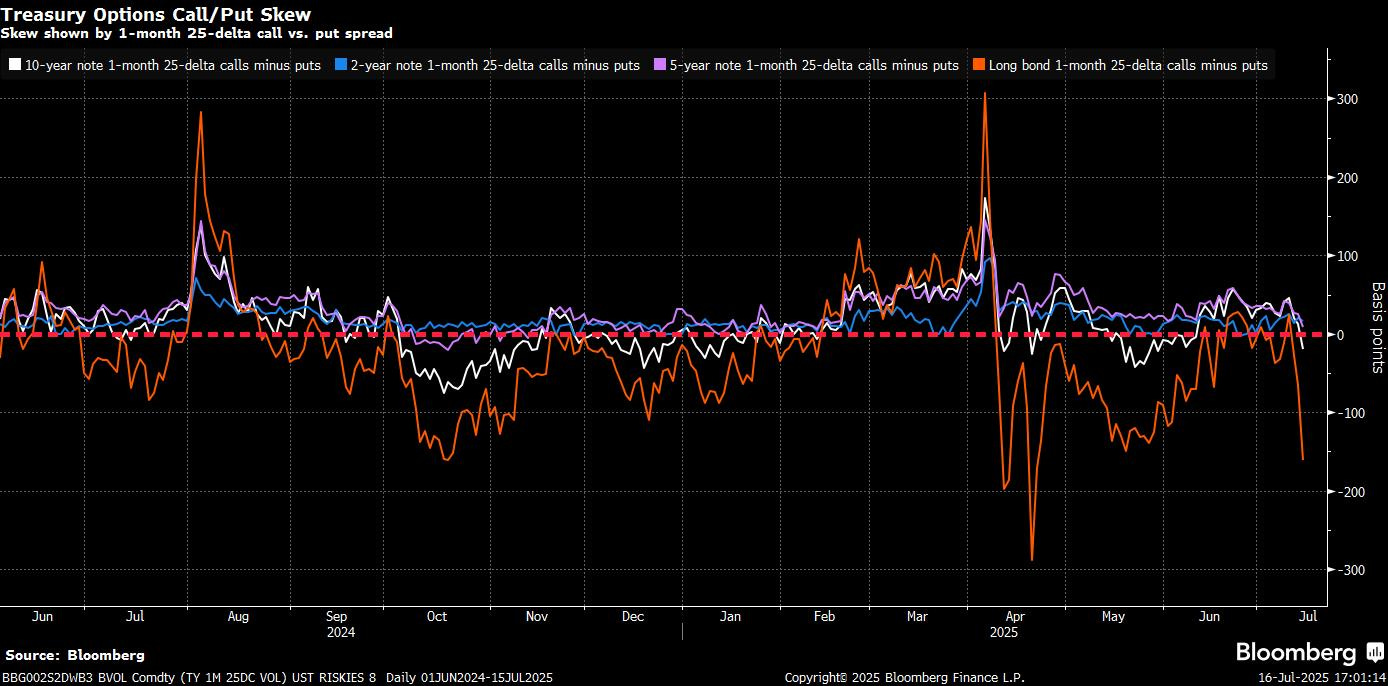

In the options market, traders are positioning for higher long-end yields:

A series of large 30-year put option trades priced in over $10 million in premium this week, targeting a move toward 5.3% yields within five weeks (a level not seen since, you guessed it… 2007).

The skew in 30-year Treasury options flipped sharply in favour of puts, showing the highest demand to hedge downside in over a month.

In contrast, skew in front-end and belly options remains neutral, reinforcing the idea that pressure is specific to the long end.

SOFR derivatives show similar signs of stress. The 95.625 strike has become a magnet across Sep 25, Dec 25, and Mar 26 tenors, especially via put spreads and put trees. These structures express a view that policy rates will not fall as fast or as far as once expected. Meanwhile, upside call spreads on front-end mid-curve options have seen significant flows too, consistent with traders keeping optionality open for a dovish surprise, but not betting heavily on it.

Futures positioning paints a mixed picture:

Asset managers added to net longs in long-end and ultra-long bond futures, increasing exposure by $6.3 million per basis point over the week ending July 8.

Hedge funds, on the other hand, covered shorts in the 2- and 5-year sectors—a tactical flattening trade that may have run its course.

The implication is clear: conviction in a long-duration trade is waning. Professional accounts are neutralising risk, and derivatives markets are betting more aggressively on higher yields ahead.

(To get full access to all research and notes posted, subscribe to premium.)

A Politicised Fed?

Looming over all of this is a deeper institutional question: can the Fed remain independent?

The Powell saga is no longer fringe speculation. Despite odds still implying an 80% chance he serves out the year, the drumbeat of criticism from Trump-aligned officials is growing louder and more coordinated. Powell is under fire for allegedly misleading Congress over building renovation costs, but the subtext is monetary: rates are too high, and the administration wants them lower.

If Powell were to resign or be forced out, the implications would be severe:

Short-term rates would drop as markets price in a dovish replacement.

Long-term yields would rise, reflecting a loss of central bank credibility and inflation anchoring.

The dollar would fall, possibly by 3–4% in 24 hours, according to Deutsche Bank estimates.

Equities might rally, as looser policy boosts liquidity—even amid long-end turmoil.

This is the textbook setup for a bear steepener.

It’s not just theory. We saw a taste of it in April after the Liberation Day tariffs were announced. Yields spiked, the MOVE index surged, and volatility returned. This time, the trigger could be institutional—a frontal assault on the Fed’s independence.

The irony is that while Powell is under fire for keeping rates too high, his removal would likely push long-end yields even higher. That’s the market’s punishment for politicising monetary policy.

Ten-year yields near 5% would be a policy failure… and a fitting consequence for turning the Fed into a political pawn.