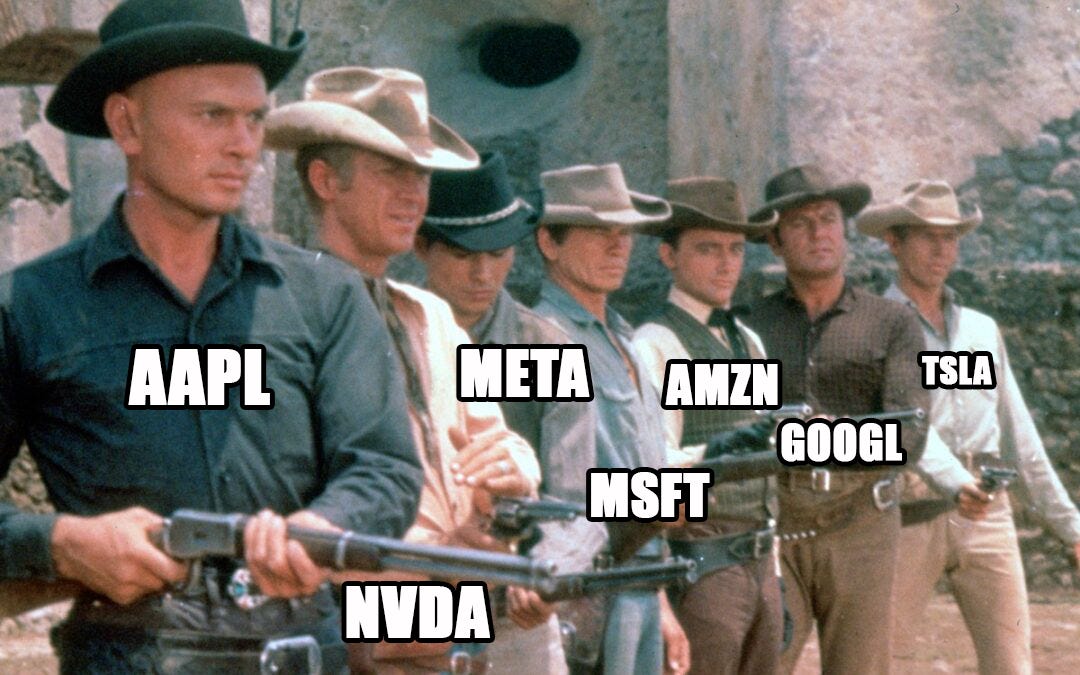

The MAG7 Safe Haven

Why Apple was, but might not be, the best place to hide.

Even before the market rout at the end of last week, the MAG7 had been under pressure. The run-up in the group, led by Nvidia, has been a well-telegraphed story by investors over the course of the past year.

Yet the tree shake over the past few weeks in the group is something that has woken many up from the dream that the MAG7 basket only goes up.

We won’t dive in today as to whether the MAG7 (and broader US equities) are a dip worth buying. Rather, we wanted to mull over a really interesting question that was the topic of conversation with some traders earlier this week.

Namely, should Apple still be considered the safe haven of the tech sector and, by extension, the MAG7?

Not sure what we’re talking about? Let’s start at the beginning.

Before we get into the article, you can become a premium subscriber with us for just $20 a month. This provides you full access to our weekly articles without a paywall, including our flagship Monday trade ideas and full access to what we are buying and selling in our Global Asset Portfolio.

Apple At The Core

Towards the end of last year data compiled by CFRA showed that Apple has outperformed the S&P 500 Index in 64% of market corrections, with an average decline of 7%.

This was less than half the 14.6% average drop of the benchmark index. The broader S&P 500 tech sector only surpasses in 30% of market corrections.

These statistics on Apple being a place to hide during a storm is backed up by the fundamentals of it as a company.

Jack Ablin, CIO at Cresset Capital, noted in the past that:

“It (Apple) is gigantic, offers pretty predictable growth and cash flow in an uncertain world, and it is a very high-quality company that doesn’t have much debt. Its fundamentals are so solid that it is basically the Treasury of the equity market.”

Sam Stovall, chief investment strategist at CFRA, noted:

“High-quality stocks tend to be more resilient in challenging periods, and Apple really embodies the quality theme, with its cash flow, buybacks, and balance sheet.”

So far, so good. Things got even better for Apple at the June Worldwide Developers Conference.

It introduced Apple Intelligence, with several key features and improvements powered by advanced machine learning and AI technologies.

This included Writing Tools, which is a feature that can help you find the right words virtually everywhere you write. With enhanced language capabilities, you can summarize an entire lecture in seconds, get the short version of a long group thread, and minimize unnecessary distractions with prioritized notifications.

More on the fun side, AI will soon be able to help in creating images from your sketches and even make a custom memory movie based on the description you provide. The brand-new Genmoji is also a feature that users will likely enjoy playing around with.

Apple also announced improvements to Siri, leveraging AI to make the voice assistant more intuitive, context-aware, and responsive. Siri is now better at understanding complex queries and can perform tasks with more natural language processing, making interactions smoother and more conversational.

The bottom line from the conference was that Apple is at the forefront of the pack in using AI and in being able to monetise it via new product sales like the iPhone. As a result, the share price continued to hold as investors saw it as a firm that could make practical use of AI and not window-dress any attributes around it (as some other firms are doing).

Surviving The Tree Shake

When we compare the quarter-to-date performance with the rest of the MAG7, we can clearly see that Apple has been the relative low vol / safe haven.

Apple (shown in white) is the only stock with a positive gain over this period, at +0.28%. This contrasts with the worst performer, Nvidia, which is down 18.81% over the same period.

Why Things Could Change

A few events over the past week have made us (and some others) question whether Apple will retain the crown of safe haven play going forward.

To begin with, news broke last week that legendary investor Warren Buffett had reduced his stake in Apple by almost 50%.