"The Man Who Made Too Much"

We take a look at the life and best trades of John Paulson.

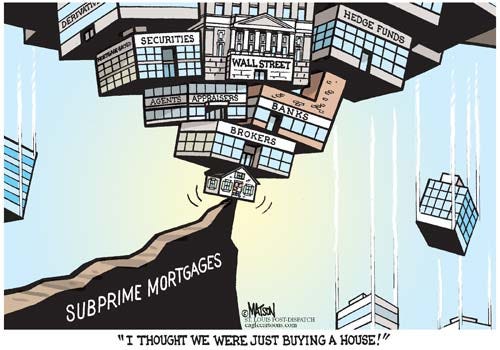

Welcome back to another investor Sunday edition, where this week we go back to familiar territory with hedge funds. We tune in to John Paulson, who made his name making billions from the crisis in 2007/8. He took advantage of the collateralized debt obligations (CDOs) market, but didn’t need Margot Robbie sitting in a bath to explain things to him (if you haven’t watched the Big Short, please stop here and put it on immediately).

Who is he?

Born on December 14, 1955, in Queens, New York, Paulson's journey to becoming one of the most successful hedge fund managers in history began with humble origins.

Paulson grew up in a middle-class family in Queens, where he attended public schools before earning his undergraduate degree in finance from New York University's College of Business and Public Administration. Following his undergraduate studies, Paulson pursued an MBA from Harvard Business School, graduating in 1980.

After completing his education, Paulson began his career on Wall Street, initially working at Boston Consulting Group.

In 1984, John Paulson joined Odyssey Partners, a boutique investment firm founded by Jack Nash and Leon Levy. During his tenure at Odyssey, Paulson specialized in merger arbitrage and event-driven investing.

In 1994, Paulson founded his hedge fund, Paulson & Co., with an initial investment of just $2 million. The firm initially focused on merger arbitrage and event-driven strategies, leveraging Paulson's expertise in these areas to generate consistent returns for its investors.

When the subprime mortgage crisis hit in 2007 and culminated in the financial meltdown of 2008, Paulson & Co. reaped billions in profits from its bets against mortgage-backed securities and CDOs. The firm's main fund reportedly made approximately $15 billion in profits in 2007 alone, earning Paulson the title of "The Man Who Made Too Much" on the cover of BusinessWeek magazine.

He continues to run the fund down to present day.

Investment strategy

Paulson & Co states that the main strategies it employs to make money are event-driven investing, merger arbitrage, and distressed credit strategies. Each of these approaches reflects Paulson's ability to identify opportunities arising from corporate events, market inefficiencies, and economic downturns.

Event-Driven Investing: this involves capitalizing on specific events or catalysts that have the potential to impact the prices of securities. These events can include mergers and acquisitions, spin-offs, bankruptcies, regulatory changes, or other corporate actions.

We’ll go into his legendary trade from 2007 later on, but this falls into this category.

Merger Arbitrage: Merger arbitrage is a specific form of event-driven investing that focuses on profiting from the price differentials between the current market price of a target company and the price it is expected to be acquired at. Paulson has been a notable practitioner of merger arbitrage, leveraging his firm's expertise to assess the likelihood of deal completion and potential returns.

In merger arbitrage, Paulson & Co. may take long positions in the target company's stock while shorting the acquirer's stock to hedge against market risk. By carefully analyzing deal terms, regulatory approvals, and financing conditions, Paulson aims to capture the spread between the current market price and the deal price upon completion. This sounds easy, but there’s a lot that goes on in these deals!

Distressed Credit: Distressed credit trading involves acquiring the debt or securities of companies experiencing hardship or undergoing restructuring.

In distressed credit investing, Paulson & Co. may purchase distressed bonds, bank loans, or other debt instruments of troubled companies at a discounted price. Paulson seeks to enhance value through active engagement, restructuring initiatives, or asset sales. In theory, he can achieve attractive risk-adjusted returns if the debt can be flipped later on at a higher price.

Talking through 2007

Paulson made billions in 2007 and 2008 by betting against collateralized debt obligations (CDOs) and other mortgage-backed securities (like CDSs) tied to the subprime mortgage market. His analysis of the housing bubble and subsequent market collapse enabled him to profit enormously from the financial crisis.

He is recorded as having made $15 billion in 2007 alone, with some individual swaps netting an incredible return on capital. Consider one trade that he made, according to a 2009 CNBC article about him:

“Long before the financial crisis hit, Paulson, according to one person briefed on the trade, invested $22 million in a credit default swap that eventually paid $1 billion when the federal government opted not to rescue Lehman Brothers. That amounts to a staggering $45.45 for each dollar invested.”

Here's how he did it…

To begin with, he recognized early signs of the housing bubble forming in the mid-2000s. He observed that lending standards had significantly deteriorated, leading to a surge in subprime mortgage originations and the proliferation of mortgage-backed securities (MBS) and CDOs. Paulson correctly anticipated that many of these mortgages were highly risky and likely to default as housing prices declined.

He identified the structural flaws in many CDOs, which were often composed of risky subprime mortgage-backed securities bundled together and sold to investors. Paulson recognized that these securities were overvalued and vulnerable to significant losses as borrowers defaulted on their mortgages.

Armed with his insights into the subprime mortgage market, Paulson structured bearish bets against CDOs and related instruments. He entered into credit default swaps (CDS) and other derivative contracts that would pay off if the underlying mortgage-backed securities experienced significant defaults or declines in value. These positions effectively allowed Paulson to profit from the downturn in the housing market without directly owning the underlying assets.

Paulson's timing and execution were critical to his success. He began building his bearish positions in the subprime market well before the housing crisis unfolded, gradually increasing his exposure as conditions deteriorated. As defaults surged and housing prices plummeted in 2007 and 2008, Paulson's bets against CDOs and MBS paid off handsomely, generating billions in profits for his firm, Paulson & Co.

Quotes to live by

"Successful investing is about having people agree with you... later."

This quote encapsulates Paulson's contrarian approach to investing. He emphasizes the importance of independent thinking and the willingness to hold unpopular opinions in the face of conventional wisdom. As I think we can all relate to, success often involves going against the crowd and having the conviction to maintain one's positions even when they are met with skepticism!

"You can make a lot of money in the markets by being a trend follower, or you can make a lot of money by being a contrarian. But you cannot make a lot of money by being a trend follower at the peaks or a contrarian at the troughs."

This shows the importance of timing in investing. He acknowledges that both trend following and contrarian strategies can be profitable under the right circumstances, but timing is key for success. Paulson cautions against blindly following trends at their peaks or attempting to be contrarian at market bottoms without considering the underlying fundamentals and market dynamics.

"Risk is where you're not expecting it."

This quote highlights Paulson's emphasis on risk management and the need for investors to anticipate potential pitfalls in their investment strategies. He recognizes that risks often emerge from unexpected sources and emphasizes the importance of being vigilant and proactive in identifying and mitigating risks.