The Paradox Driving Markets Higher

Policy dynamics and central banks keep the equity bid alive.

There’s a growing paradox at the heart of global markets: rising concerns of weakness in both the economy and financial indicators, yet an equity tape that insists on delivering strength.

In recent weeks, data deterioration has been observed in the labour market, and this week we received some signals from the PMI data that may be the first indication that tariff costs are no longer passing through cleanly. Geopolitical risk remains, with Trump reversing his position on the war in Ukraine, now claiming that Kyiv could recover all of its territory from Russia. Fiscal concerns loom large as well: in the US, deficit reduction has been quietly abandoned in favour of growth-at-all-costs, while Europe faces no less daunting fiscal arithmetic. And in the background, gold grinds at all-time highs, a classic risk-off signal that markets would usually heed.

Yet risk assets power on. Why?

1) A Natural Corrective Mechanism

Markets are acting as a brake on policy itself. Push tariffs too far, expand the deficit too aggressively, or threaten central bank independence, and the reaction is immediate: higher yields, weaker currencies, tighter financial conditions. That negative feedback forces policymakers to moderate before mistakes compound, functioning as a self-correcting mechanism that keeps deeper declines at bay.

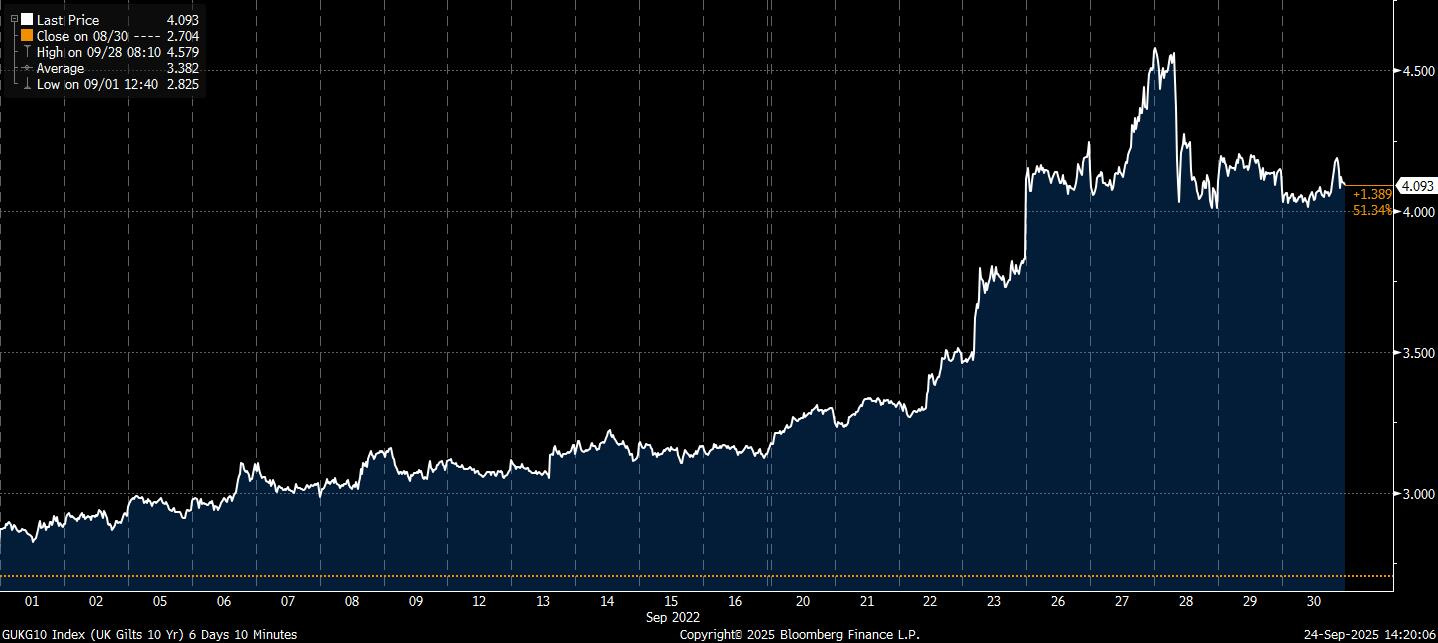

The political incentives to respect those signals are obvious. Aggressive market selloffs generate negative headlines, sap growth through wealth effects, and carry real political costs. That’s why policy reversals are often swift once markets push back. Liz Truss’s downfall in 2022 remains the clearest case study: her “mini-budget” was never even implemented, undone by a gilt market revolt so severe it forced her resignation.

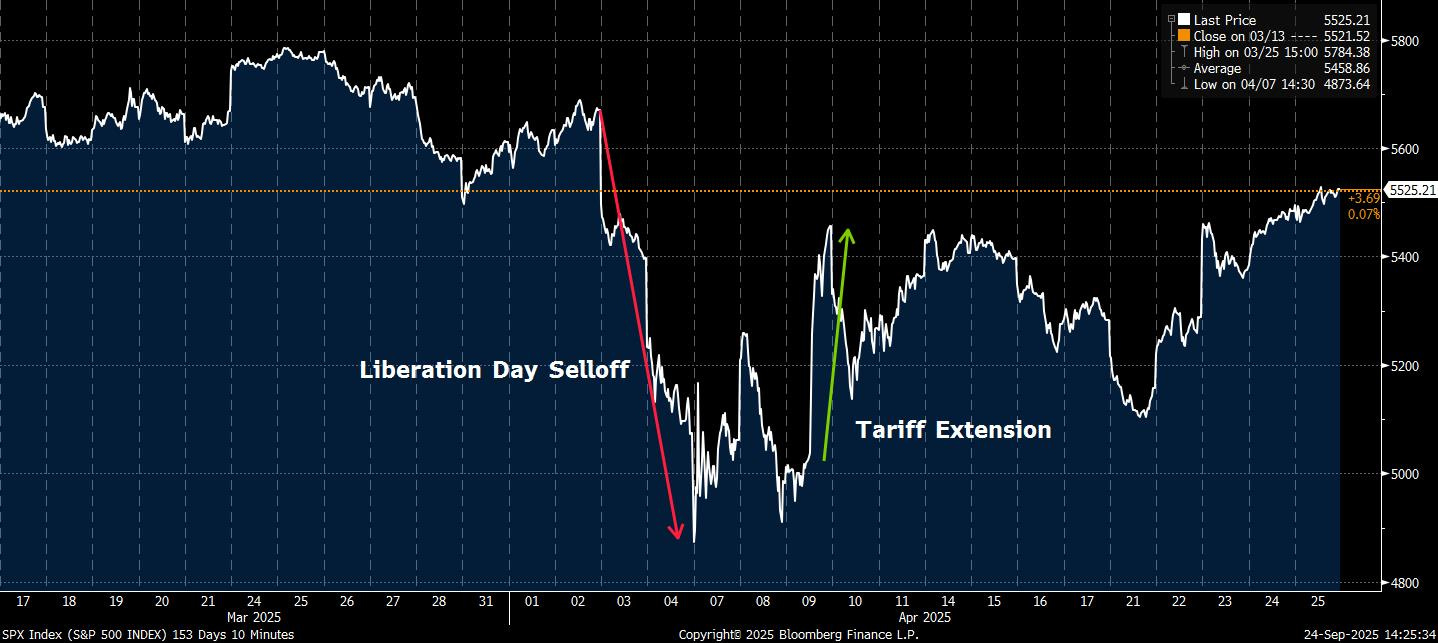

The same reflex has been visible in 2025. In April, Trump extended tariff implementation by 90 days after market turmoil followed his initial announcement. In July, he floated the idea of firing Powell and even waved a letter of intent, before walking it back as “highly unlikely” in the wake of a 0.75% S&P 500 pullback. The sequencing is familiar: markets react first, policy adjusts second.

That dynamic matters because the biggest risks today are policy-induced. Unlike 2020, when Covid dictated outcomes beyond government control, today’s cycle is being shaped by tariffs, deficits, and central bank independence, all areas where policymakers retain discretion, even if hemmed in by politics. And as long as they remain unwilling to tolerate sharp selloffs, markets themselves will continue to act as a disciplining force, preventing the conditions for a deeper break.

A free trial to read our full research is available here.

2) Nothing Sustained or Substantial

The conditions that have historically triggered major selloffs aren’t present today. If we look back, aggressive risk-off moves tend to emerge only under fairly specific circumstances, with none of them being evident right now.