The Problem Is EU

Eurozone issues and how to trade it.

When starting to build our list of who took the biggest losses of 2024, the Eurozone collectively was a name that was noted down early on. We feel like the problems in the bloc have accelerated over the past few weeks.

Even though markets have been trying to reflect the concerns of investors, which could be due some tactical buying from oversold conditions in the short term, we feel that 2025 could yield more issues for the bloc stemming from actions that happened this year.

Today, we wanted to run through a couple of the main problems as we head into next year, what our view on them is and then finally, our favourite cross-asset trade expressions.

The French Farce

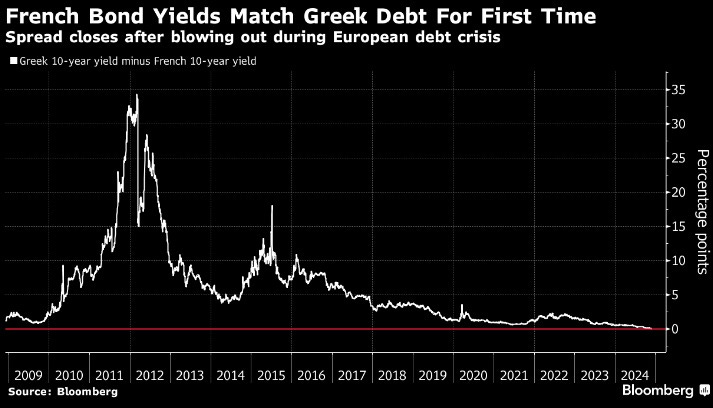

Let’s start with France, as it’s the most topical this week. Bloomberg flagged up on Thursday that the French 10yr yield equalled the Greek equivalent for the first time:

Before we break this down further, let’s have a quick recap of French politics in 2024.

It all kicked off following the European parliamentary elections in June. President Macron’s centrist coalition, Ensemble, suffered a substantial defeat to the far-right National Rally (RN) led by Marine Le Pen and Jordan Bardella. In response, Macron dissolved the National Assembly and called for early legislative elections.

The resulting elections backfired on almost everybody. The political landscape became more polarised, with no single faction securing a majority. The main contenders were Macron’s Ensemble Alliance, the leftist New Popular Front (NFP), and the far-right RN. This tripolar outcome contributed to market anxiety, as investors feared potential economic policy shifts and political instability.

Macron eventually appointed Barnier as PM in September, with a focus on keeping a lid on spending and general budget issues.

This political uncertainty has, in part, affected French bond yields. Investor concerns about fiscal stability, especially the potential for increased spending under a leftist or far-right government, led to higher yields as compensation for perceived risks.

When we look ahead, we don’t see this situation being resolved in any way. Barnier’s 2025 budget is aimed at reducing the public deficit gap to 5%, but Bloomberg reported earlier this week that:

“France’s finances were a growing concern for investors as plans to reduce debt slipped off course at the end of 2024. With tax revenues far below estimates, the government now expects the budget deficit to reach 6.1% of economic output this year instead of declining to 4.4% as initially planned.”

The year-end budget deadline looks increasingly tight, especially with chatter around both those on the left and the right vetoing any deal and talk of triggering article 49.3 to adopt a bill without a vote.

The bottom line here is that France’s finances are in a real mess, and fixed-income investors know this.

Germany In A Spin

In Germany, politics is only half the problem. Every cloud has a silver lining, right?

Let’s talk about politics first, though. Chancellor Olaf Scholz’s coalition has struggled for the entire year to make any kind of progress to help the economy. The ruling coalition, comprising the Social Democrats (SPD), Greens, and Free Democratic Party (FDP), couldn’t agree on much at all, with disunity over budgetary policies, particularly.

The European Parliament elections in June 2024 highlighted these challenges. The coalition suffered a major setback, with the far-right Alternative for Germany (AfD) gaining ground, reflecting growing public frustration over economic concerns and immigration policies

The collapse of the coalition was formalised earlier this month when Scholz fired Finance Minister Christian Lindner. The coalition relied on Lindner’s pro-business party, so it was game over.

The election is being mooted for 23rd February, with Scholz just receiving confirmation that he will lead his party and aim for a second term. Yet this is already set up for disaster, given that President-elect Trump will take office in January. With the EU on his potential hitlist in terms of trade tariffs, Europe needs to be united. The fact that Germany will be so engrossed in internal politics for basically all of Q1 doesn’t bode well for European assets at all, in our view.

The other half of German (and EU) problems lies with the auto industry. It has been well documented in the news over recent months about job cuts and missed earnings targets from players, including the likes of VW, BMW, Mercedes, etc.

We flag up a few reasons for the auto gloom:

Higher Competition from China - this doesn’t need too much elaboration.

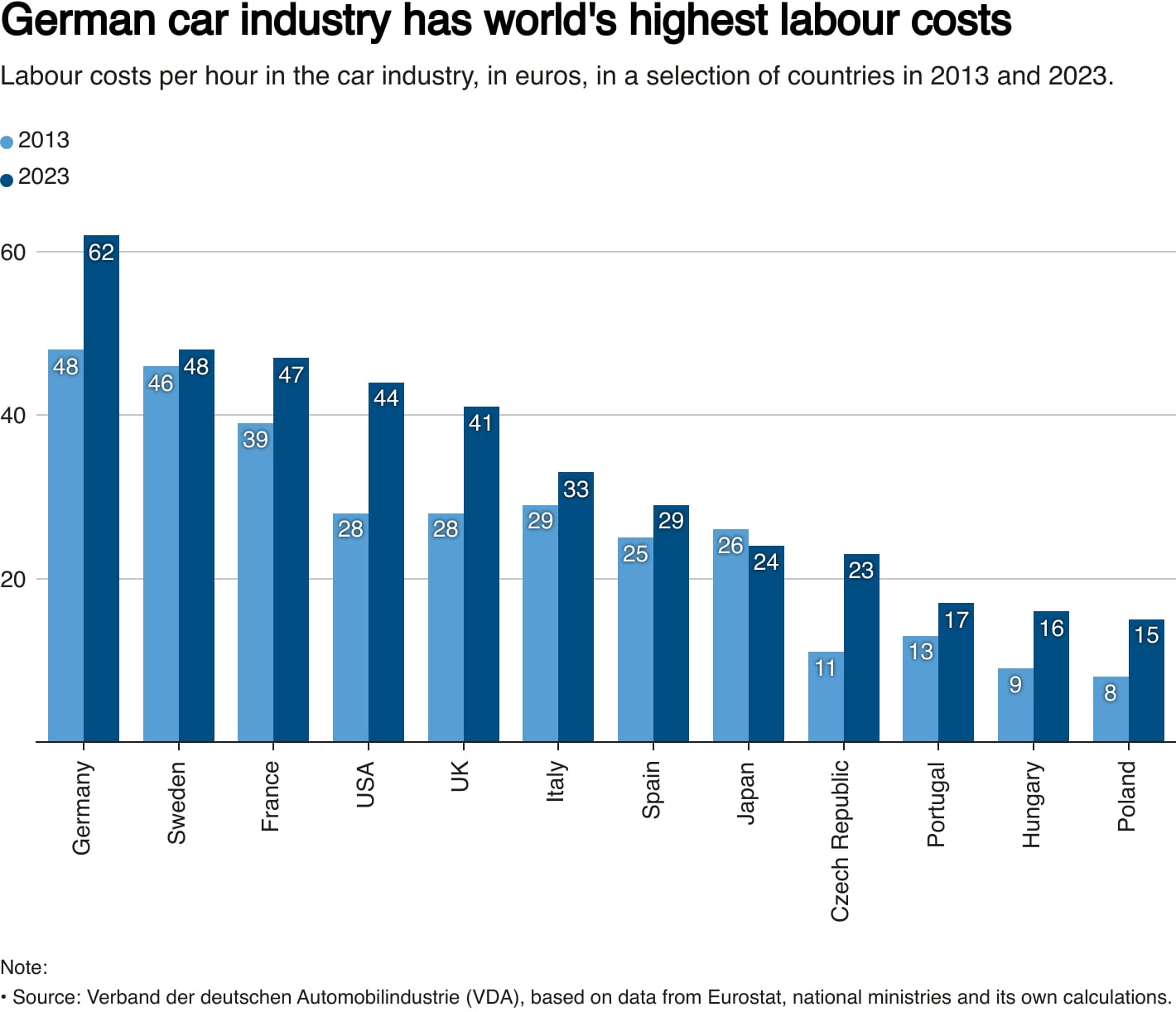

Higher Production Costs - post-pandemic inflation is now back under control, but the damage has been done via a period of high energy prices and rising labour costs. This impacts Germany more than other more cost-effective regions.

Slow EV Transition and Weak Demand - VW and other manufacturers are late to the party here. Even though they are now investing heavily in EV production, growth in EV demand hasn't met expectations.

Economic Slowdown - the manufacturing recession and weakening consumer confidence just compounds the strain on the auto industry.

Looking to 2025, weaker German growth is more than likely to spill over into weaker Eurozone growth. Contracting PMIs, lower consumer sentiment, etc etc, act as a spiral. There’s still scope for the surprise index to become more negative. All of this acts as a headwind for European assets.