The Quant King

This weekend we discuss Jim Simons, the founder of arguably the most successful quant trading firm ever, Renaissance Technologies.

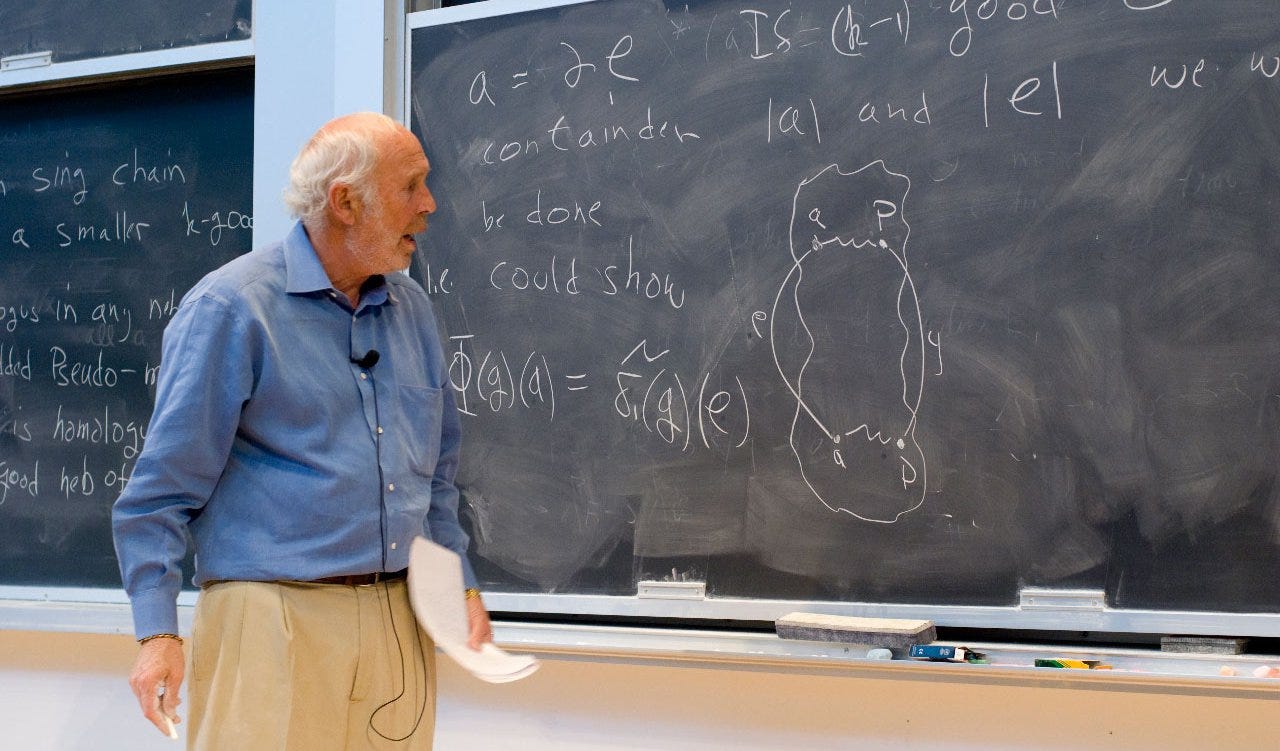

After heading down the road of asset management last week, we take a sharp turn back to trading and look at the world of quantitative trading. This method of trading is based on mathematics and statistical models, hence why you note Jim Simons standing by the blackboard in the cover photo.

With a net worth of $30.7bn, it’s worth us getting the chalk out.

Who is he?

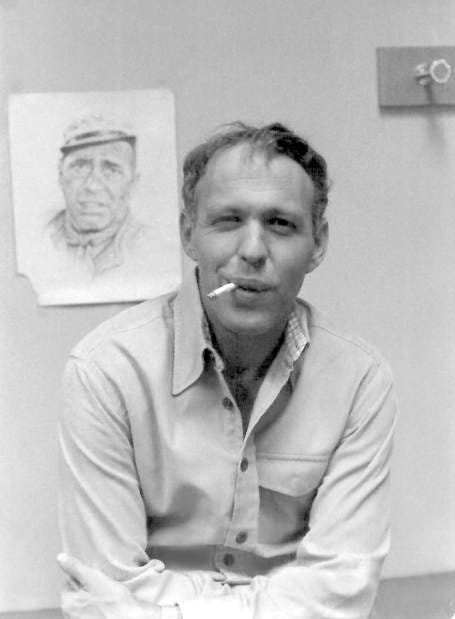

Jim Simons, a renowned American mathematician and hedge fund manager, had an early life marked by intellectual curiosity and academic prowess.

Born on April 25, 1938, in Newton, Massachusetts, he exhibited a prodigious aptitude for mathematics from an early age. Simons' journey began with his educational pursuits, where he excelled in school and eventually earned a bachelor's degree in mathematics from the Massachusetts Institute of Technology (MIT).

His academic journey continued at the University of California, Berkeley, where he obtained his doctorate in mathematics under the guidance of the celebrated algebraic topologist, Bertram Kostant.

These formative years laid the foundation for his later ground breaking work in mathematics and finance, ultimately leading to the establishment of the highly successful Renaissance Technologies, a quantitative hedge fund that would redefine the world of quantitative trading.

Renaissance Technologies

Simons founded Renaissance Technologies in 1982 following a decade as the Chair of the Department of Mathematics at Stony Brook University.

The company focuses on trading quant strategies, across a range of assets. Their trading algorithms are designed to exploit market inefficiencies and price differentials, executing thousands of trades within milliseconds to capitalize on these opportunities.

Additionally, Renaissance's use of high-frequency trading and machine learning technologies enables them to adjust their strategies in real-time, reacting swiftly to changing market conditions.

Even though many are tight lipped about specific strategies, Gregory Zuckerman provided a glimpse into the thought process behind it via his book on Simons.

"Did the 188th five-minute bar in the cocoa-futures market regularly fall on days investors got nervous, while bar 199 usually rebounded?" Zuckerman wrote. "Perhaps bar 50 in the gold market saw strong buying on days investors worried about inflation but bar 63 often showed weakness?"

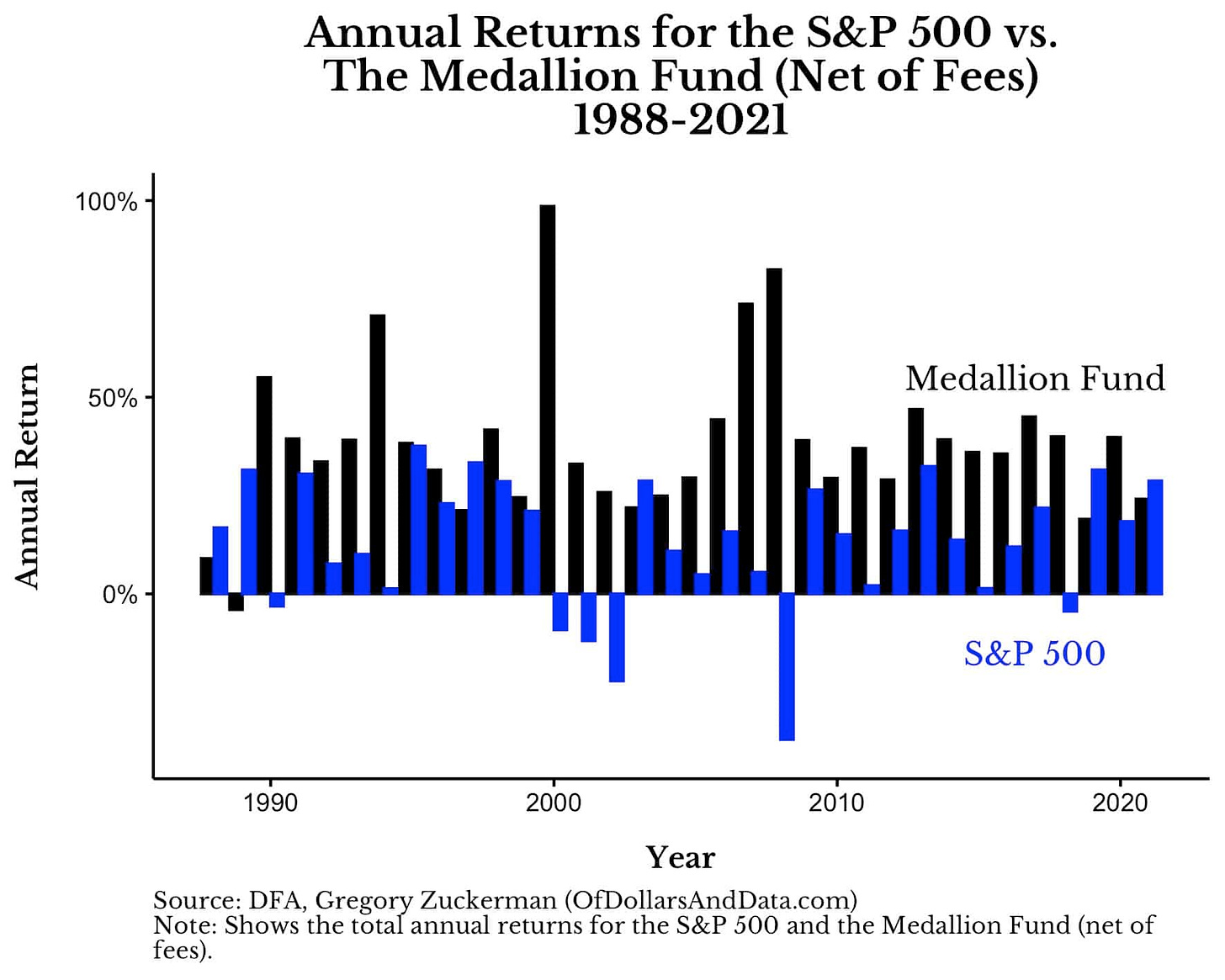

The returns really speak for themselves. The flagship Medallion fund returns (black) almost always beat the S&P 500 (blue) over a span of several decades:

The firm Simons built

When you look at the ‘About Us’ section of RenTech, you are greeted with a simple list of bullet points, which we share below. One can’t help but smile at the simplicity of it, yet be amazed at the same time of the business that Simons built over 40 years ago:

Quotes to live by

Simons is famous for not giving out many interviews and keeping operations secret. He also doesn’t allow employees to go out to industry conferences to speak.

Yet over the decades, we have picked up pieces of information about the great man and his thinking.

"The key to making money is to be right at the end of the bull market, just before the bear market begins."

This quote highlights the importance of timing in investing, emphasizing the value of recognizing market cycles.

"I don't believe in backtesting. If it works, it works tomorrow."

Simons suggests that the validity of an investment strategy lies in its real-time performance, rather than past historical data.

"Mathematics is the most beautiful and powerful creation of the human spirit."

Although not directly about investing, this quote reflects Simons' deep appreciation for mathematics, which has been integral to his approach in quantitative finance.

"You shouldn't be afraid to do something just because no one else has done it. A lot of stuff that's really easy or really cheap hasn't been done simply because no one else has done it. The fact that it's never been done, or nobody else is doing it, gives you an edge."

Simons encourages investors to think outside the box and consider unconventional strategies, as they may offer unique advantages.

"The more shortsighted a quantitative model is, the more likely it is to be overfit and to produce worse results in real trading."

This quote underscores the importance of developing models that consider long-term trends and avoid overfitting to short-term noise.