The Rally Has Room to Run

A weekly look at what matters and how to trade it. (September 22nd)

US equities closed the week at new highs as markets absorbed the Fed’s quarter-point rate cut and began to position for a dovish glide path into year-end. While Powell acknowledged lingering inflation risks, the weak employment backdrop gave investors confidence that further easing at the next two FOMC meetings is in play.

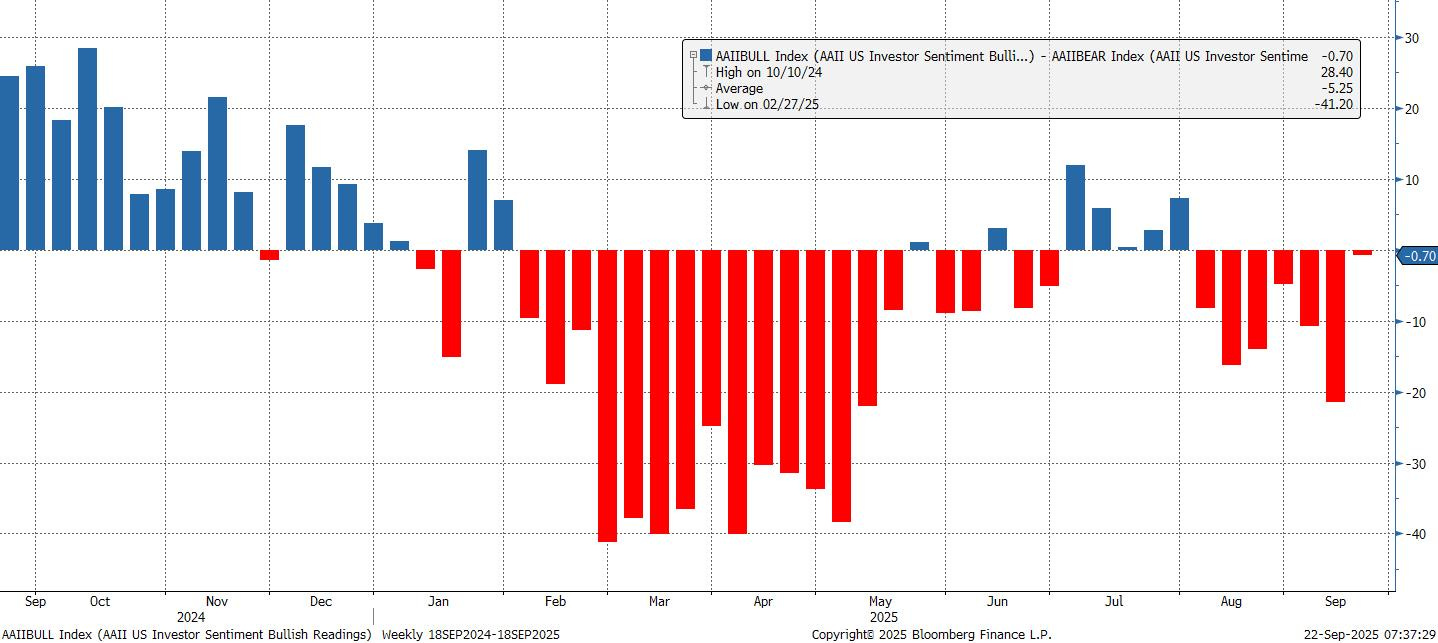

Tech led the charge: Nvidia’s $5bn stake in Intel and reports that Beijing dropped its antitrust probe into Alphabet added fuel to the rally. By contrast, consumer staples lagged as inflation pressures continued to weigh on household spending. Even with fresh highs, sentiment remains fragile. AAII data showed bears outnumbering bulls for a seventh consecutive week, but disbelief can fuel a rally.

The Fed’s move was historic in its own right. Powell managed to corral a divided committee behind a “risk-management cut,” while steering between White House pressure and economic necessity. Markets sold the news on Wednesday, rotating briefly out of megacaps, before resuming their upward climb into the week’s end. OIS now prices in roughly 22bps of additional easing by October and close to 50bps by December, with Powell’s speech next Tuesday likely to decide whether expectations coalesce around a full 25bp cut at both upcoming meetings.

Beyond policy, corporate developments underscored shifting market dynamics. Intel’s surge on the Nvidia deal (coming on top of US government and SoftBank stakes) highlights how capital is being marshalled to secure strategic footholds in semiconductors. Alphabet’s legal reprieve in China reinforced that geopolitics and regulation remain as much a driver of tech multiples as earnings. Meanwhile, retail and consumer names told the other side of the story: Cracker Barrel’s profit warning and the fallout from cultural controversies showed how inflation and politics are colliding in the staples sector.

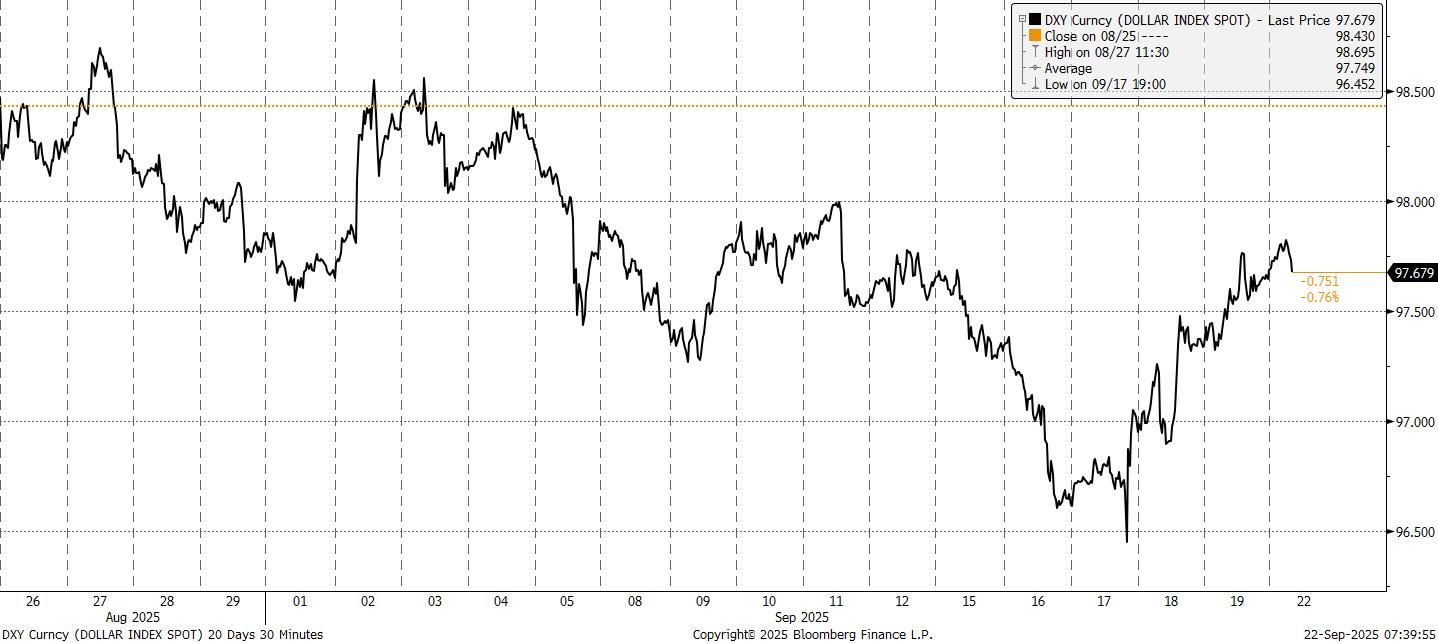

The dollar regained its footing post-Fed, ending near weekly highs after an early slide, while Treasuries pivoted around the 2-year as short-end pricing adjusted to the dot plot.

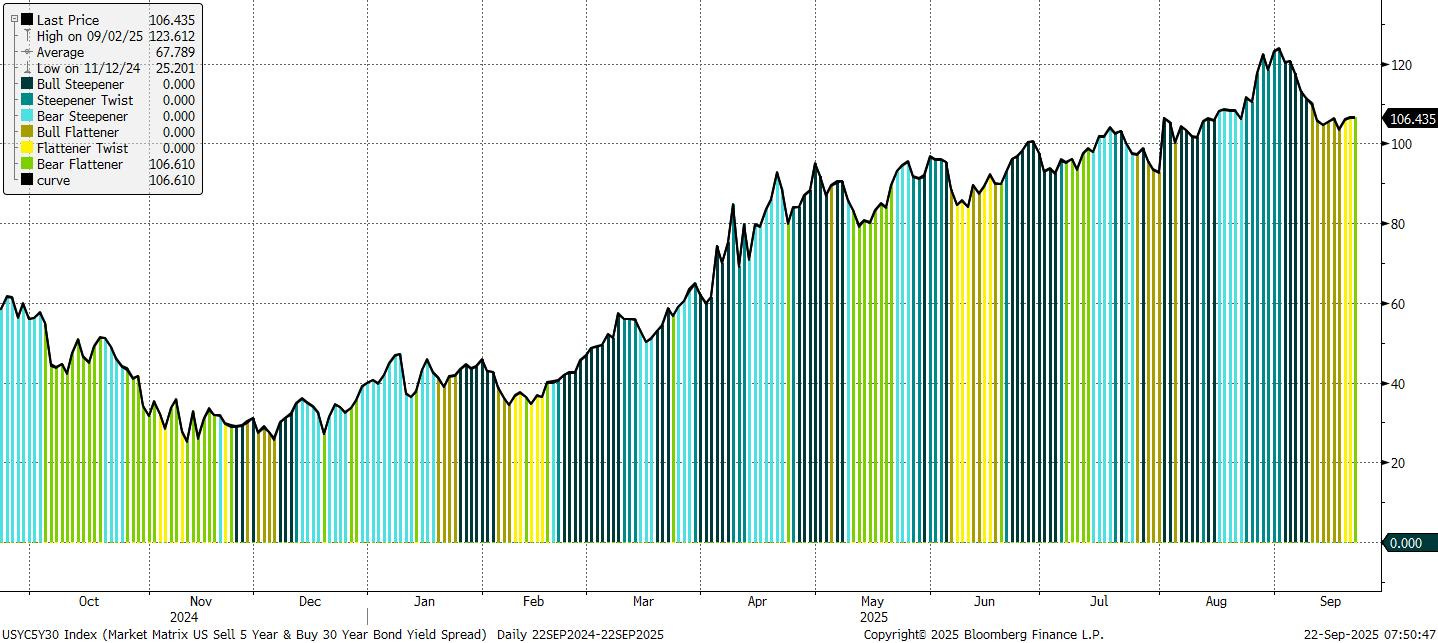

The curve steepened modestly in 5s30s, but the heavier action was in the front end, where October and December cuts remain the central debate. Positioning risk in the short tenors will dominate into the next FOMC, with equities watching closely for any shift that hardens the Fed’s dovish bias.

The Week Ahead

The calendar is crowded with Fed appearances (17 in total), including Powell on Tuesday, who’ll set the tone on the economic outlook. Data flow is heavy, too. Final Q2 GDP, core PCE and jobless claims will all shape the pace and depth of the coming rate-cut cycle. On the political front, Trump addresses the UN General Assembly while China’s Li Qiang makes his own appearance in New York.

Global PMIs will test how far tariffs are bleeding into private sector activity. Europe brings the German IFO survey and steady hands from the SNB and Riksbank. In Asia, Chinese banks are expected to leave loan prime rates unchanged, while CPI prints from Tokyo and Australia add another layer to the regional inflation picture.

Why the Rally Has Room to Run

The disconnect between sour sentiment and buoyant markets remains one of the defining features of this cycle. Data has softened, geopolitical risks are elevated, fiscal anxieties are mounting, and tariffs are still filtering through. Yet equities, credit, and volatility markets continue to price in optimism.

There are several reasons why this resilience can persist. First, policymakers have shown a consistent willingness to respond when markets wobble. Tariff extensions, fiscal course corrections, or dovish pivots are all examples of policy functioning as a circuit breaker.

Second, the classic recession-rate hike dynamic that has driven past bear markets simply isn’t present. Growth is slowing but still positive, and the policy conversation remains focused on rate cuts, not hikes. Third, unlike the 2010s or the inflation surge of 2022–23, central banks now have scope to ease further, with policy rates comfortably above zero and inflation no longer binding their hands. Finally, this downturn resembles prior “mini blips” in the cycle, notably summer 2024, when weak labour data triggered fears but growth remained robust and markets ultimately rallied back.

Taken together, these conditions explain why risk assets can continue climbing the wall of worry. Even if clouds linger on the horizon, the absence of a recessionary trigger, the availability of policy support, and the self-correcting role of markets argue for the rally to extend.