The Return of Bond Vigilantism

A cross-curve expression of asymmetric dysfunction.

The bond market doesn’t bark. It waits, watches, and then punishes. And this week, it delivered warnings in stereo: one from Tokyo, the other from Washington.

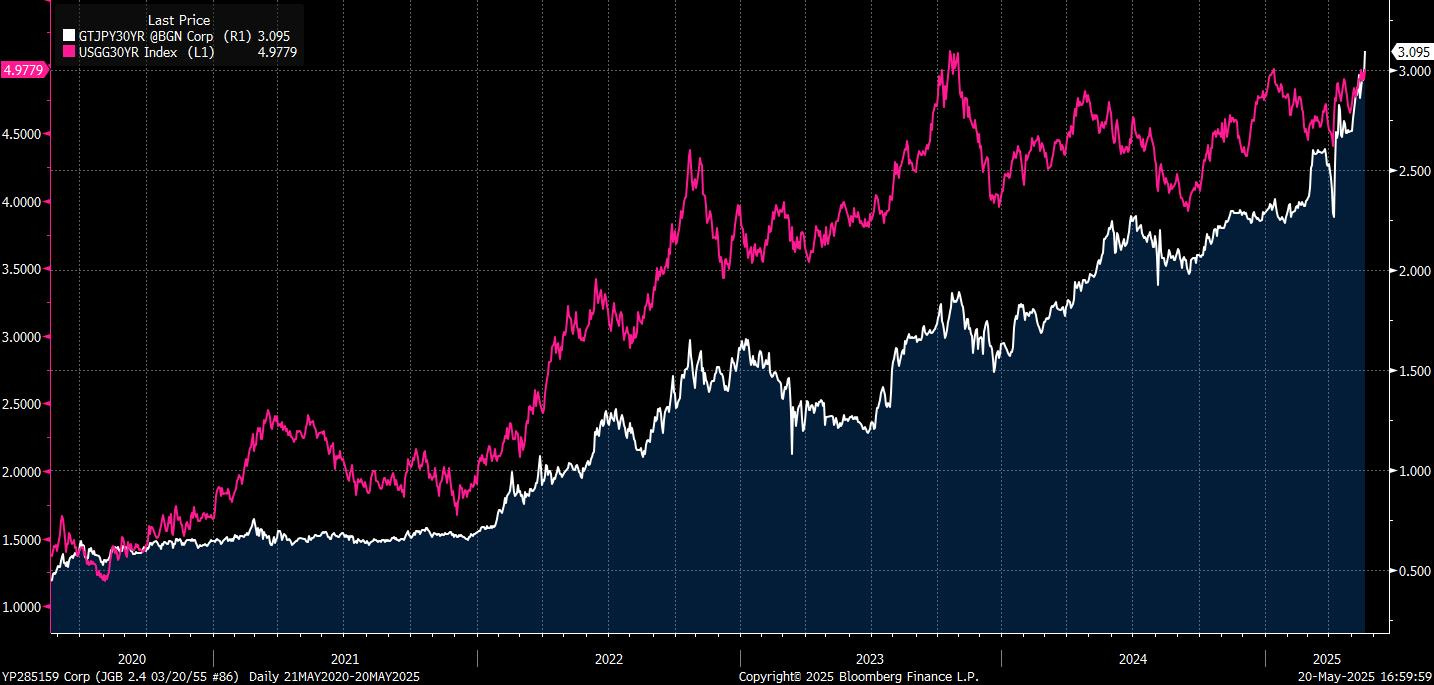

In Japan, the BoJ’s measured withdrawal from its decade-long stranglehold on the sovereign debt market has stirred dislocation, not panic. The 20- and 30-year JGB auctions collapsed under their own weight, with bid-to-cover ratios scraping historical lows and yields breaking multi-decade highs. Market participants call it a “buyer’s strike.” But behind the scenes, it’s the slow unwinding of an unnatural equilibrium, a central bank that owns more than half of its government’s debt walking back into normalcy.

In the US, the message was less clinical. Moody’s pulled its AAA rating on US sovereign debt, citing unsustainable deficits and political dysfunction. The downgrade wasn’t surprising. What matters is how much the bond market has already priced it in on that front. Yields on 30-year Treasuries blew past 5% again. Term premiums are rising, and the market is starting to reprice fiscal reality. Washington isn’t managing a normalisation like Japan. It’s navigating a funding crisis.

These are not isolated phenomena. They are two chapters in the same story: the return of price discovery in bond markets, after a decade of central bank dominance.

Japan: A Controlled Burn

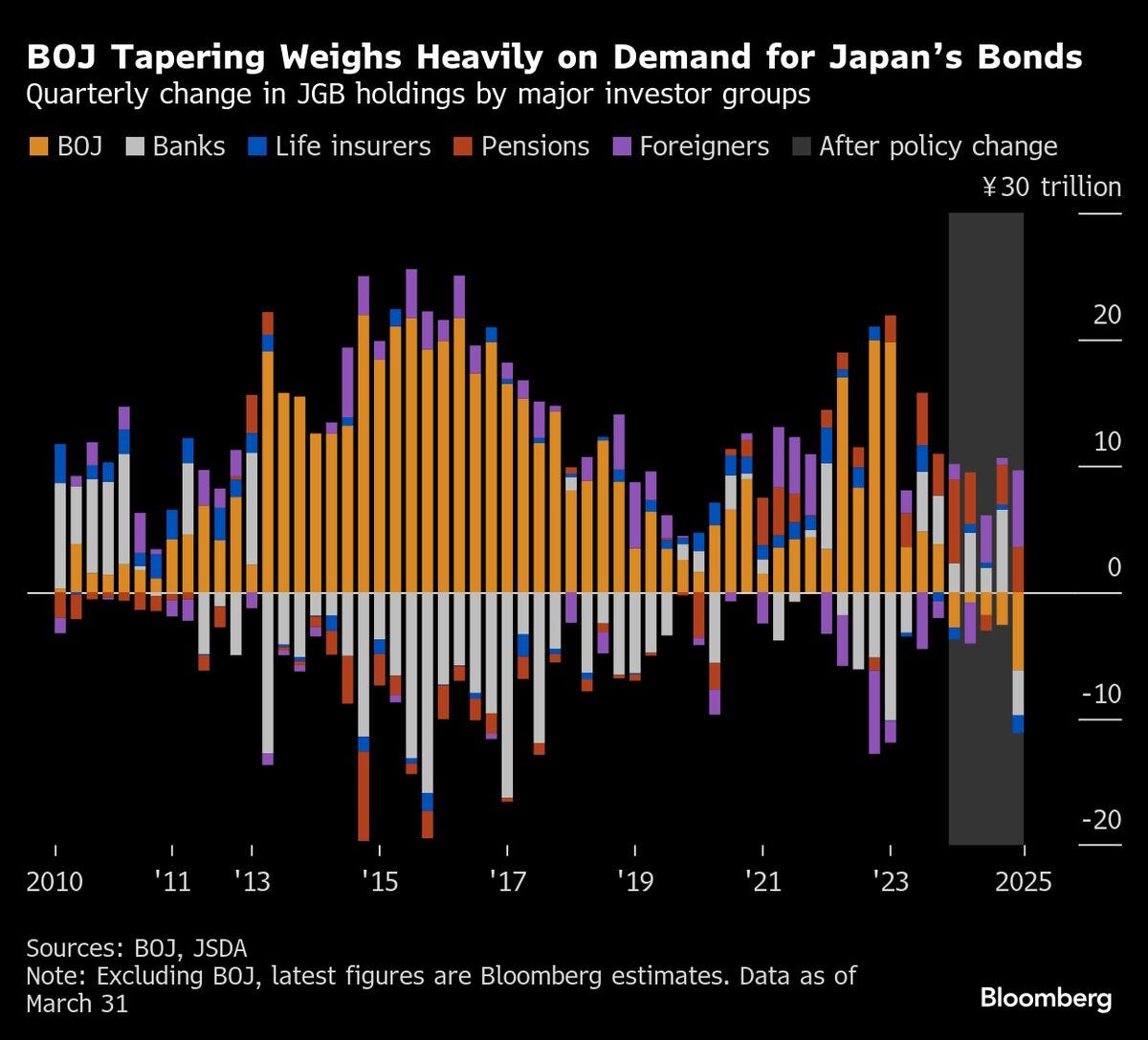

Governor Kazuo Ueda’s plan is elegant in its simplicity: reduce bond purchases by ¥400bn per quarter until spring 2026. If the current pace holds, purchases could end entirely by early 2028, conveniently aligning with the end of Ueda’s term, and symbolically closing the chapter on Japan’s experiment in extreme monetary policy.

But markets are testing the bank’s resolve. This week’s 20-year JGB auction was the weakest in over a decade, with a tail stretching back to 1987. Yields on the 30-year spiked to the highest since the instrument’s inception in 1999. The super-long end is fragmenting. Regional banks and life insurers aren’t stepping in. Liquidity is evaporating where it matters most: the long-duration paper that anchors term structure, pension liabilities, and fiscal assumptions.

Behind the scenes, the BoJ’s market survey reveals a division: some want faster tapering, while others want the central bank to continue buying ¥2–3 trillion per month in perpetuity. The consensus is: there is no consensus. And that, paradoxically, is a win for the bank. Divergent views signal that policy is threading the needle. Too slow, and the market gets addicted again. Too fast, and dysfunction returns.

But this is Japan. Fiscal overhang is enormous, but political culture is wary of brinkmanship. Prime Minister Shigeru Ishiba this week compared Japan’s fiscal position to Greece’s, but then publicly rejected tax cuts funded by debt. Words matter. The BoJ can taper slowly because the political class hasn’t declared war on its balance sheet… yet.

What’s happening now is not a crisis, but a shift in ownership. From the BoJ to the market. From stability to risk pricing. And that process, so far, is working, albeit with pain at the long end.

The US: No Plan, No Cover

Contrast this with the United States. The warning signs aren’t technical; they’re existential.

Moody’s downgrade may be symbolic, but the market reaction is not. The long end of the Treasury curve is in revolt. Yields breached 5% not because inflation is out of control, but because deficits are.

The 10-year has tacked on 30 basis points this month alone. The term premium is back, and with it, the ghost of the bond vigilante.