In this week’s report:

A week focused on earnings season and Fed speakers

Trump-Xi bromance resumes

Rerating an AI name

Commodity longs

US equities powered to fresh highs this week, led by the Nasdaq 100 as mega-cap tech earnings reignited risk appetite. Nvidia crossed the $5 trillion threshold, a milestone that now defines both the scale of the AI trade and its gravitational pull on the broader market. New partnerships with Nokia, Samsung, and Hyundai reinforced its role as the cornerstone of the AI ecosystem.

The Magnificent Seven once again did the heavy lifting as the rest of the market struggled for traction, with buying in AI-linked names showing no signs of fatigue. Corporate earnings have largely reinforced the soft-landing narrative, and markets have already begun to look toward a familiar year-end dynamic: the seasonal melt-up.

Sentiment was further buoyed by signs of easing trade tensions between the US and China after Presidents Trump and Xi agreed to extend their tariff truce. While the agreement does little to alter the structural rivalry between the two powers, it helped cool geopolitical risk and gave equities another tailwind.

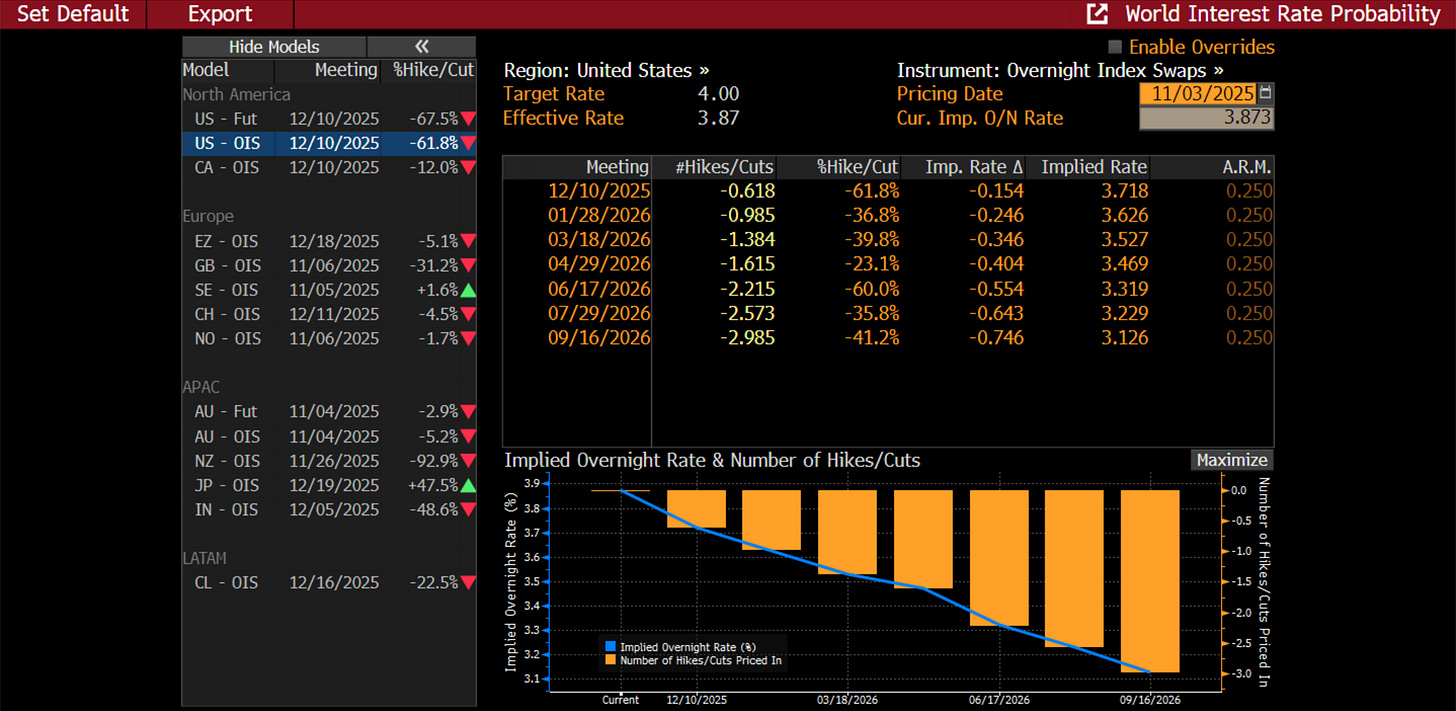

The Fed’s “hawkish cut” midweek triggered a mild sector rotation, though not enough to dent the broader advance. Real estate and rate-sensitive sectors lagged as Powell signalled uncertainty around a December move. Consumer stocks also softened as policymakers reiterated concerns over sticky service inflation. The market quickly adjusted, with OIS pricing now implying just 15bps of further cuts by December, down sharply from the prior week.

We remain comfortable that even if the Fed slows its pace, the easing bias remains intact.

The dollar strengthened following the Fed decision, aided by month-end flows and the repricing in rate expectations. EUR/USD drifted toward 1.15 while USD/JPY approached 155, levels that may test intervention lines if the rally extends.

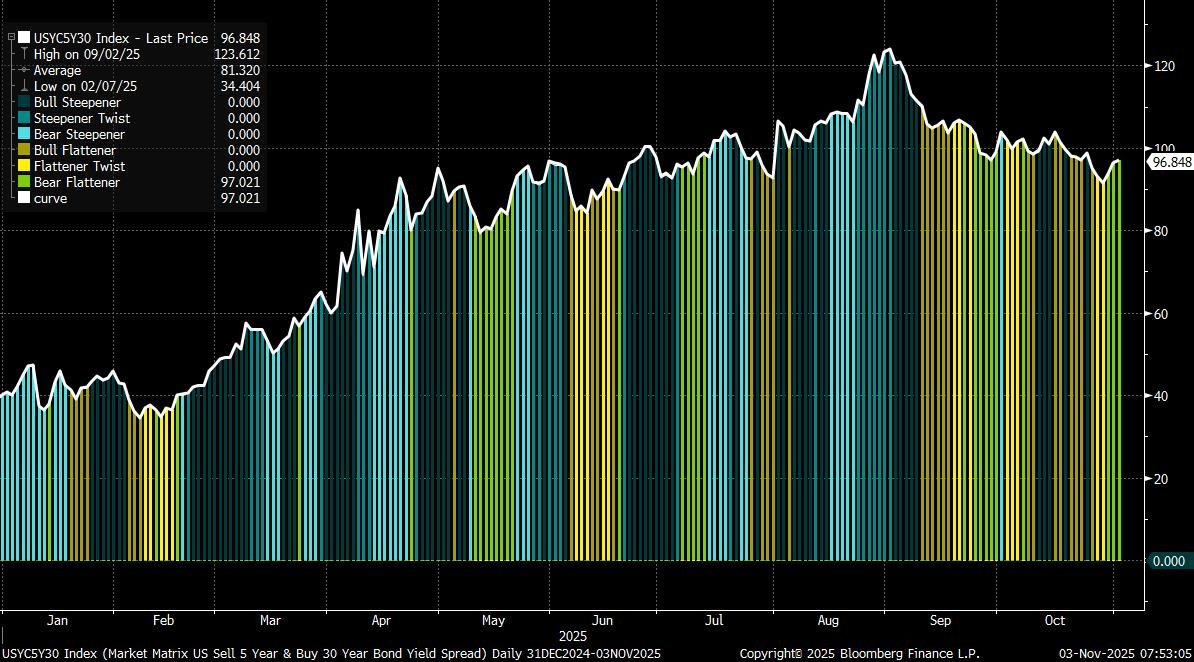

Treasuries sold off modestly, led by the belly of the curve, as traders pared bets on additional cuts. Repo funding tensions into year-end have driven a jump in SOFR basis volumes, while swap spreads continued widening on expectations of a revised QT plan.