The UK's Growth Illusion Just Broke

Why we can't fund spending with non-existent growth.

Thursday’s UK GDP data was a clear miss. The economy contracted by 0.3% in April, exceeding the expected 0.1% decline and the worst reading in 18 months. For the Labour government, it’s a reality check. Early-year momentum has fizzled, and the macro backdrop is starting to bite. Growth is stalling, inflation is flatlining, the Bank of England is divided on the path forward, and the Treasury’s plan to fund spending through expansion is already under pressure.

We’re not calling a recession just yet, but the risks are rising. For markets, the implications are clear: the pound looks vulnerable, especially if incoming data keeps disappointing and the BoE starts leaning dovish. Domestic-facing UK equities, particularly small caps and consumer names tied to wage growth or credit demand, could struggle in this environment. The April drop may prove to be more than just a wobble; it could be the start of a more difficult stretch for UK assets.

Data Delving

The drop was primarily driven by a 0.4% fall in the services sector, which had previously been a consistent source of growth. Key areas such as retail, legal services, and real estate saw weakness, likely reflecting pressure on consumer and business spending amid higher taxes and tighter financial conditions. Production and manufacturing also declined by 0.6%, adding to the drag, while construction was the lone bright spot, growing by 0.9%.

One of the most significant contributors to the weak data was an unprecedented £2 billion drop in exports to the United States, following new US tariffs that disrupted UK trade flows. This hit the external sector hard and widened the UK’s trade deficit sharply in a single month. The export slump is particularly concerning for an economy already struggling with sluggish growth.

As expected, the Chancellor has already countered the data, stating that the monthly numbers are ‘notoriously volatile’. She also flagged the recent trade deal with the US, as well as ones with India and the EU, as potential catalysts to spark growth in the near future.

Even her recent comments (alongside the PM) hailing the strong growth from Q1 need to be put a little into perspective, which the below visual does without us having to go into depth.

Assessing the Forecasts

Any single data point needs to be taken with a pinch of salt. But when we look at what is projected, it doesn’t make the picture any rosier. Let’s start with GDP growth.

According to the BoE, Q2 25 is forecasted at +0.1%, Q3 at +0.3% and Q4 at +0.3%. However, given the variation in the actual versus expectation that we saw for April, there’s clearly scope for the Q2 figure to be negative.

Let’s flip to inflation. In the May MPC report, they noted that “inflation is likely to rise to 3.7% by September. This is partly because of increases in energy prices, and increases in some regulated prices such as water bills.”

We have a mix of rising inflation and stagnating growth—the classic formula for stagflation. Do people want to invest in an economy exhibiting these signs? Not really.

Monetary & Fiscal Policy

The weak April figures complicate the outlook for the Bank of England. While the central bank had been steadily cutting as part of the easing cycle, the combination of sticky inflation and stalling growth we mentioned above means it’s in a tough spot.

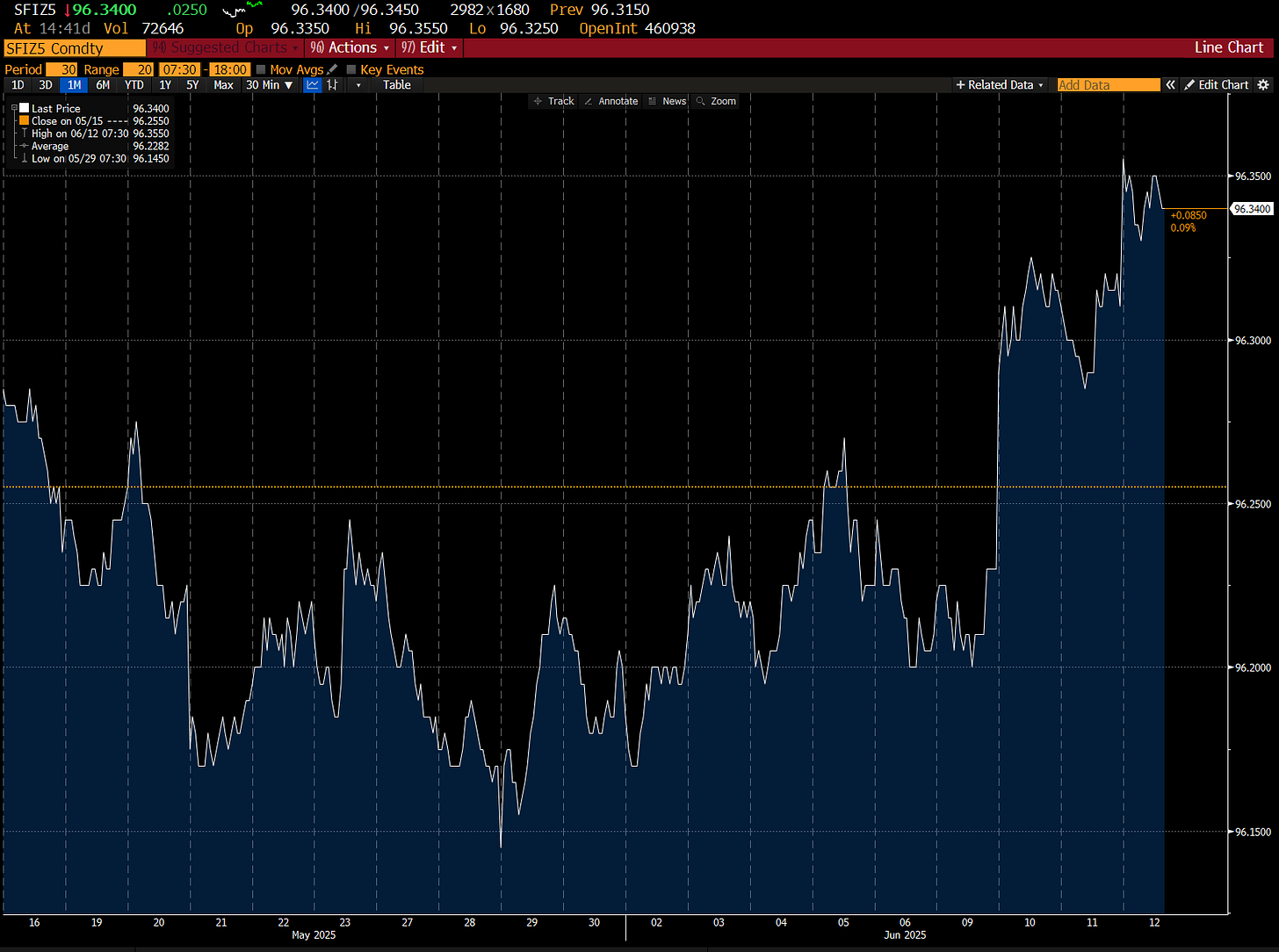

In terms of an immediate reaction, we saw the SONIA Dec 25 futures contract spike, with pricing picking up for at least two cuts through to the end of the year.

This could prove tricky, though, given the 5-4 split on the vote last month. Sure, some of the split was based on cutting in a larger increment, but there are still members who don’t see the need for any cuts.

In other words, we don’t think there’s much confidence in the BoE’s right not to take a proactive stance on getting the economy going.

Fiscal policy, too, faces growing challenges. Chancellor Reeves now faces pressure to deliver on spending and investment promises in an environment of falling growth and constrained revenues, raising the likelihood of tax hikes or reprioritised spending in the autumn budget.

Let’s not forget that the original plan for the Government hinges on the assumption that a growing economy will boost tax receipts (through higher income, corporate, and VAT revenues) and reduce the relative debt burden. This “growth-first” approach aimed to avoid politically painful choices like raising income taxes or cutting public services, while still delivering investment in infrastructure, green energy, housing, and public services.

Given the lack of growth and increasing likelihood of raising taxes, Labour is likely going to pivot to signalling a push for infrastructure-led investment as a medium-term growth strategy. While this could help buffer the impact of weaker trade and support GDP later in the cycle, it doesn’t change the dimming near-term economic outlook.