The Unhedged, Risk-On Market Upon Us

Greed and euphoria are taking over. The view of a contrarian could be a good one.

There is only one way to describe equity markets over the past four months:

Euphoric.

Since the March banking crisis dropped the S&P 500 5% over three trading days, the market has been on an upward trajectory, rising 20% from that low.

It started with the ‘Magnificent Seven’ leading the market higher. Although many headlines claimed these seven names (Apple, Amazon, Google, Meta, Microsoft, Nvidia and Tesla) were the only reason behind a climbing market, there was, in fact, progress being made in other sectors.

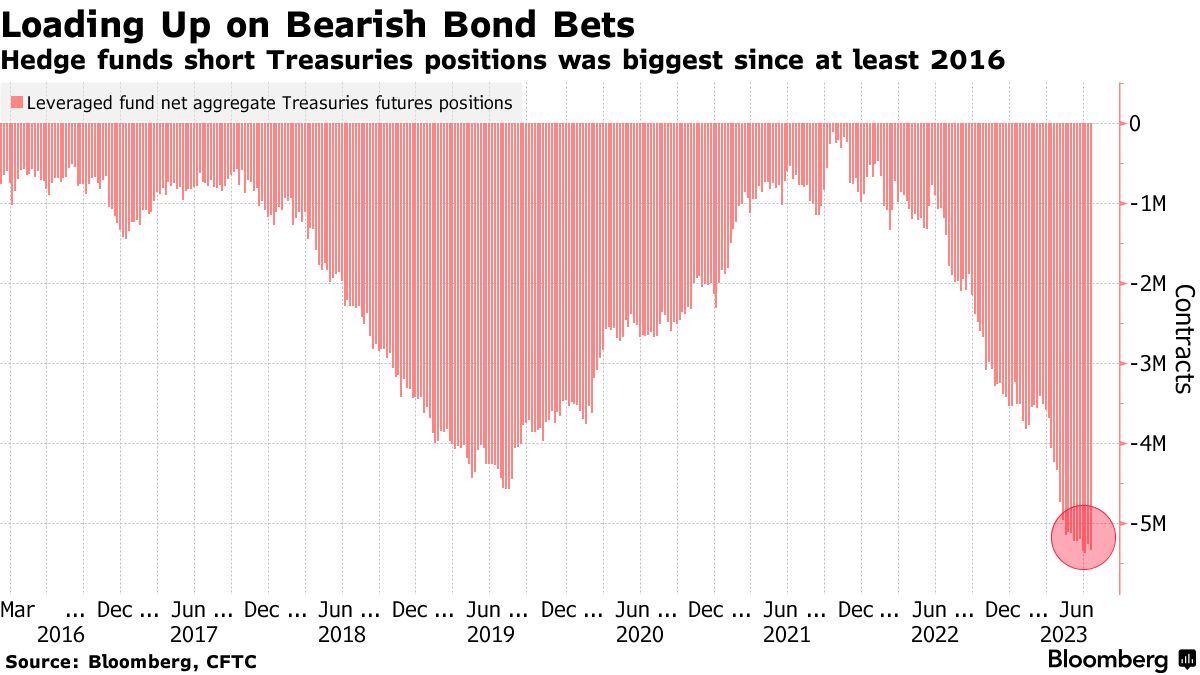

Now the mania is pilling into every sector. Industrial shares are tearing, junk-bond spreads are narrowing, quants are ramping up Treasury shorts, and everyone is piling into every stock, from meme to mega-cap.

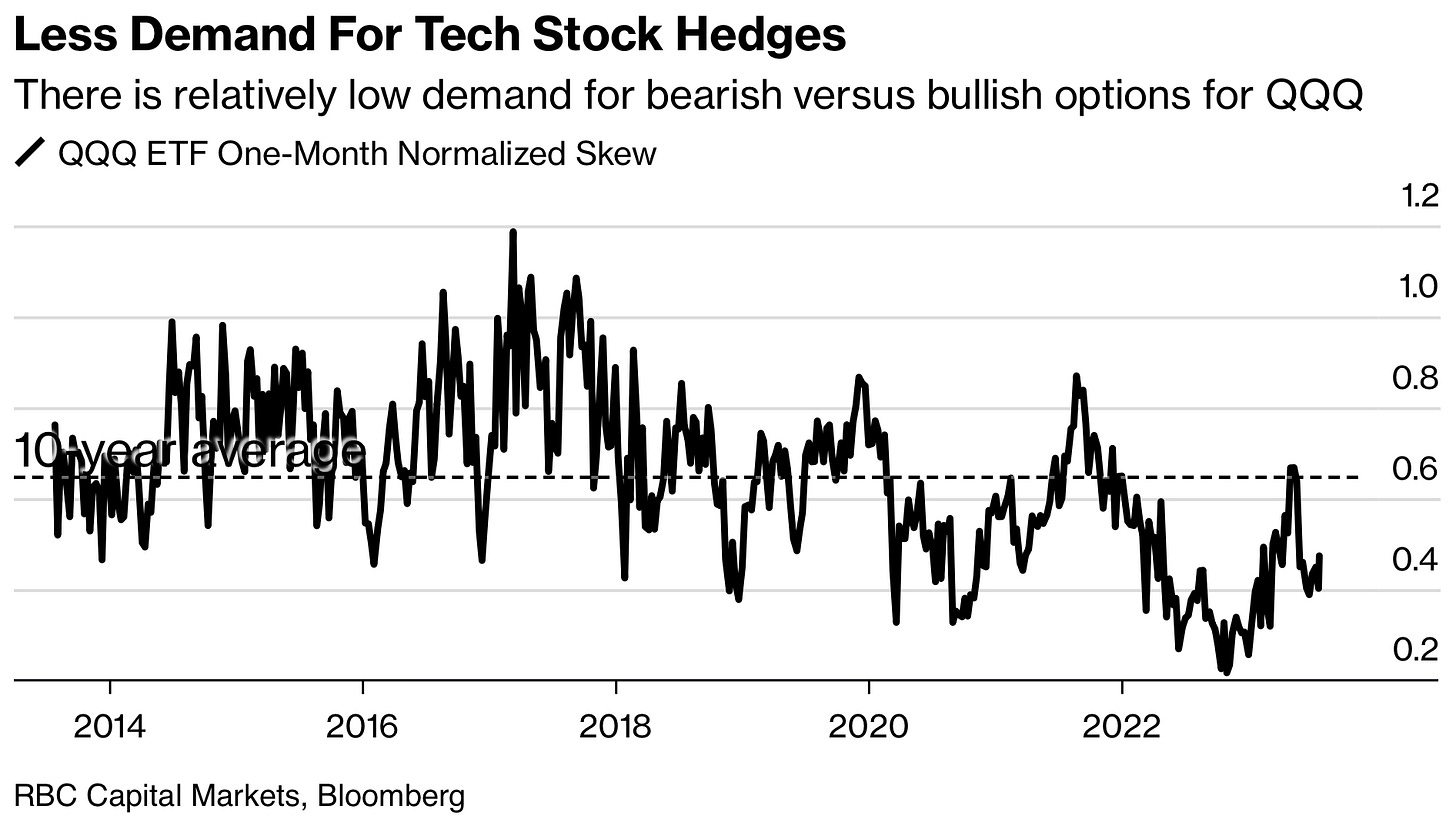

Where this gets interesting is the lack of hedging currently in the market. Investors are so confident of more upside that put option demand is at a low. We'll be able to talk about that later.

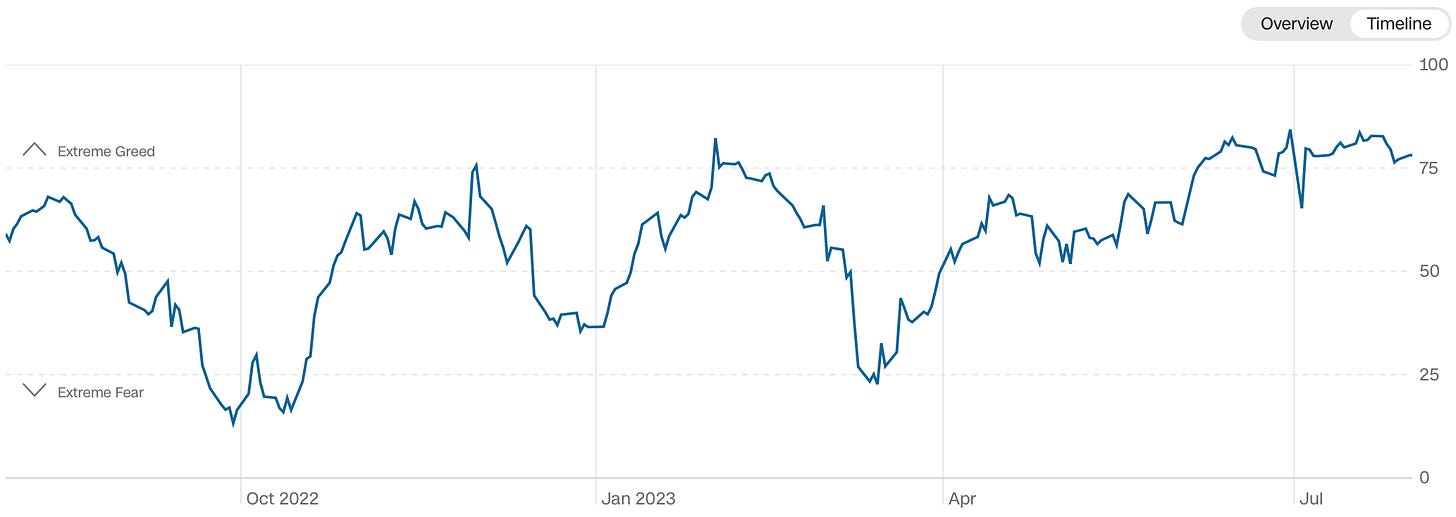

Bearish agendas keep getting denied by stronger-than-expected economic data. The good news on the economy is sucking more and more investors into risky assets. A steady expansion in speculative spirits has pushed equity positioning to the highest level since January 2022, with net call volume at its highest since January 2021.

More than half of clients surveyed by JPMorgan Chase last week say they are convinced the US economy can continue to expand despite rapid-fire hikes, so-called "soft” or "no landing" scenarios. The survey shows a jump in the number of investors planning to boost equity exposure at the expense of bonds.

The lack of hedging

The cost of hedging a portfolio is as cheap as you’ve likely ever seen before. For every $100 in notional — the value an options contract covers — investors now pay only $3.50 for an S&P 500 put option expiring a year from now with a strike price 5% below current levels, data compiled by Bank of America show. That’s the least in the bank’s data going back to 2008. (Between the premium and the strike price, the contract will be profitable if the S&P 500 falls at least 8.5% a year from now.)

Historically, a low level of put-to-call ratio has translated into a flat performance for the stock market over the following three months.

Over the past 30 years, September and August have been the two worst months for the S&P 500, with a 0.4% drop in the former and a 0.2% decline in the latter.

With the current sentiment leading investors to hold heavily exposed portfolios, are we in for some quieter times in the market?

Given the weak market seasonality in August and an upward bias in 10-year bond yields, Scott Rubner, a managing director at a firm that studies the flow of both long and short funds, is telling clients to either reload on shorts or put on downside hedges.

“I am so bullish that I am actually bearish now for August. I am looking for a small-ish equity market correction in August,” he wrote in a note. “My core behavioural view is that I no longer speak to any ‘macro’ bears. Positioning and sentiment are no longer Pessimistic, it is Euphoric.”

The contrarian view

A contrarian investor would use the put-call ratio to help them determine when market participants are getting overly bullish or too bearish. An extremely low ratio means the market is highly bullish. A contrarian might conclude that the market is too bullish and is due for a pullback.

If we go off basic market principles, this idea makes sense. Buy fear and sell greed. The market has been in “greed” territory (above 75) for two months.

Looking into this side of the market makes us believe protection against the downside is needed, even if the crowd is moving on.