The Unwind Of The 2023 Trade

Nearly halfway into the year, a slew of consensus bets are losing big time as the US economy defies predictions of a recession.

Stocks shadow bonds as tech continues to rally

China’s recovery was short-lived

The dollar strengthens against the yen, blindsiding fund managers

Sell-side strategists and macro hedge fund managers are baffled by Wall Street's latest blow to conventional thinking. Getting a handle on investing and economic trends has proven challenging during the previous three years, with anything from perpetual inflation to the big bear market of 2022.

Nearly halfway into the year, a slew of consensus bets are losing as the US economy defies recession predictions.

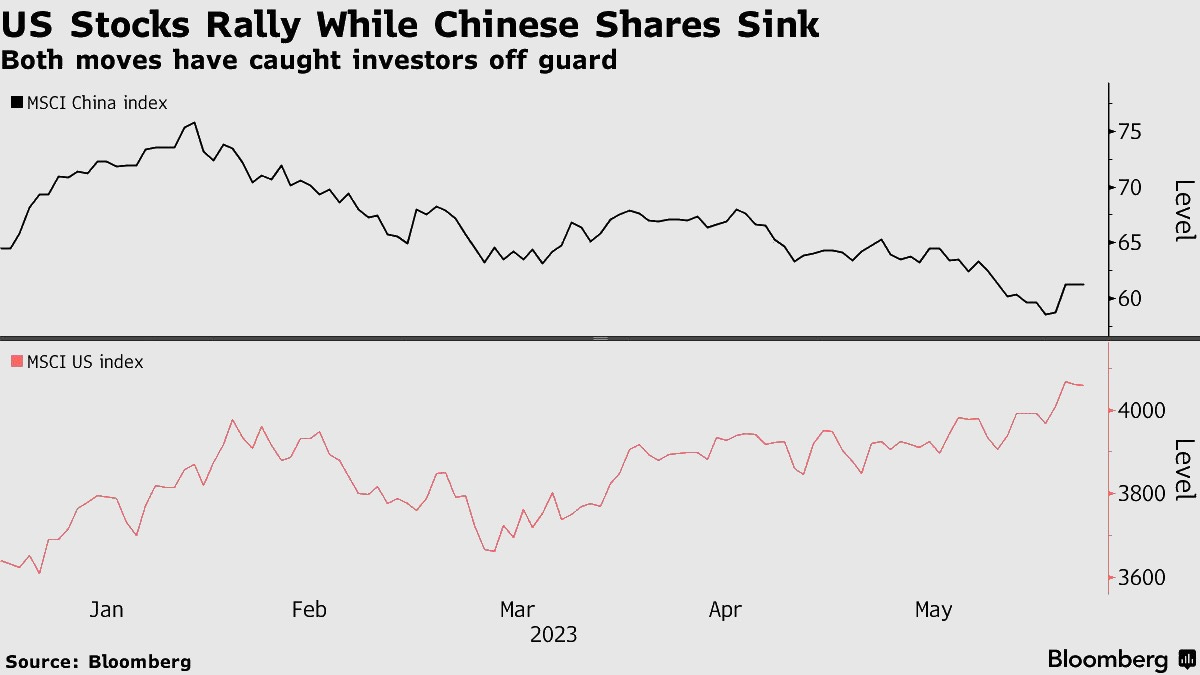

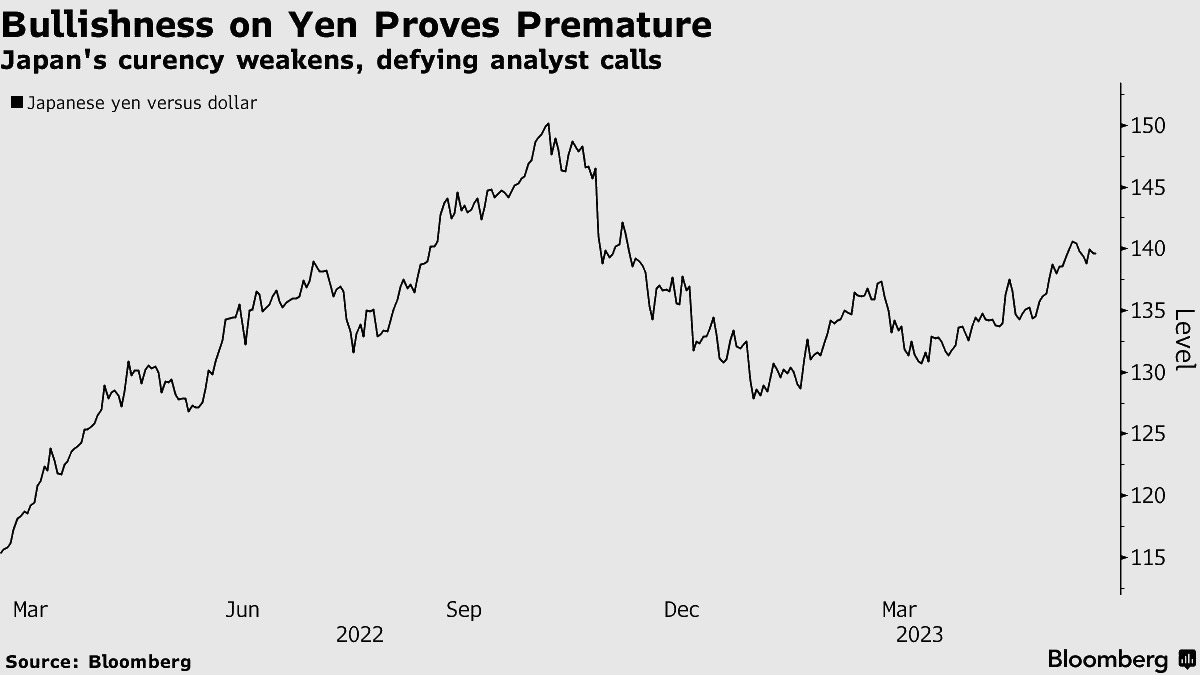

Examples of unsuccessful methods are selling Big Tech companies, shunning the dollar, and investing in the promise of emerging market equities as China emerged from Covid lockdowns. Instead, Chinese stocks are falling into a bear market while US growth shares are on the verge of a full-blown meltdown. The value of the dollar has increased rather than decreased, rising 6.8% against the Japanese yen.

Those who anticipated stock returns to be dwarfed by fixed income have likewise been caught off guard. The global share MSCI index is up 10%, but global bond prices are up just 1.4%.

Stocks v Bonds

Investors who avoided stocks in favour of bonds out of concern that the Federal Reserve's relentless monetary tightening would wreck the world's largest economy are feeling the pain the most acutely. Government bonds were predicted to be the best-performing asset in 2023 in a survey of fund managers conducted in December by Bank of America Corp. Allocation to fixed income was at its highest level since April 2009 relative to equities.

Treasuries have increased in value in the US but are still far behind equities. Government debt is off to the second-worst start of a year in a decade relative to the S&P 500, trailing by seven percentage points in the first five months.

The euphoria surrounding AI in the wake of the introduction of ChatGPT in November is what's driving the unexpected equity outperformance. The seven top IT companies, including Microsoft and Nvidia, are responsible for roughly half of the market's gains. The enthusiasm has prompted a boom in shares of computer and software behemoths.

Better-than-expected corporate earnings and economic data have also helped US stocks tune out bond market recession alarms.

However, during the last week or so, it can be observed that flows have started to move into other sectors of the S&P 500, boosting the performance further.

US v China

Meanwhile, enthusiasm for China turned out to be unfounded. The expectations for the Asian economy's development reached a 17-year high in January, while allocation to emerging markets, including China, climbed to levels not seen since June 2021.

An MSCI index that tracks stocks in emerging countries is currently eight percentage points behind its US equivalent this year. Chinese equities remained one of the worst laggards rather than rising to the top performer, as projected by Wall Street. Additionally, strategists at companies like Morgan Stanley and Goldman Sachs are hastily reducing their predictions.

China's rocky recovery from the pandemic is an issue. Recent figures reveal that manufacturing is declining once again, the housing market is failing, and local governments' financing vehicles are struggling to pay off their debt after an early recovery following the lifting of the Covid limitations.

Dollar v Yen

Another area where investors misjudged is the currency market. In a study conducted by BofA in December, the percentage of fund managers who were considering a weaker dollar reached its highest level since 2006. The expectation that US interest rates would peak and reduce demand for the dollar underpinned the cautious outlook.

However, the dollar has maintained its strength as one of the highest-yielding currencies in the industrialised world thanks to a strong economy and persistent inflation.

That was especially discouraging for yen bulls, who had hoped that a prospective change in the Bank of Japan's ultra-easy monetary policy would halt a two-year decline. Kazuo Ueda, the new governor of the BOJ, has repeatedly emphasised the danger of a hasty removal of stimulus notwithstanding solid inflation.

Note, though, that USDJPY is rising higher, signalling dollar strength compared to the yen. Many will follow the Dollar Index (DXY), which would show a decline this year. However, this index is heavily weighted towards EURUSD with a 57.6% weighting, and the euro’s strength has risen with continued hikes from the ECB.

If you enjoyed this article, please share your support by liking this post. If this is your first time reading, please consider subscribing to receive our articles straight to your inbox.