"There Are Times to Make Money And There Are Times to Not Lose Money."

We run through the life, best trades and quotes of hedge-fund giant David Tepper.

We hope you’re all enjoying your weekend. Back again this Sunday is another investor special, with one of the team here at AP remarking how surprised he was that we haven’t yet covered David Tepper, despite us having run this series for over a year now.

We’re therefore setting the record straight today, diving into the life, trades and advice from arguably one of the most successful hedge fund managers of our generation.

Before we get going, a friendly reminder that you can become a premium subscriber with us for just £10 a month. This provides you full access to our weekly articles without a paywall, including our flagship Monday trade ideas and access to our portfolio.

Who is he?

David Alan Tepper was born on September 11, 1957, in Pittsburgh, Pennsylvania, USA. He was raised in a middle-class Jewish family,

Tepper's academic journey began at Peabody High School in Pittsburgh, where his exceptional aptitude for mathematics became evident. He continued to excel academically and went on to attend the University of Pittsburgh, where he earned his undergraduate degree in economics, graduating magna cum laude in 1978.

After completing his education, Tepper began his career on Wall Street, working for various firms including Republic Steel and Keystone Mutual Funds. However, it was when he joined Goldman Sachs that things started to kick off. Joining the high-yield bond desk in 1985, Tepper quickly distinguished himself as a sharp and innovative investor. His ability to identify undervalued assets and assess risk with precision earned him respect within the industry.

In 1992, Tepper left Goldman Sachs and founded Appaloosa Management, a hedge fund based in Short Hills, New Jersey.

Over the years, Tepper's wealth and influence have grown exponentially, earning him a place among the wealthiest individuals in the world. Incredibly, Tepper has been returning client assets over the last decade, meaning that Appaloosa's $15bn under management now is primarily his own personal capital.

Outside of investing, Tepper is also renowned for his philanthropy, particularly his contributions to education and healthcare. Through his charitable foundation, he has donated millions of dollars to support initiatives aimed at improving access to education and healthcare services for underserved communities. He also owns the NFL’s Carolina Panthers.

Investing strategy

The main strategy for Appaloosa focuses on distressed debt. Tepper and his team specialize in identifying undervalued bonds or other debt instruments of companies facing financial distress. By conducting thorough analysis and assessing the underlying value of these securities, Appaloosa aims to capitalize on the potential for significant price appreciation as distressed assets recover.

For those wanting to understand the process of distressed debt investing in more detail, there’s a great primer on it here.

Further, Appaloosa Management actively seeks out event-driven investment opportunities. These can result from mergers, acquisitions, spin-offs, and corporate restructurings.

These events often create temporary dislocations in the market, presenting opportunities for savvy investors to profit from mispricings or arbitrage situations. Often this can tie in to fixed income securities like the distressed debt mentioned above, but it can also present itself from equity markets too.

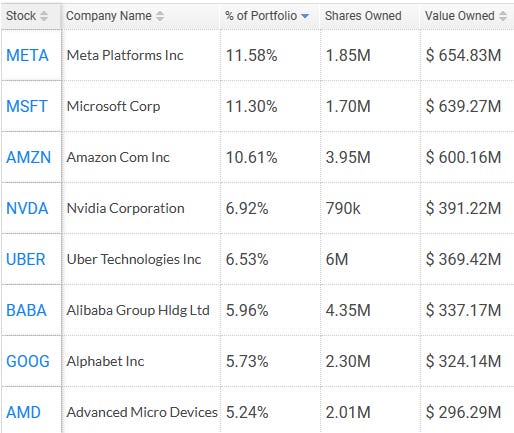

Aside from this, Tepper does also hold some more conventional stocks within his portfolio. As of the end of 2023, here were his largest holdings:

Best trades

Profiting from Bank of America during the Financial Crisis

During the height of the global financial crisis in 2009, Tepper made a bet on financial stocks, particularly Bank of America (BofA). Tepper recognized that despite the turmoil in the financial sector, many banks were fundamentally sound and trading at deeply discounted valuations. In early 2009, as fear gripped the markets and BofA's stock price plummeted to historic lows, Tepper aggressively accumulated shares of the bank.

Tepper's contrarian bet paid off handsomely as financial markets stabilized and investor sentiment improved. As the economy recovered and BofA's financial health improved, its stock price soared, delivering a whopping $7bn worth of profits for the fund.

One article gave this incredible insight:

“Day after day, Mr. Tepper bought Bank of America Corp. shares, then trading below $3, and Citigroup Inc. preferred shares, when that stock was under $1. One of his investors insisted more carnage loomed. Friends who shared his bullish beliefs were wary of aping his moves amid speculation that the government was about to nationalize the big banks. “I felt like I was alone,” Mr. Tepper recalls. On some days, he says, “no one was even bidding.”

Betting on Fannie Mae and Freddie Mac

In the aftermath of the financial crisis, Fannie Mae and Freddie Mac, the government-sponsored enterprises (GSEs) responsible for guaranteeing a significant portion of the U.S. mortgage market, faced immense challenges. Amidst uncertainty surrounding the future of these entities, Tepper saw an opportunity. Recognizing the critical role that Fannie Mae and Freddie Mac played in the housing market and the government's implicit support for their operations, Tepper made another (remember he was bidding up banking stocks at this time too) bold bet on their preferred shares.

Tepper's investment in Fannie Mae and Freddie Mac preferred shares proved prescient as the U.S. housing market gradually stabilized, and the GSEs' financial conditions improved. As their stock prices rebounded, Appaloosa Management realized substantial profits.

Capitalizing on Micron Technology's Turnaround

In 2013, Micron Technology, a leading semiconductor company, was struggling with weak demand, pricing pressures, and intense competition in the memory chip industry. However, Tepper saw potential in Micron's turnaround efforts and the improving dynamics of the semiconductor market.

Tepper initiated a significant position in Micron's stock, betting on the company's ability to capitalize on growing demand for memory chips in various applications, including smartphones, data centers, and automotive electronics.

The investment in Micron Technology proved to be highly profitable as the company's financial performance improved, driven by robust demand for its products and favorable industry trends.

From his entry price in the $7-9 range, he completely exited the position by 2022, which we estimate netted him a 6-9x return depending on exact timings of sales.

Below we flag up the share price chart of Micron Technology over the years:

Quotes to live by

"The most important thing is to be able to go against the tide, to go against the prevailing wisdom of the time and have the judgment to know that you're right and the market is wrong."

This quote highlights Tepper's contrarian approach to investing. This ties in with his edge that he developed in distressed debt, in buying what others were selling. He emphasizes the importance of independent thinking and the willingness to diverge from consensus opinion when it comes to making investment decisions.

"Sometimes you need money to make money."

Aside from telling this to your casino dealer next time you’ve been stumped on the blackjack table, this statement underscores the importance of capital allocation and the role of leverage in investment success. Tepper acknowledges that strategic use of capital and access to financial resources can amplify investment returns, especially in opportunistic situations such as distressed debt investing or corporate restructurings.

"There are times to make money and there are times to not lose money."

This quote encapsulates Tepper's emphasis on risk management and capital preservation. He recognizes that successful investing is not just about maximizing returns but also about minimizing losses during periods of market volatility or economic uncertainty.