Top Trade Ideas - April 14th

And now we do it all over again.

“Two securities might be unrelated, but the same investors own them, implicitly linking them in times of stress.”

Last week was a historic one for markets. Wednesday saw double-digit returns across U.S. indices, one of the best single-day returns on record. Indices finished the week with their best return since November 2023. We had a “basis trade blowout” in the Treasury market that captivated headlines. And, of course, many twists and turns in the tariff narrative.

The weekend’s headlines were noteworthy. The current paradigm means thoughts you have on a Friday at the market close might be dead and buried by the Sunday futures open. There’s no rest in what is going on in the markets right now, not even over the weekend. Here is a quick summary:

Saturday:

*US PUBLISHES TARIFF EXCLUSIONS FOR SPECIFIED PRODUCTS

*US TARIFF EXCLUSIONS APPLY TO COMPUTERS, SMARTPHONES

*US TARIFF EXCLUSIONS ALSO APPLY TO CHIP-MAKING EQUIPMENT

*TARIFF EXCLUSIONS APPLY TO SO-CALLED ‘RECIPROCAL’ TARIFFS

Sunday:

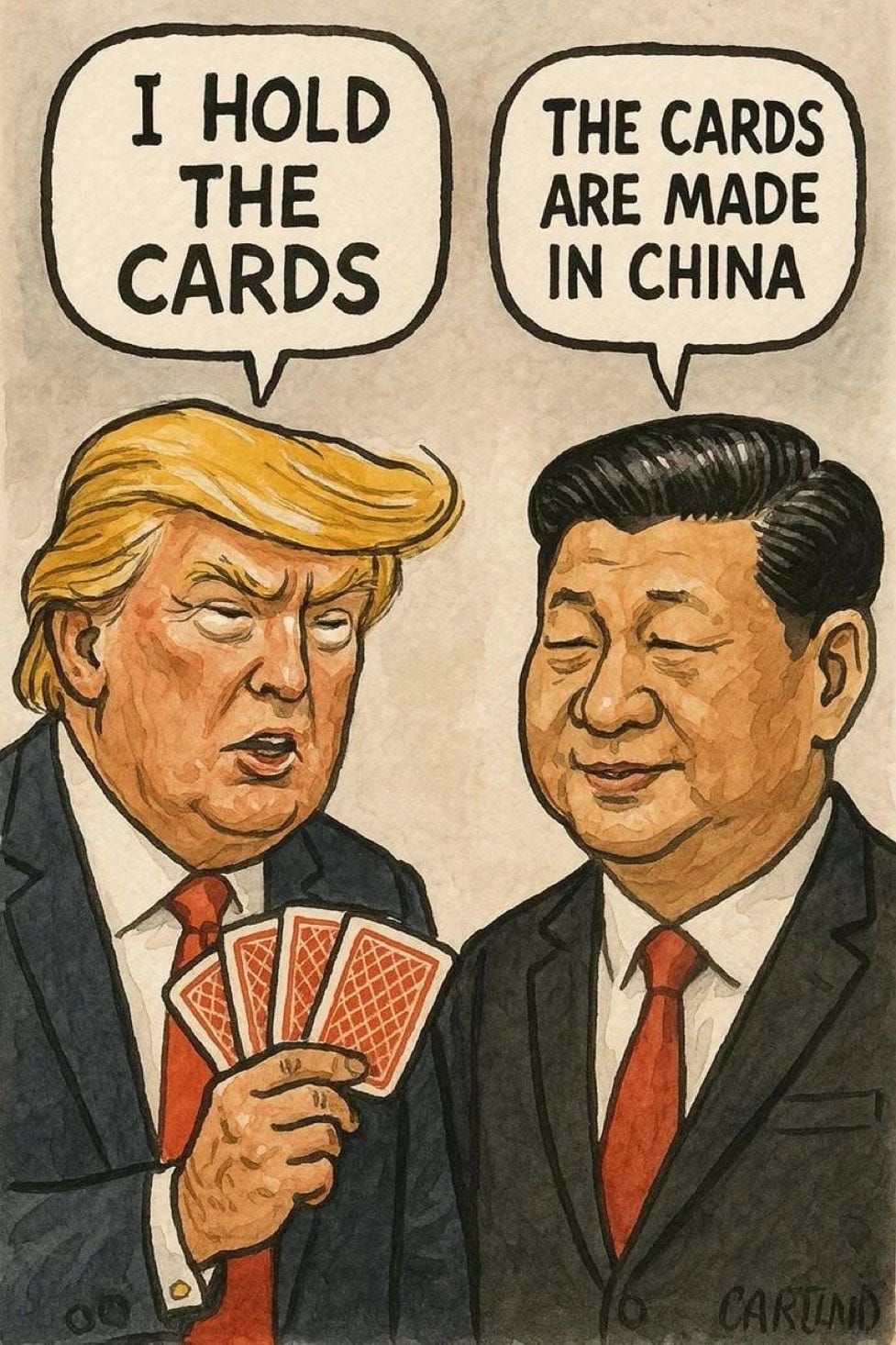

*TRUMP: NOBODY GETTING “OFF THE HOOK” FOR UNFAIR TRADE

*TRUMP: THERE WAS NO TARIFF ‘EXCEPTION’ ANNOUNCED ON FRIDAY

*TRUMP: CHIPS TO BE ASSESSED IN NATIONAL SECURITY TARIFF PROBES

There was much talk about how those Saturday headlines might have saved Apple, which relies heavily on Chinese manufacturing. However, we may need more time to find out precisely what will be exempt or not. So far, it looks like tech levies may be moved into another basket.

Equity futures are higher after the open, but that move may have been dampened after yesterday’s headlines. Likely, all of the headlines are building expectations that Trump will walk back the strength of tariff actions, even with China.

The Week Ahead

Following a week marked by significant volatility, driven by sharp declines in U.S. Treasurys and the U.S. dollar in response to President Trump’s broad trade tariffs, followed by a 90-day reprieve for many of them, investors are likely to welcome a calmer stretch ahead of the Easter holiday observed in several countries. Nonetheless, lingering uncertainty around tariffs, heightened U.S.-China trade tensions and concerns about potential economic fallout will keep markets on edge.

Market participants will closely monitor U.S. retail sales data for insight into consumer sentiment under the current administration. Meanwhile, interest rate decisions from the European Central Bank and the Bank of Canada will be scrutinised for indications of how policymakers are responding to trade-related risks and recent market movements.

In Asia, attention will turn to a wave of economic data releases from China, as well as monetary policy decisions in Singapore and South Korea.

Let’s start with our thoughts on FX markets this week.

FX

In G10 FX, economic data releases took a back seat as risk sentiment became the flavour of the week. This was evident with the move in the DXY, which fell off a cliff (technical jargon…) and traded comfortably below 100.00 into Friday’s close, to levels not seen since early 2022.

Going into this week, we wanted to present two ideas, one for each side of the coin when it comes to market sentiment.

Some feel there’s further potential unwinding here with investors selling U.S. Treasuries and US stocks and, therefore, selling USD back to EUR, JPY, etc. Further, selling USD is one of the cleanest expressions of betting on further asymmetry when it comes to US vs RoW damage from tariffs.

Our preferred expression for a USD weaker move is EUR/USD higher. Blanket US tariffs are bad for Europe but worse for the US. Add into the mix more EU hedging of U.S.-specific risk, sentiment boosted via German spending package, etc., and this could trade towards 1.1800 in the coming weeks.

TRADE IDEA - EUR/USD HIGHER ON DE-DOLLARIZATION

Buy a one-month EUR/USD call spread, 1.15 / 1.18 strikes, costing 0.76% with a max payoff of circa 3.5:1

Those in the other camp will point to the bounce we had in US equities to end the week. Any potential for a continued relief rally in this coming week likely sees safe havens like CHF and JPY underperforming.

In terms of currencies to pair this up on the long side, we’d be happy to get long GBP here. GBP lost ground last week, with us taking advantage of it via the break on EUR/GBP, which we flagged up in our piece last Monday.

Yet if we see a risk reversal, the opposite move should be seen, especially with the strong UK data to end last week.

GBP/CHF technically looks oversold, and with a tight stop it could make for a tidy reversal play at spot if traders start the week on a better footing.

TRADE IDEA - GBP/CHF LONG ON REVERSAL OPTIMISM

Entry: 1.0700

Stop Loss: 1.0595

Take Profit: 1.0925