Top Trade Ideas - April 22nd

We share our best-quality ideas across global markets for the busy week ahead.

Last week, volatility continued to rise across global markets. Gold chopped around in range, oil fell lower and couldn’t hold an initial gain following escalated tensions in the Middle East, and Europe and American equity markets fell lower.

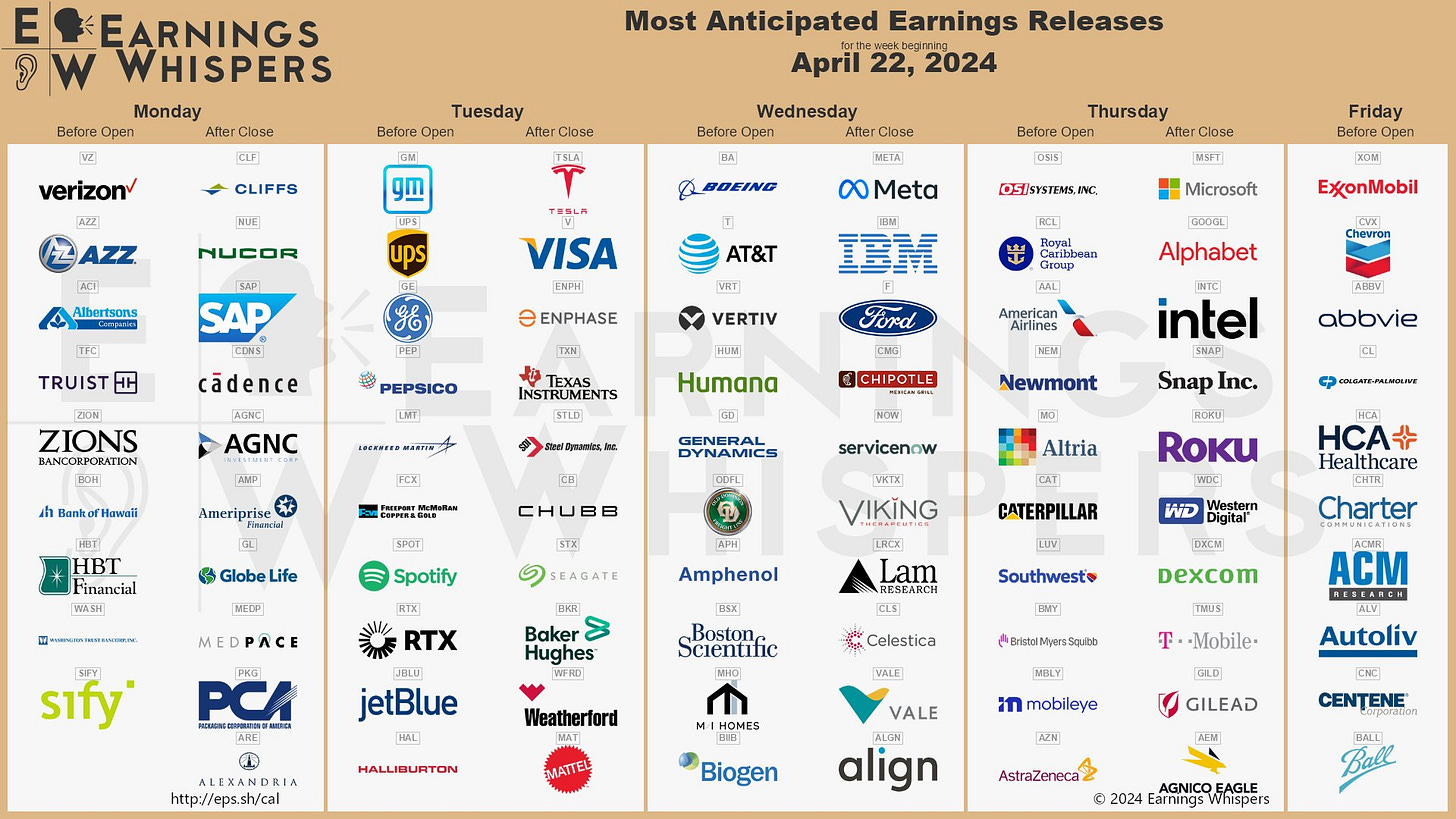

We have been stressing the importance of the upcoming earnings season for the next leg of the S&P 500, and the week ahead has some major names reporting:

In G10 FX, most USD pairs spent the week consolidating (but not reversing) the greenback’s gains from the previous week. This week, we watch the BoJ meeting on Thursday and US PCE inflation data, also on Thursday.

As usual, the team has collated their ideas for the week ahead, sharing some short and longer-term ideas with our readers. We start off this week with equity ideas before moving into currency, commodity, and index ideas.

Equities

Recently, we have seen a sharp increase in military conflict and tensions across multiple regions. As a result, Defence and Aerospace stocks are back in the limelight as countries look to bolster their military spending and presence, which should act as a positive uplift for the revenue prospects and stocks of defence contractors. Following a brief pull back in price, we look to the SPDR ETF in order to gain broad exposure across the main sector names in this medium-term thematic long trade.

TRADE IDEA - LONG SPDR S&P AEROSPACE & DEFENSE ETF (XAR)

Entry: 132.24

Take Profit: 143.00

Stop Loss: 126.90

As markets pullback from recent highs, we turn our head to equity names that have lower beta to the benchmark. We scan through these less volatile names for opportunities that we would like to capitalise on. When looking at Berkshire Hathaway (NYSE: BRK.B), the recent move lower looks good to go long.

Buffett’s iconic conglomerate is up 13.7% YTD compared to the S&P 500’s 4.8%.

TRADE IDEA - CHANCE TO ADD SOME LONG-TERM

Entry: 405.10

The ideas continue below.