Top Trade Ideas - April 29th

Markets continue to present plenty of opportunities.

Equities had a rollercoaster week, ending with strong momentum higher following Google and Microsoft’s earnings. What next?

The week ahead sees Amazon and Apple report earnings, along with other big names like Sofi, PayPal, Pfizer, Qaulcomm and Novo Nordisk.

An FOMC will have market attention on Wednesday. There is nothing to note about the rate decision, which is priced in to be held at the current level. Comments from J Powell 30 minutes after will be key to understanding the Fed’s thoughts following recent data.

Following the stability that was gained last week (compared to the previous week), we lean towards a more risk-on approach in equity markets.

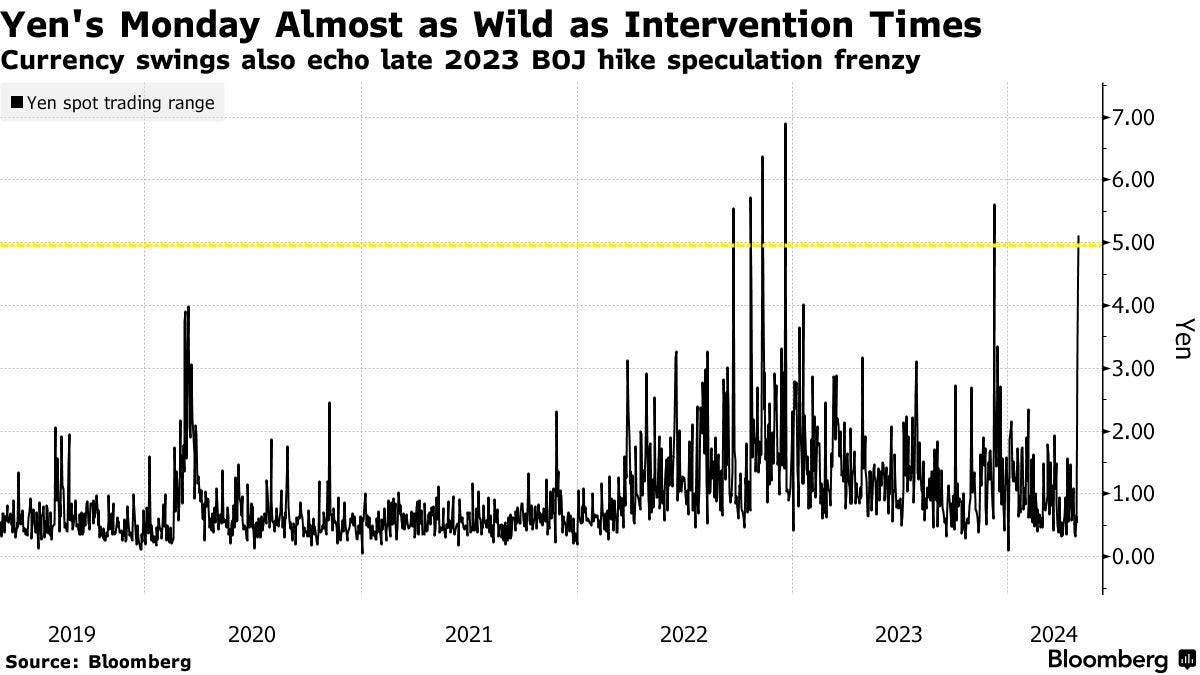

In G10 FX, the US Dollar struggled to get traction either way following a mixed bag of economic data releases. Traders also watched on in disbelief as the Japanese lack of intervention saw USD/JPY trade up to close above 158. Monday has kicked off with even more action for the pair.

Equities

Meta Platforms (NASDAQ: META) fell heavily after earnings. Buyers stepped in the following day, keeping prices stable and reducing further volatility. This week, we look towards a mean reversion play on this drop, targeting the 0.5-0.618 fib level on the gap.

We will give levels for a spot trade, but this is an easily accessible name for trading options, so calls are an alternative.

TRADE IDEA - META MEAN REVERSION

Entry: 443.50

Stop Loss: 436

Take Profit: 457-465

TKO Group (NYSE: TKO) was flagged on our radar due to insider activity. This is always a good screener to keep an eye on. Insiders know what is going on in the business, and they only want to load up on additional stock if things look bright in the near future.

Over the last 30 days, TKO insiders purchased 13.5% of the total float. Earnings are upcoming, and the technical setup is there for a long entry this week.

TRADE IDEA - TKO INSIDER PLAY

Entry: 96.80

Stop Loss: 93.50

Take Profit: 104.70 (if you wanted to trade this over a longer period, we highlight 115 as a target)

As usual, we continue more equity ideas below before moving into a currency rundown and commodity market thoughts.

If you would like to trial our premium content, a 7-day free trial can be accessed here.

Onto the rest of the alpha.