Top Trade Ideas - April 7th

Deal, delay, or detonate the tariff threat.

A seismic shake-up of global trade and $5 trillion in losses in the U.S. stock market made last week one that will go down in history. Liberation Day materialised as Liquidation Day for many.

Maybe it all turned out how Trump wanted it to. Yields are falling, with the 10-year touching a three-handle for the first time since October—Bessent is finally finding buyers for his bonds. Trump has touted his tariff stance and shown markets that stocks would endure pain if necessary. Markets failed to believe him. Pain was felt.

The Week Ahead

In the United States, markets are increasingly convinced that the Federal Reserve will need to respond to growing economic uncertainty and the fallout from President Trump’s latest tariffs with aggressive monetary easing. A total of 121 basis points of rate cuts are now priced in for 2025, with the first move fully expected by June.

This week’s release of the March consumer and producer price data, alongside minutes from the Fed’s most recent policy meeting, will be pivotal in shaping those expectations. A further uptick in inflation could complicate the Fed’s path, even as consumer sentiment continues to show signs of deterioration, with the University of Michigan’s April survey due Friday likely to reflect the latest impact of trade-related anxieties.

In China, March inflation data due Thursday will offer a key reading on whether the economy remains at risk of deflation. While consumer prices are expected to turn slightly positive, producer prices are likely to remain in contraction, reinforcing expectations for additional stimulus. However, room for rate cuts may be limited by renewed depreciation pressure on the yuan, which has come under strain as tariff tensions escalate. Any signs of further economic weakness could intensify calls for action from Beijing, particularly as officials continue to pledge strong countermeasures in response to U.S. trade actions.

Japan also faces a consequential week, with the Bank of Japan releasing its regional economic report on Monday and Governor Kazuo Ueda scheduled to speak on Wednesday. His remarks will be scrutinised for any signal of when the central bank may follow up on its March rate hike. Meanwhile, bank lending and current account data will help flesh out the broader economic picture, while long-end bond issuance on Tuesday is expected to attract solid demand from domestic institutional investors hunting for yield.

In Europe, economic releases are relatively light, but attention will remain on how eurozone policymakers respond to U.S. tariffs and the broader trade threat. Germany’s joint economic forecast, due Thursday, will likely draw greater attention than usual, given growing fiscal ambitions and external headwinds. Revised inflation data from Germany and Spain on Friday could help shape expectations for the European Central Bank, which has so far been more cautious about pivoting to rate cuts.

Elsewhere, the Reserve Bank of New Zealand holds a policy meeting on Wednesday, where it is expected to cut interest rates by 25 basis points and outline its response to deteriorating global conditions. Australia’s central bank is under similar pressure, and Thursday’s speech by RBA Governor Michele Bullock may offer insight into whether the bank risks falling behind the curve amid mounting recession fears.

There’s one place to start this week in our commentary.

Global Tariff Turmoil

The aftermath of Liberation Day saw many industries, especially energy, sell off on stronger-than-expected tariff implementation. Consumer Staples were green. But turning into Friday, market turmoil swamped every sector as the S&P fell nearly 6%.

As we have said, this was never the end of the tariff story. Trump may claim “Mission Accomplished” on socials, but this is now the start of a twisting story ahead. Friend-of-the-house Eliant’s Exploits said it very well over the weekend: “Now it’s Trump’s move—deal, delay, or detonate.”

Knowing which route he will go down is a certain unknown. Maybe Trump’s closest may not even be fully sure.

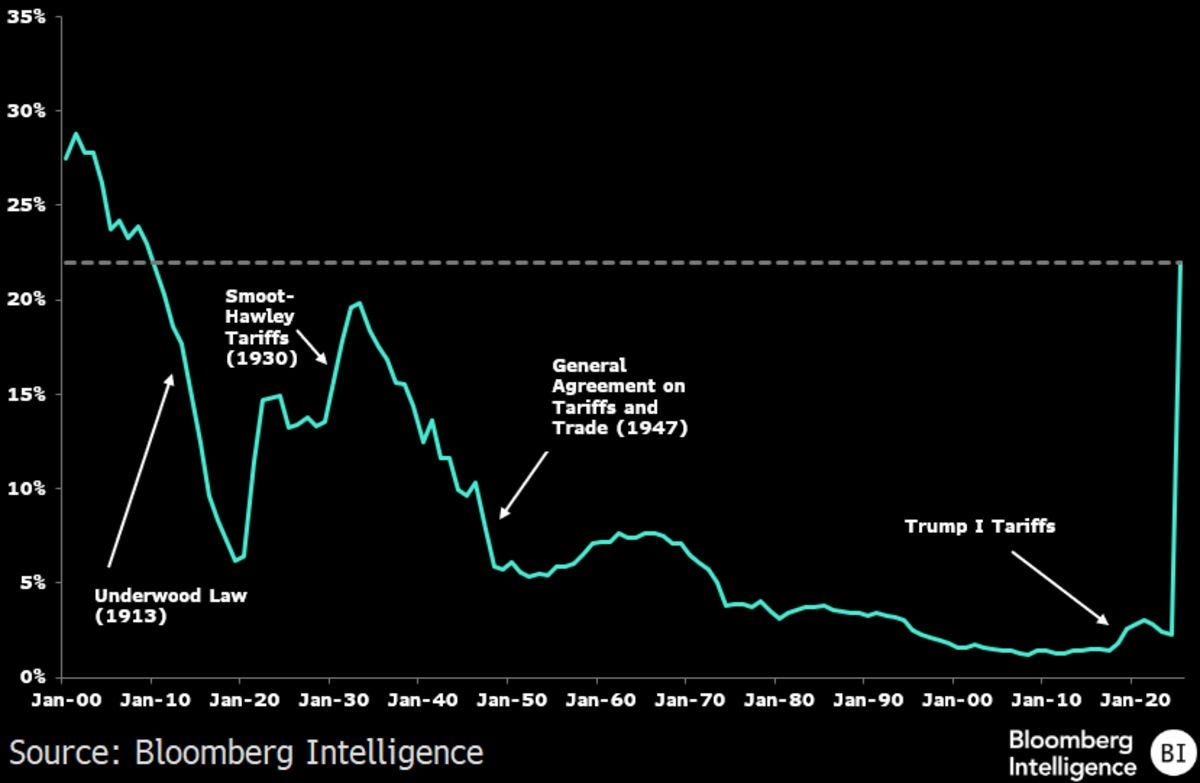

President Donald Trump’s 2025 tariffs are impacting the global equity markets more significantly and severely than the levies imposed in 2018. These duties are expected to hit U.S. multinationals the hardest, followed by companies from Europe and Japan. Ironically, the US’s largest trading partners—Canada, Mexico, and China—might be somewhat shielded from these effects due to their limited direct equity exposure.

We mentioned some headwinds were present for the Nikkei going into the tariff announcements, and there could be some further to go on this selling, potentially past 30,000.

TRADE IDEA - OUTRIGHT SHORT

Short Nikkei targeting 27,500 area (2021/22 mid range)