Top Trade Ideas - April 8th

This week, all eyes turn to the next CPI print.

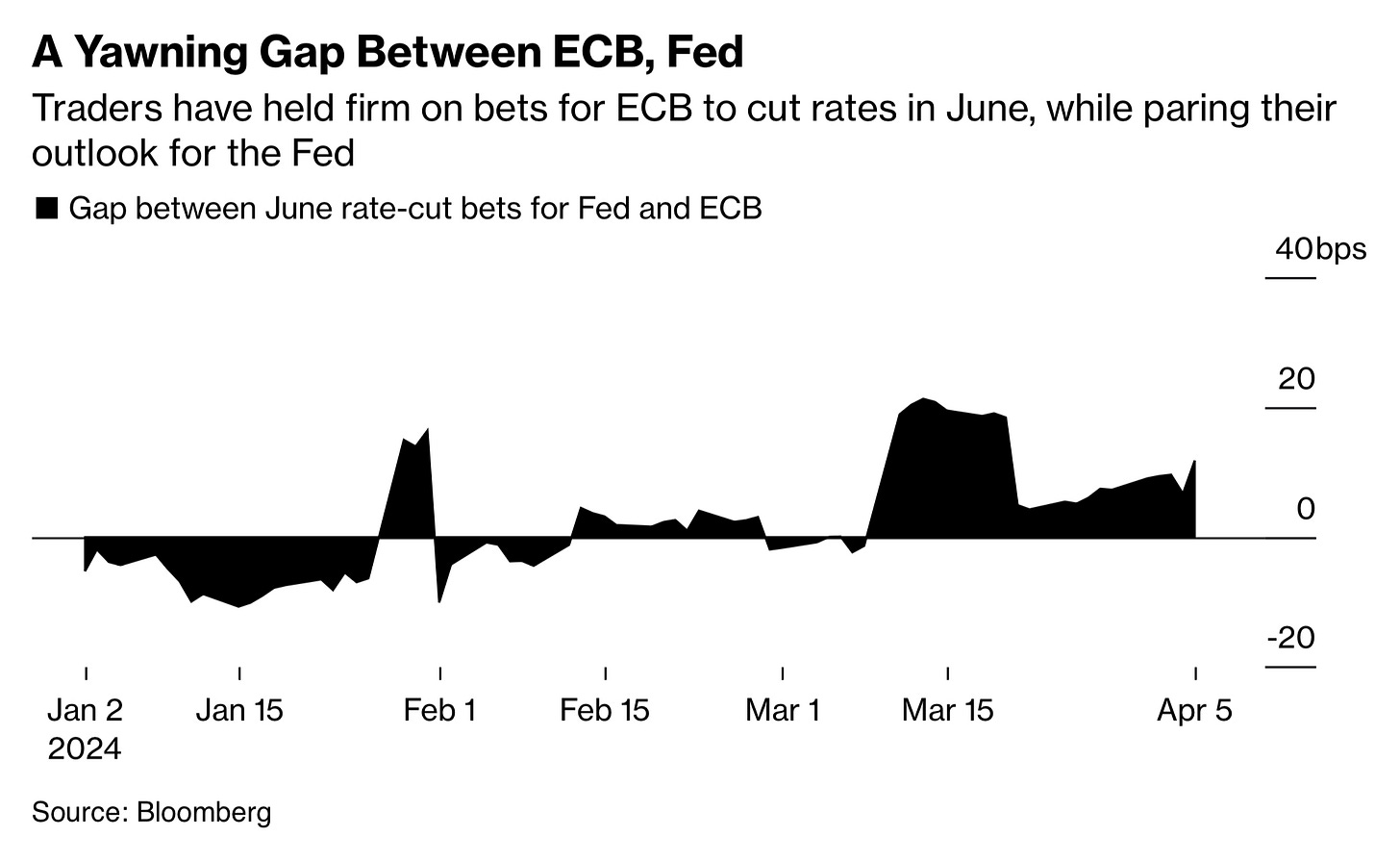

In the past week, traders have grown far less certain that the Federal Reserve will cut interest rates in June, thanks to blowout employment data that suggest perhaps the American economy isn't in dire need of lower borrowing costs. Meanwhile, wagers for a rate cut from the ECB that month have held firm, resulting in a widening gap in expectations for the two central banks:

In G10 FX, hawkish Fed chatter and a strong headline NFP beat did little to provide the US Dollar with a meaningful kick higher. Most are now looking to position key inflation data for Wednesday.

Equity markets will also be looking at the CPI numbers. After surpassing many hurdles already this year, will the indices overcome the next CPI day?

The team has spent the weekend writing up their thoughts on global markets for the week ahead. We also have a guest contributor this week. Here’s the rundown:

Guest Feature: Shark

Silver has shown strong momentum after breaking out of a multi-week balance range. Price closed at $25.03 during Friday’s session, which is another key level to hold. In my opinion, as long as Silver can hold over $24.25, I do not see this slowing down. Traders may want to look for a base to form within the $24-$24.50-25.00 range. The next big break-out level to watch is $25.75, which should lead us into the $26.50 area.

In addition, with geopolitical tensions on the rise again, investors may also be looking to metals as a flight to safety. We have seen strong moves in gold as well, hitting new highs recently. However, we also have to keep in mind what these moves in gold and silver mean in terms of how people view the economy and inflation. Typically, it’s not a good outlook. What is interesting is that we have also been seeing strong moves in the dollar which normally we do not see at the same time that gold and silver rally. I think it’s the geopolitical backdrop that is muting this typical inverse correlation lately.

Equities

EQT Corp (NYSE: EQT) is a company that has piqued our interest due to the potential for a break in its downtrend. Despite last week's rejection of this level, we believe it's crucial to keep a close watch on this development.

The 50-day moving average is just below, and we note this level as suitable for a long trade. A break higher out of resistance could see a move above recent swing highs (38.00) and towards the 200-d.

TRADE IDEA - EQT LONG ON THE 50

Entry: 35.60

Stop Loss: 34.20

Take Profit: 39.00

In the rest of this article, we discuss our thoughts on another equity trade and trade watches in currency, index, and commodity markets.

You can access all of the trades along with our full research by using this 14-day free trial link.

Onto the rest of the alpha.