Top Trade Ideas - August 21st

A new week creates new possibilities, but Jackson Hole and Jerome Powell steal the focus ahead of Friday's meeting.

US equities continued lower last week, but Opex on Friday showed some sign of relief for bulls. Could we be in for a trend reversal? Or maybe a relief bounce? Well, we have a big week upcoming. Jackson Hole is this Friday, where Jerome Powell will give his speech.

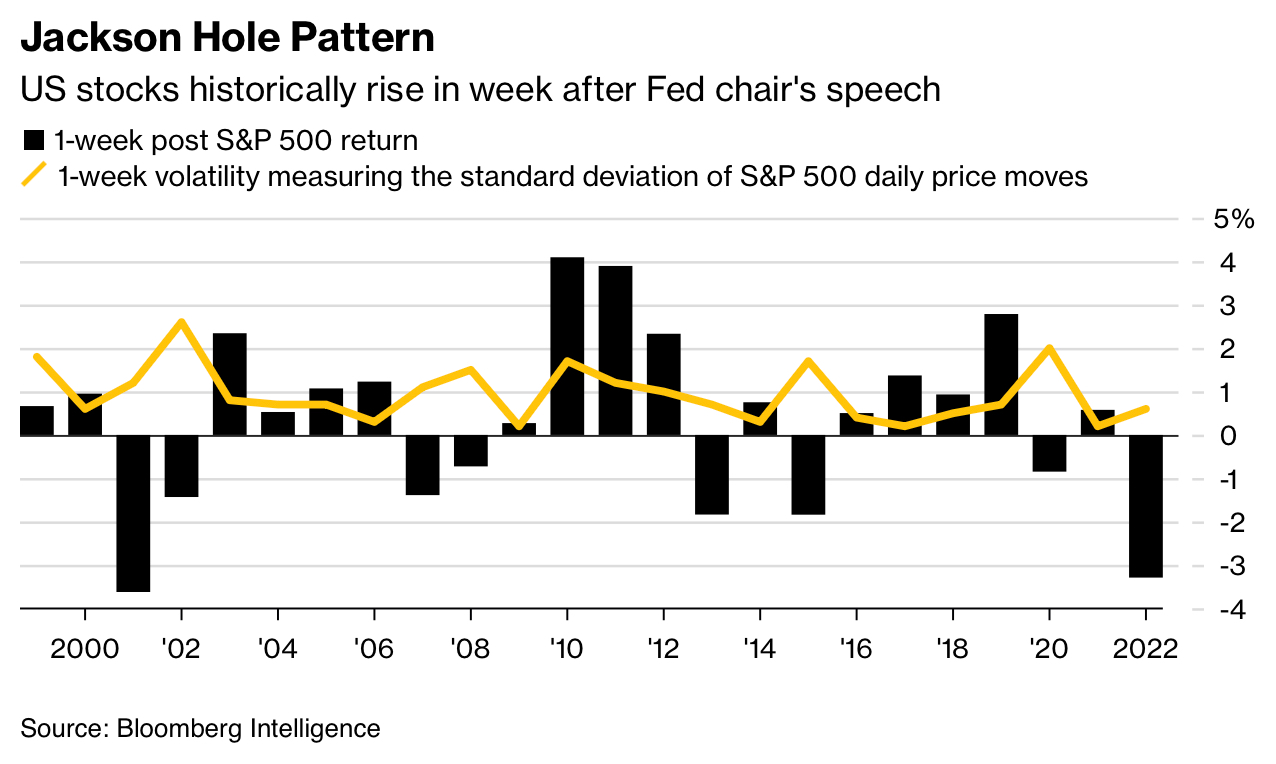

Jackson Hole gives a mixed bag of results for the S&P 500. The following week after the speech averaged a 0.4% gain. However, last year saw a 3% decline.

The DXY managed to break out of the multi-month downtrend to trade above 103 last week, buoyed by safe-haven flows from equity markets and Chinese homebuilder distress.

This week, we focus on Powell’s speech at Jackson Hole, which effectively becomes the FOMC meeting for August.

FX

Last week we flagged up a trade to go long USD via the DXY on a break of 103. This order was filled, with the index finishing the week at 103.42.

While we admit that we didn’t have a huge amount of follow-through action in the days that followed, we like to be long again going into Jackson Hole. We feel there are plenty of reasons for Powell to sound hawkish. Even just last week, we had a stonking retail sales print along with a tepid initial jobless claims.

On that basis, we look to target 104.50 on the index.

TRADE IDEA - BUYING USD IS BACK IN VOGUE

Entry: 103.00

Take Profit: 104.50

Stop Loss: 102.50

In the rest of this article, we take a look at some FX pairings for the week. We also break down five equity names that we think look strong and could see some upside this week. Finally, we have some index analysis and share our thoughts on a volatility trade.