Top Trade Ideas - August 26th

Macro volatility has settled. NVDA earnings take the stage.

Good morning, everyone!

A UK bank holiday is upon us, but we all know that markets never stop.

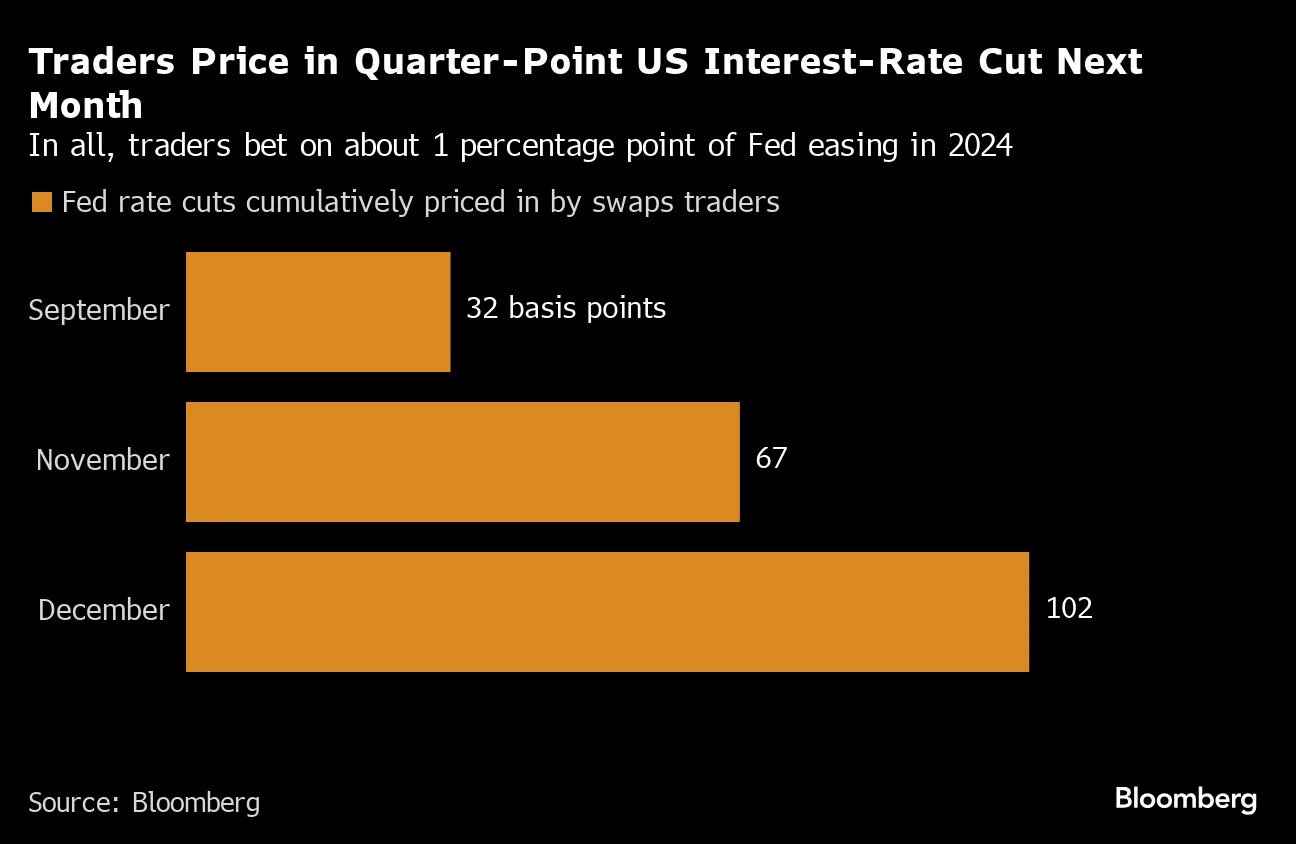

Last week, Jerome Powell’s Jackson Hole speech was the main event. He navigated markets to expect a September cut as the global rate cut cycle now gets underway.

In G10 FX, we saw the DXY take another leg lower, contrary to our view coming into the week. Although nothing noteworthy came out from the FOMC minutes or Powell’s Friday speech, both did just enough to keep a dovish steer on rate pricing, thus seeing the greenback offered in the market.

Week Ahead

US PCE inflation figures, alongside data on the US economy, are likely to take centre stage as investors anticipate that the Federal Reserve will cut interest rates next month.

Nvidia earnings on Wednesday will also be a key event, with the semiconductor behemoth often leading the direction of tech stocks and, therefore, the US indices. Options markets are pricing an 11% move.

Eurozone inflation figures and a rate decision in Hungary are due, while in Asia, the focus centres on end-of-month Japanese economic data, Australia’s latest inflation print, China’s PMIs and India’s quarterly growth.

Equities

JD Sports Fashion (LSE: JD) posted a really strong quarterly update last week, a swift turnaround from the profit warning at the start of the year that saw the share price crater lower.

Given the key break above 139p late last week, we now expect the price to rally and fill the gap from the profit warning tumble at 155p and make a test of the Q4 highs just below 180p.

TRADE IDEA - GETTING INVOLVED ON JD STRENGTH

Entry: 149.25

Take Profit: 175.00

Stop Loss: 137.00

We’ve spoken before about our views on small-cap stocks in relation to upcoming monetary policy loosening. It’s worth keeping in mind that the Russell 2000 is still full of a lot of “junk” stocks.

There are times when junk becomes the hottest thing, but we are much more likely to get a more consistent return focusing on the strong small-cap names—those that are actually profitable for one thing.

CNX Resources Corp (NYSE: CNX) is a natural gas company with a net annual income of $1.7 billion. The stock has had a terrific year, up 37%. With small caps likely to do well, the trend should continue for CNX.

TRADE IDEA - LONG THE CNX TREND

Entry: 27.50

Stop Loss: 25.00

Take Profit: 34.00

Reminder: If you’re not subscribed to our premium already, you should check it out. 7-days free.

Onto the rest of the ideas.