Top Trade Ideas - December 11th

A busy week ahead sees 60% of central banks' rate decisions announced, along with closely watched US CPI data and Treasury auctions.

A combined $108 billion of 3-year, 10-year and 30-year bonds hit the block Monday and Tuesday, along with $213 billion of shorter-term bills. The last 30-year auction was not well received by markets, with the S&P 500 dropping 0.8%. Investors are waiting to see the results of the auction, which has started to effect equity prices more than previous years.

Also this week, we have US CPI on Tuesday. Wednesday sees PPI and the FOMC meeting, along with a new dot plot. Thursday sees many of the European banks have meetings.

In G10 FX, price action was erratic for much of the week. JPY saw a sharp spike as traders rushed to price in a change in monetary policy, while the US Dollar struggled to make up its mind on how to react to the Thursday and Friday data releases.

Equities

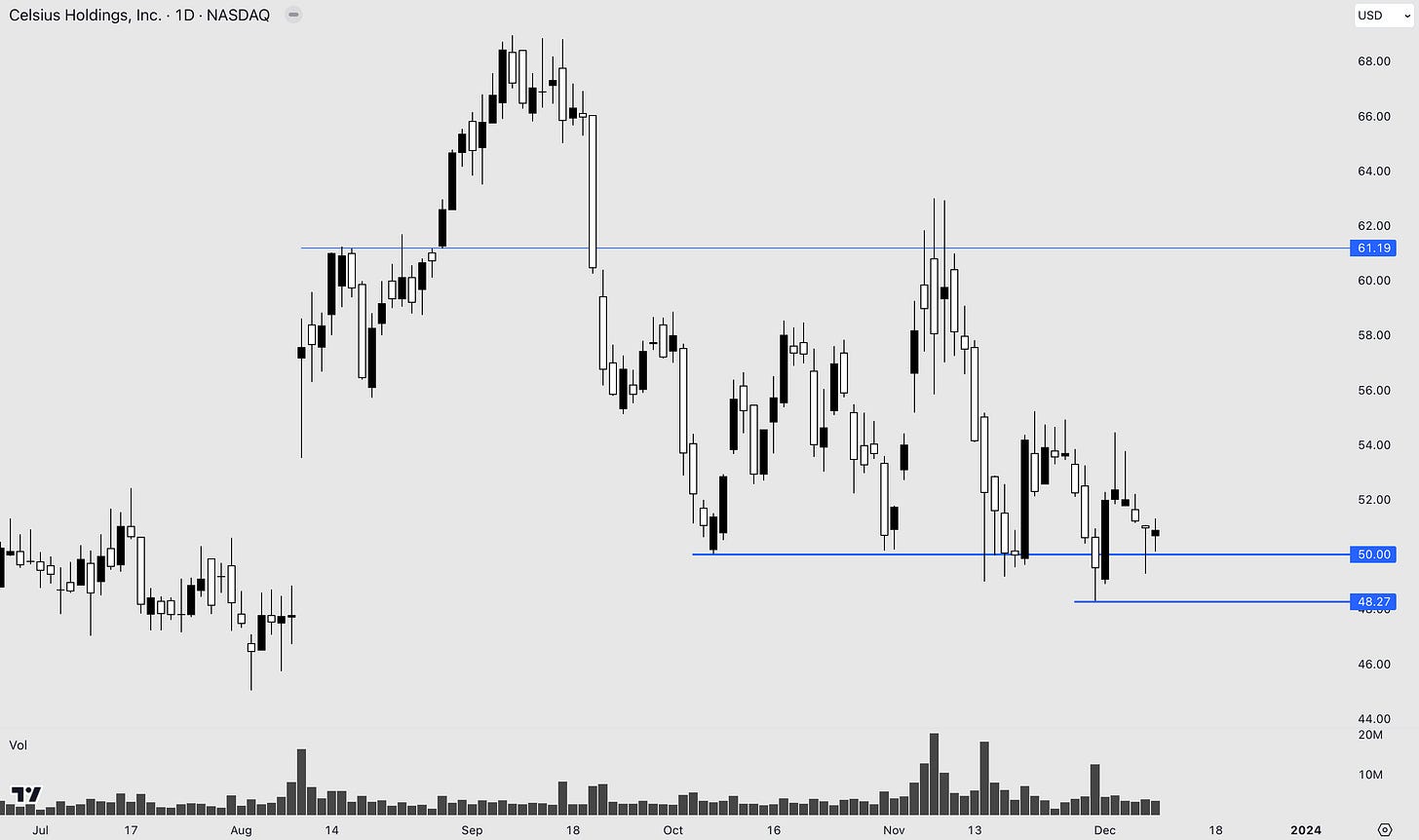

Celsius Holdings has done a good job this year at trying to break its way into a difficult energy drink sector. Adoption of the product has been positive, and the share price has reflected this.

Looking at the daily chart, we think the risk/reward here is good.

A break below the recent low at 48.27 would invalidate our trade. But a move higher above 60 may be possible with equities strong across the board.

TRADE IDEA - CELSIUS HOLDINGS HIGHER

Entry: 50.90

Stop Loss: 48.00

Take Profit: 61.00

Tesla is always a volatile name to play. Taking a look at the technical setups, we may see a break higher out of this resistance soon (giving that equities ride the data wave we have this week).

If it does break higher, it would be expected to be a strong move, as Tesla usually does.

We would be looking to take profits early on a breakout, and not overstay our welcome.

TRADE IDEA - TESLA TESTING BREAKOUT

Entry: 244.00

Stop Loss: 239.00

Take Profit: 255.00

As always, we have scanned over all markets and have provided you with more equity ideas below, before taking a turn towards currencies and indices.

Our full ideas every Monday (and research articles on Wednesday and Friday) can be accessed by signing up for our premium subscription.

We recently announced some new features coming to the newsletter, such as a stock screener for value, growth and dividend names. If you want to know more about this, you can use this link.