Top Trade Ideas - December 4th

A strong November ends, and a chilly December gets underway with US equities bringing the heat. Here are all of our ideas, curated for you.

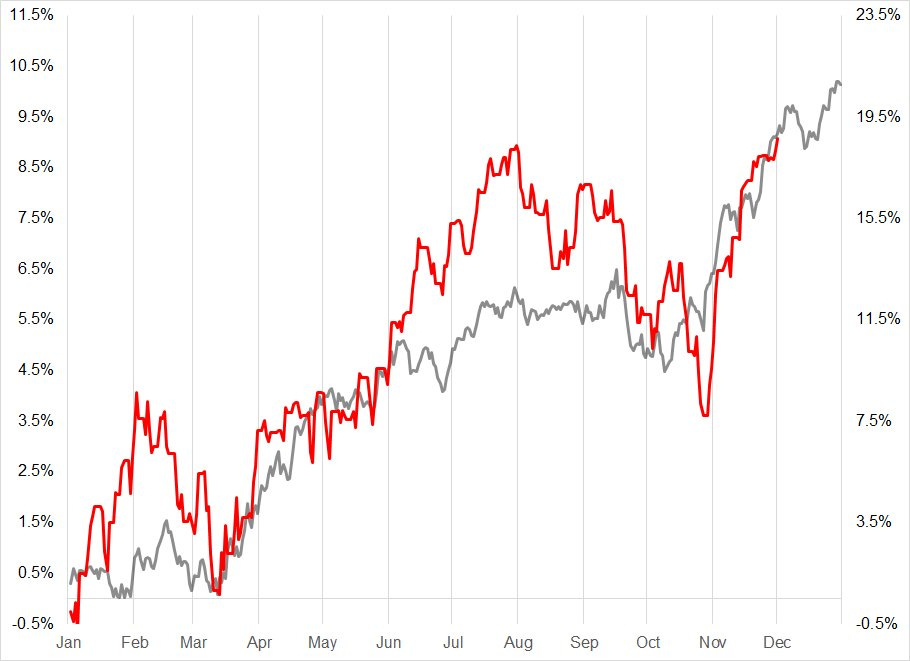

Equities seasonality has been pretty spot on this year. We keep in mind that the rally towards the end of the year is usually strong, and has been in recent weeks. However, there is a usual pullback in mid-December, which would be healthy for this current move up (or at least some sideways consolidation).

In G10 FX, last week was the quietest for a while. Data prints came out largely as expected, and even though Powell gave us some volatility to end the week (net USD negative), the broad trend in most pairs continues.

Equities

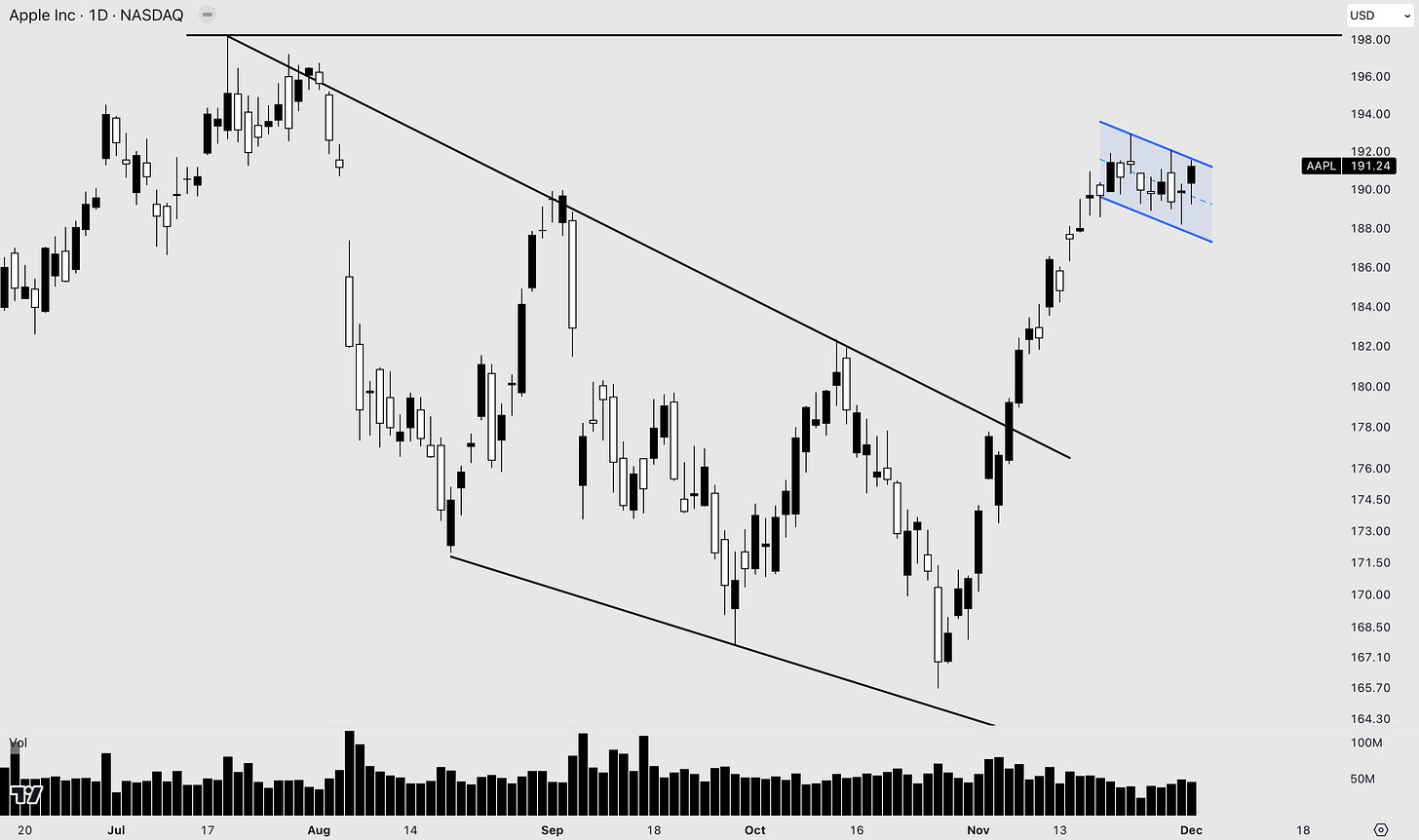

Apple has been flagging on the daily chart. Price action over the last two trading days has been good, which now makes the technical setup look like a breakout is near.

ATHs are around 198. This play, for us, looks better to play via options. You could either use Dec or Jan expiries (we prefer Jan for the extra time), looking towards the 195 strike price.

TRADE IDEA - APPLE 195 CALLS

Dec or Jan 195 calls

Fubo was a popular name during the small-cap mania in 2020/21. But taking a look at the chart now raises our interest again. Firstly, the price is building volume below a key resistance level, and we have two key levels above as potential upside.

What also makes this name interesting is the 17% short float. We may see this have an effect if the price breaks higher than $3.30, but more so if the price rises towards $4 and breaks past that first level above.

TRADE IDEA - FUBO BREAKOUT, SHORT INTEREST

Entry: 3.30

Stop Loss: 2.85

Take Profit: 4.00/4.70

We have analysed all markets over the weekend, curating our best ideas and sharing them with you here. We continue with equities, before moving on to currencies and world indices.

Our full ideas every Monday (and articles on Wednesday and Friday) can be accessed by signing up for our premium subscription.