Top Trade Ideas - December 9th

Another week of policy easing, and the Eurozone is in the spotlight.

Last week was busy with political headlines as the French government collapsed when Micahel Barnier lost a no-confidence vote, furthering the problematic situation in Europe. French stocks and bonds rallied, but we expect this was a covering in short positions leading up to the event.

On Wednesday, South Korea awoke to headlines they hadn’t dreamed of, leading to the shortest martial law event in history.

Notable news within (private) markets was SpaceX’s $350b valuation after private share sales. This is 100% more than a year ago—quite the feat.

Finally, President-elect Trump’s announcement of crypto-friendly Paul Atkins as the new SEC Chair helped push Bitcoin above $100,000 for the first time ever.

What’s in store for the following days?

The Week Ahead

The week ahead is central bank-heavy. In the early hours of Tuesday morning (London), we have the RBA interest rate decision. The BoC are due to announce their decision on Wednesday before the double whammy of the ECB and SNB on Thursday.

EZ

The European Central Bank’s last meeting of the year will take centre stage, with a rate cut looking like a done deal, although the size is still a question.

Recent weak inflation data suggests the SNB will trim its inflation forecasts again. Alongside the recent strength in the Swiss franc, this could be sufficient to push the SNB to trim its key policy rate by a half point to 0.5%, but the size is still a coin-flip.

JAPAN

The Bank of Japan’s quarterly Tankan corporate sentiment survey, scheduled to be released Friday, is in focus as market participants look for clues on whether the central bank will raise its policy rate later this month. The survey is expected to show business confidence is mostly unchanged. Whether U.S. trade policies have any impact on corporate outlook and capex plans is yet to be known.

Economists are also waiting to confirm the strength of third-quarter growth when revised gross domestic product data is released Monday.

CHINA

China is set to release key economic data starting with inflation figures on Monday. Despite efforts to boost the economy, deflationary pressures persist amid a struggling property market. Trade data on Tuesday will reveal the strength of exports, a vital growth driver in the second-largest economy. Additionally, markets are anticipating signals of further stimulus as China’s leaders convene for the Central Economic Work Conference to outline the economic agenda for the coming year. Is there scope to underwhelm investors again? Absolutely.

U.S.

Inflation data due Wednesday could be the final indication of whether or not the Federal Reserve cuts interest rates at its decision on Dec. 18.

A rate cut in December is broadly expected but far from a done deal. The past week has seen a 25bps cut rise in probability following Waller’s comments early last week, but a strong inflation reading could make it more likely that rates are left on hold. The data can potentially cause volatile moves in the dollar and U.S. Treasurys, especially on lighter December volumes.

Producer price data for November on Thursday will indicate pipeline inflationary pressures, while weekly jobless claims data on the same day will give an additional snapshot of the state of the labour market.

The Treasury will auction $58 billion in three-year notes on Tuesday, $39 billion in 10-year notes on Wednesday, and $22 billion in 30-year bonds on Thursday.

Onto trade specifics…

Equities

Consumer discretionary, communications, and financials continue to lead strength in the U.S., while tech made a strong advance last week, now up 6% over the last month.

Some software names present the best-looking opportunities for follow-through strength. After long periods of consolidation, we’re now seeing stage 1 breakouts as markets continue to be risk-on.

Two names we highlight: TEAM and SNOW.

TRADE IDEA - LONG TEAM

Entry: 278.0

Stop Loss: 267.0

Take Profit: 300.0

TRADE IDEA - LONG SNOW

Entry: 183.0

Stop Loss: 173.5

Take Profit: 200.0

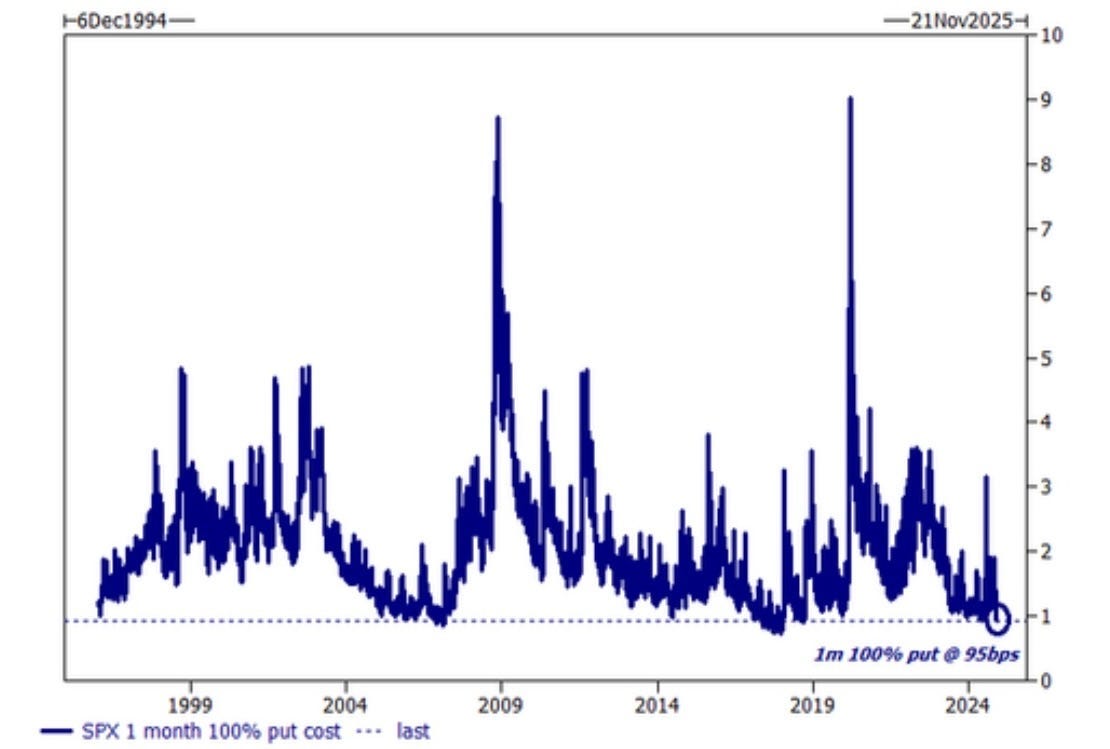

The cost to hedge is extremely low right now. With equities having such a great year (up 28.35% and nearly 6% just this quarter), allocating 1% on some puts to hedge any tail risks might be the sensible play here.